TRENDS IN HIGHER EDUCATION SERIES

Trends in

College Pricing

and Student

Aid 2022

COLLEGE

PRICING

STUDENT

AID

Trends in College Pricing and Student Aid 2022 was authored by Jennifer Ma and

Matea Pender, both senior policy research scientists at College Board.

Contact Information for the Authors

trends@collegeboard.org

Tables, graphs, and data in this report or excerpts thereof may be reproduced or

cited, for noncommercial purposes only, provided that the following attribution

is included:

Source: Ma, Jennifer and Matea Pender (2022),

Trends in College Pricing and Student Aid 2022, New York: College Board.

© 2022 College Board.

w

ww.collegeboard.org

research.collegeboard.org/trends

ACKNOWLEDGMENTS

We thank Dean Bentley, Jessica Howell, and Michael Hurwitz for their thoughtful

reviews. We also thank the cooperation and support of many colleagues at

College Board, including Connie Betterton, Mark Bloniarz, Auditi Chakravarty,

Karen Lanning, Kevin Morris, Jose Rios, Ashley Robinson-Spann, Michael Slevin,

Kayla Tompkins, Chris Villanueva, Marquis Woods, and the Annual Survey of

Colleges team.

We thank all of those who contributed to the data collection for this publication,

campus administrators who provided us with invaluable data through the Annual

Survey of Colleges.

DEFINING TERMS

“Costs” refer to the expenditures associated with

delivering instruction, including physical plant

and salaries.

“Prices” are the expenses that students and

parents face.

“Published price” is the price institutions charge for

tuition and fees as well as room and board, in the

case of students residing on campus. A full student

expense budget also includes allowances for books

and course materials, supplies, transportation, and

other personal expenses.

“Net price” is what the student and/or family must

cover after grant aid is subtracted.

“General subsidies” make it possible for institutions

to charge less than the actual costs of instruction.

State, federal, and local appropriations, as well as

private philanthropy, reduce the prices faced by all

MAR-5555

October 2022

Highlights

TRENDS IN COLLEGE PRICING

PUBLISHED TUITION AND FEES AND ROOM

AND BOARD

In 2022-23, the average published (sticker) tuition and fees for

full-time undergraduate students are (Table CP-1):

w

Public four-year in-state: $10,940, $190 higher than in 2021-22

w

Public four-year out-of-state: $28,240, $620 higher than in

w

Public two-year in-district: $3,860, $60 higher than in 2021-22

w

w

In 2022-23, average estimated budgets (tuition and fees, room

and board, and allowances for books and supplies, transportation

and other personal expenses) for full-time undergraduate

students range from $19,230 for public two-year in-district

students and $27,940 for public four-year in-state students to

$45,240 for public four-year out-of-state students and $57,570

Over the 30 years between 1992-93 and 2022-23, average

published tuition and fees increased from $2,340 to $3,860

at public two-year, from $4,870 to $10,940 at public four-year,

adjusted tuition and fees declined by 4% at public two-year colleges,

declined by 1% at public four-year institutions, and increased by 6%

In 2022-23, average published tuition and fees for full-time

in-district students at public two-year colleges range from $1,430

2021-22 to 2022-23, the average published in-district tuition and

fees at public two-year colleges did not increase in eight states,

In 2022-23, average published tuition and fees for full-time

in-state students at public four-year institutions range from $6,370

published four-year in-state tuition and fees did not increase in nine

NET PRICES AFTER GRANT AID

full-time students, including those who did not receive grant

aid. In 2019-20, 75% of public two-year, 78% of public four-

undergraduate students received federal, state, or institutional

grant aid. (Pages 17, 18, and 19)

colleges have been receiving enough grant aid on average to

Since 2016-17, the average net tuition and fee price paid by

Since 2017-18, the average net tuition and fee price paid by

four-year institutions has been declining after adjusting for

INSTITUTIONAL FINANCES

The national average state and local funding per student increased

year. State and local funding per student reached $9,330 in 2020-21,

In 2019-20, net tuition revenue accounted for 41% of total revenues

at public doctoral universities. Net tuition as a share of total

revenues in this sector remained stable between 2014-15 and

years. At other types of public institutions, net tuition as a share

of total revenues declined between 2014-15 and 2019-20, after

Between 2014-15 and 2019-20, the average subsidy per full-time

ENROLLMENT TRENDS AND FAMILY INCOME

Between 1991 and 2021, the average income increased by 64%

for the top quintile of families and by 17% for the lowest quintile of

Between fall 2019 and fall 2020, total postsecondary enrollment

fell by 631,000 (3%). The public two-two sector saw the largest

decline in enrollment—581,000 or 9%. Total enrollment at the

declined by 0.7% while enrollment increased by 33,000 (3%)

Between fall 2010 and fall 2020, total enrollment declined by 1.3

million (8%) at public colleges and universities in the United States.

Changes across states ranged from declines of 35% in Alaska and

Between fall 2010 and fall 2020, the shares of undergraduate

students who were Asian, Hispanic, or two or more races

increased while the shares of undergraduate students who were

Black, White, or Native declined. The share of undergraduate

students who were Hispanic increased from 14.5% in fall 2010 to

3

TRENDS IN STUDENT AID

TYPES OF STUDENT AID

In 2021-22, undergraduate students received an average of

$10,590 in grants, $3,780 in federal loans, $870 in education tax

In 2021-22, graduate students received an average of $27,300

federal loans, $440 in tax credits and deductions, and $60 in

In 2021-22, undergraduate and graduate students received a

federal loans, and federal tax credits and deductions. In addition,

students borrowed about $12.7 billion from nonfederal sources.

(Table SA-1 online)

FEDERAL STUDENT AID

dollars between 2011-12 and 2021-22. Pell Grants declined by

($2.3 billion). (Table SA-1 online)

were nearly $15,000, compared with $4,250 per Pell Grant

recipient. There were 6.1 million Pell Grant recipients compared

Between 2011-12 and 2021-22, federal loans to undergraduates

fell by 50%, while federal loans to graduate students declined by

PELL GRANTS

Total Pell Grant expenditures reached its peak in 2010-11 at

$44.3 billion (in 2021 dollars) and declined to $25.9 billion in

The number of Pell Grant recipients was 9.3 million in 2010-11 and

The average Pell Grant per recipient was $3,520 (in 2021 dollars)

in 2001-02. It peaked at $4,760 in 2010-11, and fell to $4,250 in

2021-22. (Table SA-5 online)

In 2022-23, the maximum Pell award is $6,895, a $400 increase

largest one-year increase in maximum Pell since 2009-10, before

OTHER SOURCES OF GRANT AID

Between 2011-12 and 2021-22, institutional grant aid for

undergraduate students increased by 53% ($20.9 billion in

Between 2011-12 and 2021-22, institutional grant aid for all students

rose by $24.2 billion (in 2021 dollars) reaching a total of $74.4 billion

in 2021-22. Institutional grants accounted for 53% of all grant aid for

ninth consecutive year in 2020-21, to $1,020—an increase of

36% ($270 in 2020 dollars) since 2011-12. In 2020-21, state grant

STUDENT BORROWING

After rapid growth in annual borrowing between 2006-07 and

2011-12, total annual federal loans to undergraduates declined

by 49% and total federal loans to graduate students decreased

In 2021-22, after the 11th consecutive decline in annual education

borrowing, students and parents borrowed $94.7 billion, down from

in 2021-22, from a peak of $6,450 (in 2021 dollars) in 2010-11.

The share of annual federal education loans going to graduate

students (who constitute about 16% of all postsecondary

students) rose from 35% ($28.2 billion out of $80.1 billion in 2021

dollars) in 2006-07 to 48% ($39.0 billion out of $82.0 billion) in

In 2021-22, 443,000 graduate students borrowed through the

The average amount borrowed through the PLUS program was

$8,960 higher than the average unsubsidized loan ($27,930 vs.

Nonfederal education loans fell from about $29 billion (in 2021

dollars) in 2007-08 to $10 billion in 2009-10 and rose to about

STUDENT DEBT

As of March 2022, 33% of borrowers owed less than $10,000 and

21% of borrowers owed between $10,000 and $20,000 in federal

loan debt. These borrowers held 4% and 8% of the outstanding

As of March 2022, 24% of the $1.62 trillion outstanding federal

loan balance was held by borrowers who were 50 and older, up

In 2020-21, 54% of bachelor’s degree recipients from public and

In 2020-21, 51% of bachelor’s degree recipients from public four-

year institutions graduated with federal loans with an average

graduated with federal loans with an average federal debt level

4

Contents

3

Highlights

7

Introduction

TRENDS IN COLLEGE PRICING

10

2021-22 and 2022-23

Published Charges,

2021-22 and 2022-23

11

Student Budgets, 2022-23

12

Published Tuition and Fees

over Time

13

Published Charges over Time

Ten-Year Percentage Changes in Published Charges, by Decade

14

Tuition and Fees by State:

Public Two-Year

15

Tuition and Fees by State:

Public Four-Year

Percentage Changes

16

Tuition and Fees by State:

Flagship Universities

17

Average Net Price:

Public Two-Year

Two-Year Institutions

18

Average Net Price:

Public Four-Year

19

Average Net Price: Private

Nonprot Four-Year

20

Institutional Revenues:

State and Local Funding

over Time

21

Institutional Revenues:

State and Local Funding

22

Institutional Revenues:

Public Institutions

Institutional Revenues per Student at Public Institutions over Time

23

Institutional Revenues and

Expenditures

24

Family Income

25

Enrollment Patterns over Time

26

Enrollment Patterns over Time,

by Sector

27

Public Enrollment by State

28

Migration

29

Enrollment by Race/Ethnicity

research.collegeboard.org/trends.

5

Contents—Continued

TRENDS IN STUDENT AID

31

Total Student Aid

Total Student Aid and Nonfederal Loans in 2021 Dollars over Time

Total Student Aid and Nonfederal Loans in 2021 Dollars over Time: All Students,

Undergraduate Students, and Graduate Students

Total Student Aid and Nonfederal Loans in Current Dollars over Time: All Students,

Undergraduate Students, and Graduate Students

32

Aid per Student

Average Aid per Student over Time

Average Aid per Student over Time: All Students, Undergraduate Students,

and Graduate Students

33

Grants, Loans, and Other Aid

Composition of Total Aid and Nonfederal Loans over Time

Total Aid and Nonfederal Loans in Current and Constant Dollars over Time: All Students,

Undergraduate Students, and Graduate Students

34

Total Undergraduate Student Aid

Total Undergraduate Student Aid by Source and Type over Time

35

Total Graduate Student Aid

Total Graduate Student Aid by Source and Type over Time

36

Sources of Grant Aid

Total Grant Aid by Source over Time

37

Types of Loans

38

Federal Aid

39

Federal Loans: Annual

Borrowing

Undergraduate Students, and Graduate Students

40

Federal Loans: Borrowing and

Balances

41

Federal Loans: Outstanding

Debt by Age

42

Federal Loans: Outstanding

Debt by Repayment Plan and

Repayment Status

by Repayment Plan over Time

43

Cumulative Debt: Bachelor’s

Degree Recipients

Institutions over Time

Average Cumulative Debt Per Borrower by Loan Type Among Bachelor’s Degree

44

Pell Grants

45

Pell Grants

46

Pell Grants

Distribution of Pell Grant Recipients by Age, 2020-21

47

State Grants

Need-Based and Non-Need Based State Grants per Undergraduate Student over Time

Percentage of State Grant Aid Based on Need by State, 2020-21

48

State Grants

State Grant Aid per Undergraduate Student by State, 2020-21

State, 2020-21

49

Instituitonal Grants

50

Notes and Sources

6

Introduction

experienced declines in enrollment.

1

In 2022-23, we continue to see

historically low increases in published tuition and fees in the public

sectors and moderate increases in published tuition and fees in the

published tuition and fees in all three major higher education sectors

declined year-over-year in both 2021-22 and 2022-23.

FAMILY INCOME, TUITION, STUDENT AID AND

NET PRICES

The latest income data from the U.S. Census Bureau show that the

median household income in 2021 was about the same as that in 2020,

after declining by 2.9% between 2019 and 2020.

2

In the last 30 years,

income inequality grew as the average income increased by 64% for

demographic characteristics. In 2021, median incomes for Black and

Hispanic families were about 60% of the median for white families

and the median income for families with at least one four-year college

graduate was more than double the median for families headed by a

Recognizing the struggles students and families face in paying for

college, especially during a pandemic, many colleges and universities

did not raise tuition for the 2020-21 and 2021-22 academic years.

As a result, the tuition increases during those two years were among

the lowest in recent decades. In 2022-23, more institutions raised

tuition and fees than in the previous two years, although the increases

in average tuition and fees at public sectors are still low by historical

standards. Compared to 2021-22, the average 2022-23 sticker tuition

and fees are 1.6% higher for public two-year in-district students,

1.8% higher for public four-year in-state students, and 3.5% higher

in all three sectors between 2021-22 and 2022-23. (Table CP-2)

Changes in sticker prices tend to garner the most media attention.

However, it is important to note that the majority of undergraduate

students do not pay the full sticker price. Grant aid does not need

to be repaid and helps lower the actual prices that students and

families pay. Grant aid comes from a variety of sources including

the federal and state governments, colleges and universities, and

employer and other private sources. In 2021-22, an estimated

$140.6 billion in grant aid was awarded to undergraduate and

graduate students. Of that total, 26% came from the federal

gov

ernment, 9% came from the state governments, 53% came

from colleges and universities, and the remaining 12% came from

Using Trends sticker price data and grant aid data from the

full-time students at public two-year colleges have been receiving

enough grant aid on average to cover their tuition and fees. In

institutions have been declining in recent years.

In addition to grant aid, students and families also received loans

undergraduate and graduate students received $82 billion in federal

loans, $1.1 billion in federal Work-Study, and an estimated $10.8

FEDERAL HIGHER EDUCATION INITIATIVES

At the beginning of the pandemic in March 2020, the federal

government suspended federal student loan payments, ended

collections on defaulted federal student loans, and suspended

interest accrual on all federal student loans through September

provisions through December 31, 2022.

3

On August 24, 2022, the Biden Administration announced a plan

that would provide one-time student debt relief targeted at low- and

middle-income families. Under this plan, Pell recipients can receive

up to $20,000 and non-Pell recipients can receive up to $10,000 in

federal debt relief. To qualify for this relief, borrowers need to have

incomes of less than $125,000 (or $250,000 for households).

4

While

for debt relief are not available,

5

(about a third) of the current 45 million federal loan borrowers have

average debt levels of under $10,000 and another 9.3 million (21%)

have debt levels of between $10,000 and $20,000.

In addition to student loan payment suspension, the federal

education institutions, and students during the pandemic. The three

$76.2 billion.

6

as grant aid to students. In last year’s report, we showed that, on

institutions with higher shares of Pell recipients received more funding

per student than those with lower shares of Pell recipients. (Trends in

College Pricing and Student Aid 2021

https://www.studentclearinghouse.org/blog/fall-2021-undergraduate-

https://research.

collegeboard.org

https://www.census.gov/newsroom/press-releases/2022/income-poverty-

releases/2021/income-poverty-health-insurance-coverage.html

estimates that the plan will cost an average of

$30 billion per year over the next decade.

7

While there is evidence that Covid-19 emergency aid improved

grades and relieved stress,

7

it is still too early to understand the full

debt were both declining prior to the pandemic, and this downward

trend continues. In 2021-22, total annual federal borrowing declined

for the 11th consecutive year to $82.0 billion, from a peak of $132.0

billion (in 2021 dollars) in 2010-11. The average amount of annual

this period, from a peak of $6,450 (in 2021 dollars) in 2010-11 to

households, have been declining since the expansion of the program

during the Great Recession of 2008. In 2021-22, $25.9 billion in Pell

Grant expenditures was awarded to 6.1 million recipients, down from

its peak of $44.3 billion (in 2021 dollars) in 2010-11 and 9.4 million

recipients in 2011-12. The average Pell Grant per recipient has been

Table SA-5 online)

a $400 (6%) increase from the previous year before adjusting for

largest one-year increase in maximum Pell before adjusting for

passed on December 27, 2020 and will be fully implemented by

2024-25. This Act will expand access to Pell Grants to more students

and link eligibility to family size and federal poverty level.

8

ENROLLMENT

enrollment data. The National Student Clearinghouse reported

another year of enrollment declines in fall 2021. The fall 2020

in this year’s and last year’s Trends

National Student Clearinghouse that total postsecondary enrollment

declined in 2020.

9

However, enrollment changes were uneven across

enrollment levels, sectors, states, and demographic groups. Between

2019 and 2020, total undergraduate enrollment declined by 698,000

and graduate enrollment increased by 67,000. Across sectors, the

public two-year sector saw the largest decline in enrollment—581,000

At the state level, nine states experienced increases in postsecondary

enrollment in 2020 compared to 2019 at public four-year colleges,

while all but one state experienced declines in enrollment at public

tw

o-year colleges. (Trends in College Pricing and Student Aid 2021,

While the enrollment numbers we present in this report are descriptive

in nature, a recent study shows similar results after taking into account

pre-pandemic trends and student demographic shifts. The updated

among students entering public two-year colleges in fall 2021.

10

revenues with net tuition revenue being the largest revenue source

11

WHAT IS NEW IN THIS YEAR’S REPORT

Enrollment by Race/Ethnicity

undergraduate students by race/ethnicity over time. Between fall 2010

and fall 2020, the shares of undergraduates who were Asian, Hispanic,

or two or more races increased while the shares of undergraduates

who were Black, White, or Native students declined. The increase in

the share of undergraduate students who were Hispanic is particularly

large — from 14.5% in fall 2010 to 21.9% in fall 2020. This is related

to the demographic shift in high school graduates as the share of all

public high school graduates in the United States who are Hispanic

increased from 17.5% to 25.3% during the same period.

12

Student Debt by Loan Type

In this year’s report, we examine the average cumulative debt per

borrower by loan type among bachelor’s degree recipients. Our

analysis of the latest data from the College Board’s Annual Survey

of Colleges shows that in 2020-21, 54% of bachelor’s degree

year institution borrowed an average of $29,100 per borrower.

52% of bachelor’s degree recipients borrowed federal loans for

their undergraduate study with an average federal loan debt level of

provides additional insight into student borrowing patterns by sector.

Ination Adjustment

We provide much of our data in constant dollars, adjusting values for

changes in the annual Consumer Price Index (CPI). Since the 2022

annual CPI is not yet available, we use the change in the CPI from

aid-improved-grades-relieved-stress

announcements/2021-06-11/beginning-phased-implementation-fafsa-

Digest of Education Statistics, Tables 333.10 and 333.50.

Knocking at the

College Door, 10

th

8

TRENDS IN HIGHER EDUCATION SERIES

Trends in

College Pricing

2022

10

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

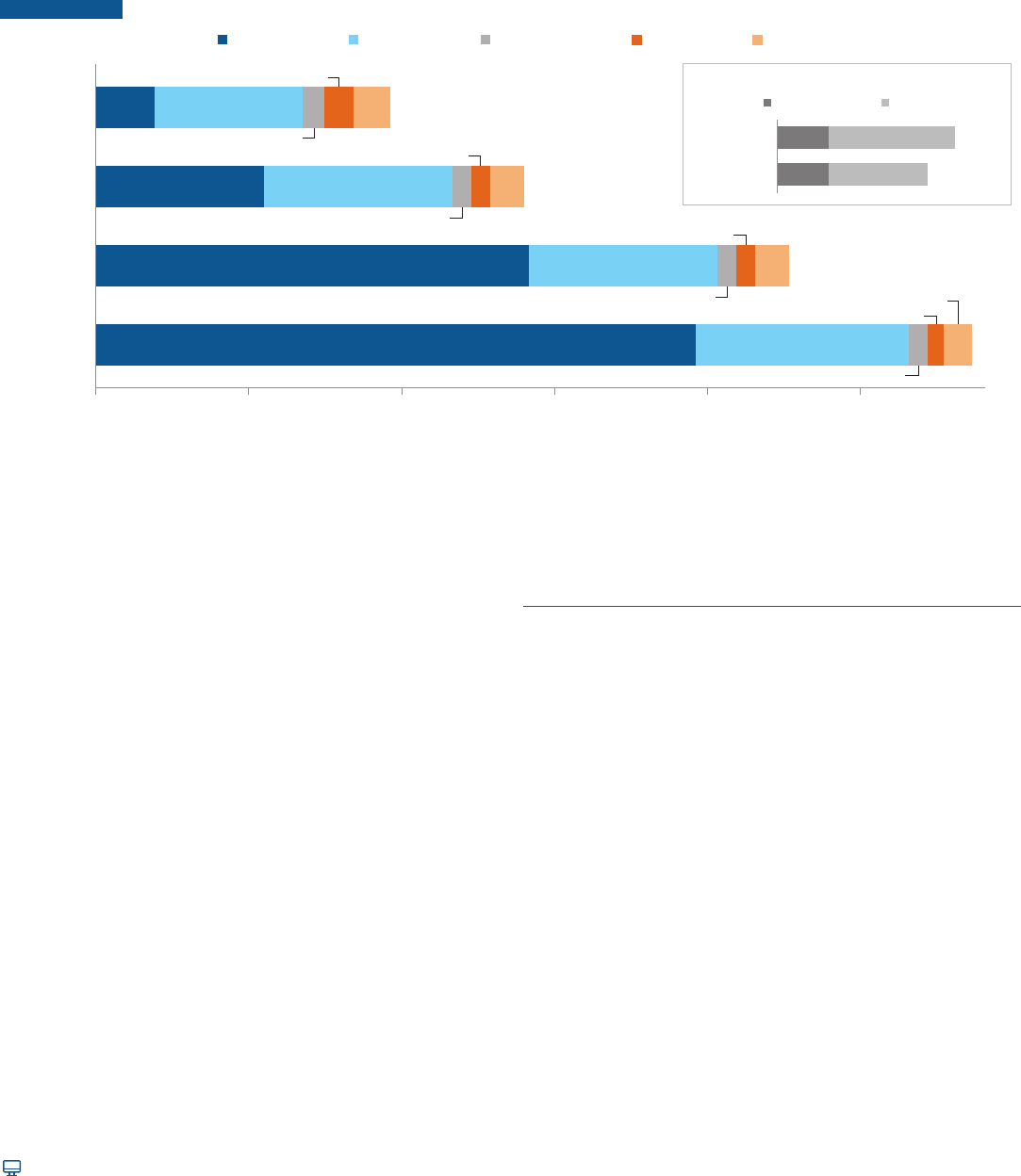

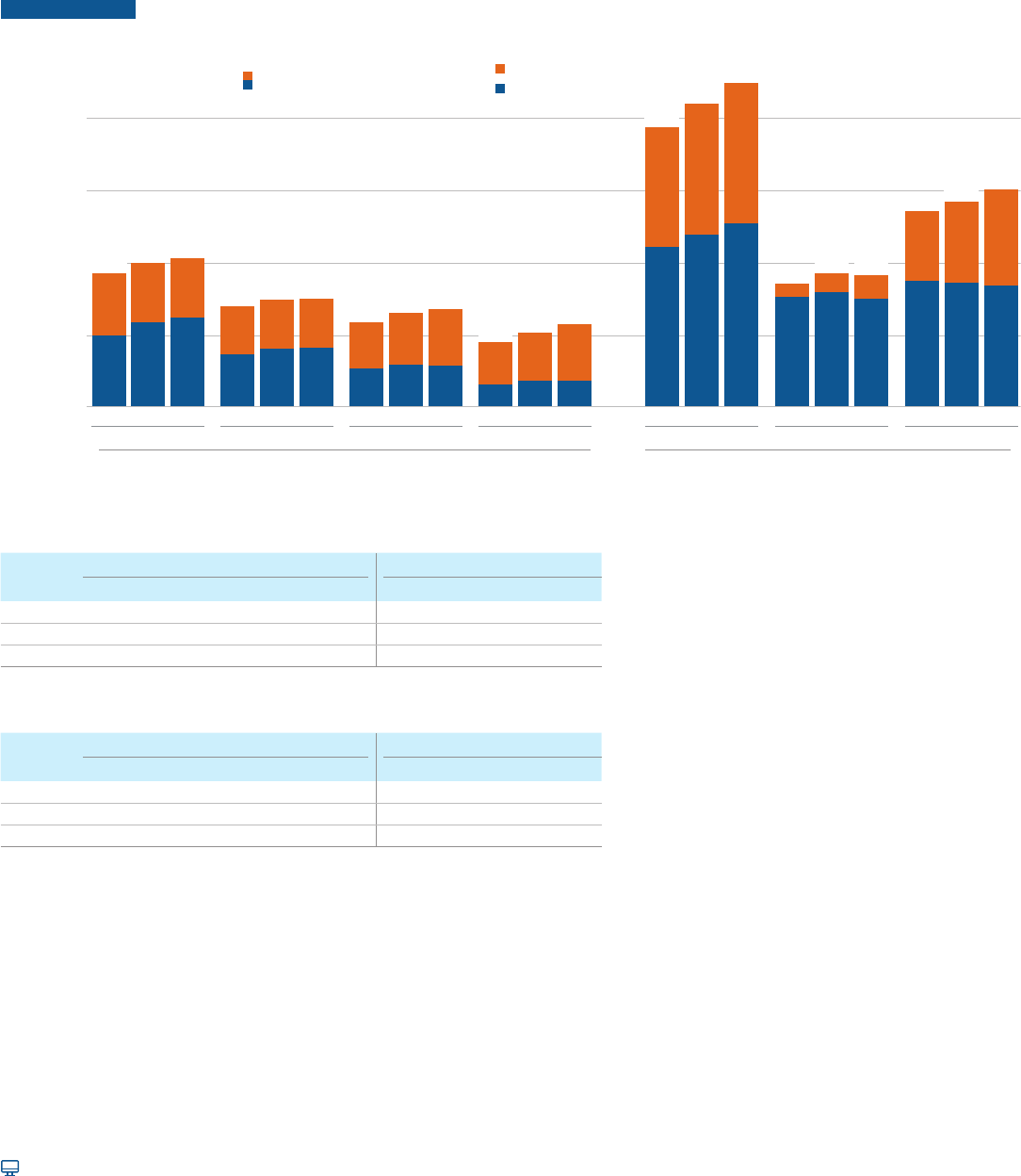

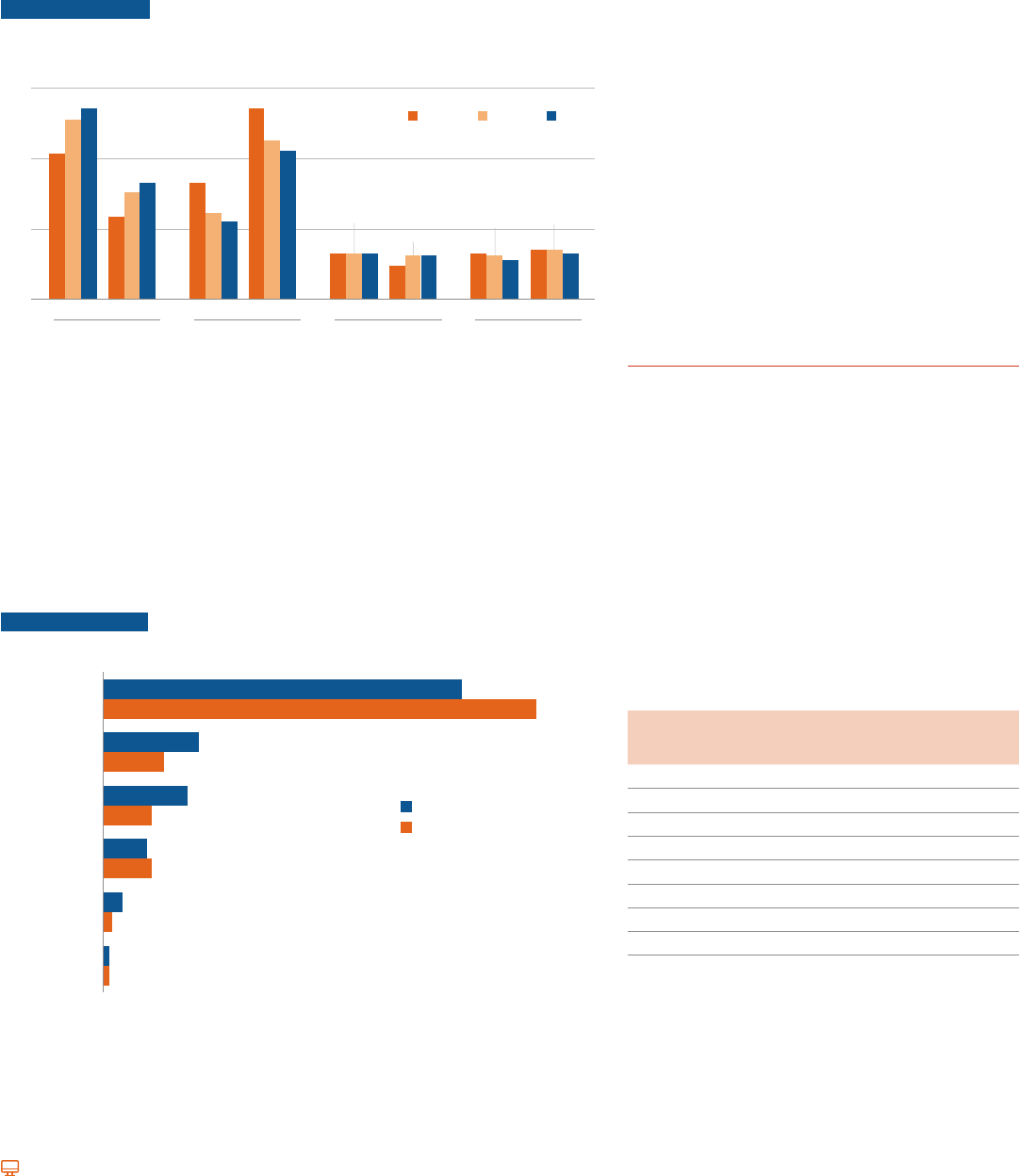

Published Charges by Sector and by Carnegie

Classication, 2022-23

In 2022-23, the average published (sticker) tuition and fee price for full-time in-state students at public

four-year institutions is $10,940, $190 (1.8% before adjusting for ination) higher than it was in 2021-22.

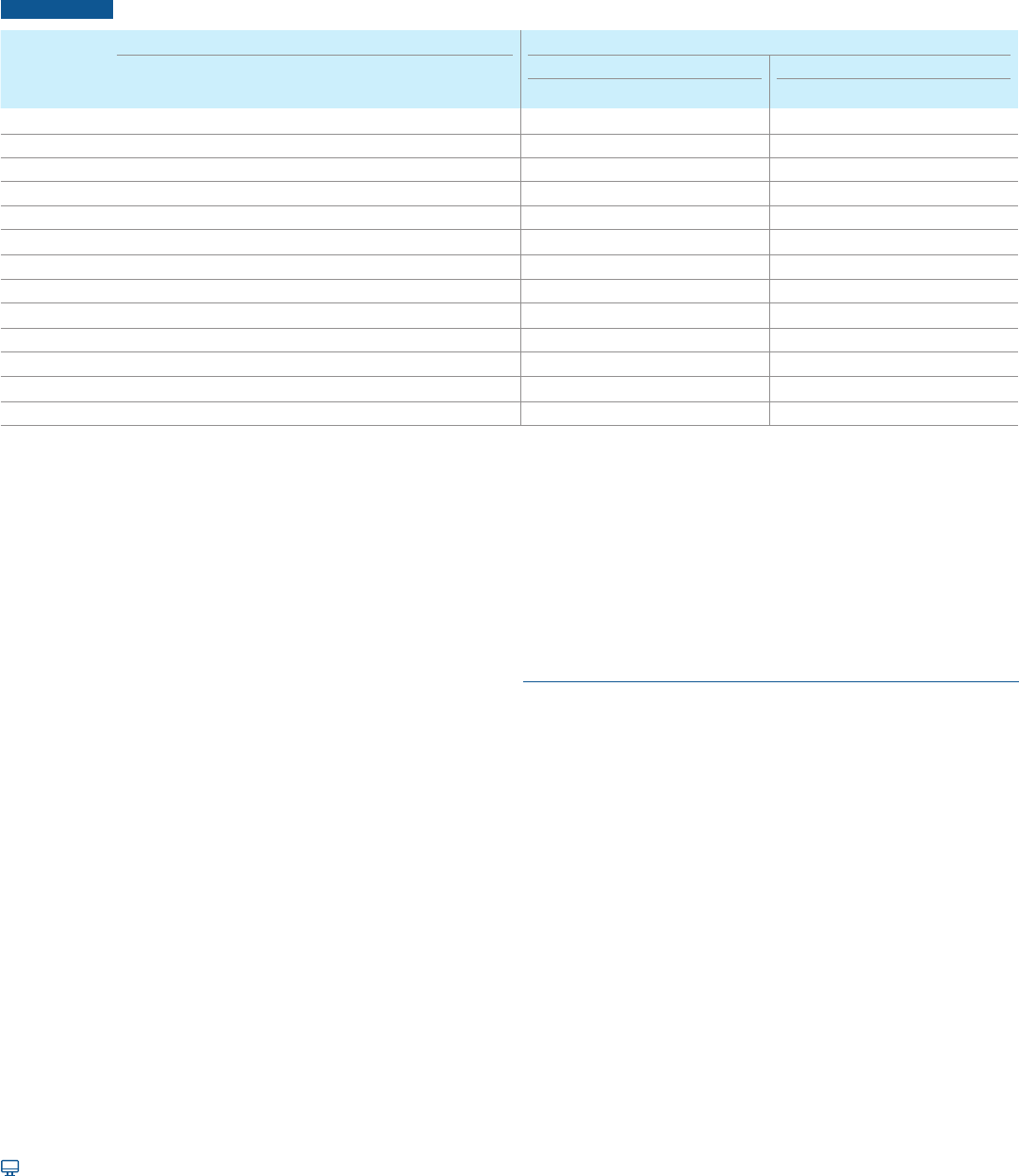

TABLE CP-1 Average Published Charges (Enrollment-Weighted) for Full-Time Undergraduates, 2021-22 and 2022-23

Sector Carnegie Classication

Public

Two-Year

In-District

Public

Four-Year

In-State

Public

Four-Year

Out-of-State

Private

Nonprot

Four-Year For-Prot

Public Four-Year Private Nonprot Four-Year

Doctoral Master’s Bachelor’s Doctoral Master’s Bachelor’s

Tuition and Fees

2022-23 $3,860 $10,940 $28,240 $39,400 — $11,860 $9,150 $9,110 $47,500 $30,650 $39,570

2021-22 $3,800 $10,750 $27,620 $38,070 $15,710 $11,630 $9,010 $8,990 $45,830 $29,660 $38,270

$ Change $60 $190 $620 $1,330 — $230 $140 $120 $1,670 $990 $1,300

% Change 1.6% 1.8% 2.2% 3.5% — 2.0% 1.6% 1.3% 3.6% 3.3% 3.4%

Room and Board

2022-23 $9,610 $12,310 $12,310 $14,030 — $12,880 $11,310 $11,390 $16,000 $13,180 $13,020

2021-22 $9,330 $11,950 $11,950 $13,620 — $12,500 $10,980 $11,060 $15,530 $12,800 $12,640

Tuition and Fees and Room and Board

2022-23 $13,470 $23,250 $40,550 $53,430 — $24,740 $20,460 $20,500 $63,500 $43,830 $52,590

2021-22 $13,130 $22,700 $39,570 $51,690 — $24,130 $19,990 $20,050 $61,360 $42,460 $50,910

Percentage of Undergraduates Enrolled Full Time

Fall 2020 35% 80% 82% 68% 83% 75% 53% 87% 75% 87%

NOTE: Prices in Table CP-1 are not adjusted for ination. Tuition prices reported for 2021-22 have been revised and may dier from those reported in Trends in

College Pricing and Student Aid 2021. The latest tuition and fee estimate available for the for-prot sector is for 2021-22. Carnegie groupings are based on 2018

Carnegie classication.

SOURCE: College Board, Annual Survey of Colleges; NCES, IPEDS Fall 2020 Enrollment data and IPEDS 2021 Institutional Characteristics data.

Enrollment-weighted tuition values represent the price charged by each institution weighted by the number of full-time undergraduate students enrolled in fall 2020,

the latest year for which enrollment data are available. Public four-year in-state charges are weighted by total fall 2020 full-time undergraduate enrollment in each

institution, including both in-state students and out-of-state students. Out-of-state tuition and fees are computed by adding the average in-state price to the out-of-

state premium weighted by the number of full-time out-of-state undergraduate students enrolled at each institution. Room and board charges for 2021-22 and 2022-23

are calculated by applying the average one-year percent changes among institutions that reported data in both years to the previous year’s sector averages. In Trends

in College Pricing 2019 and earlier editions, room and board charges were weighted by the number of undergraduate students residing on campus for four-year

institutions and by the number of commuter students for public two-year institutions.

In 2022-23, the average published tuition and fee price for

full-time in-district students at public two-year institutions is

$3,860, $60 (1.6% before adjusting for ination) higher than it

was in 2021-22.

In 2022-23, the average published tuition and fee price for full-time

students at private nonprot four-year institutions is $39,400,

$1,330 (3.5% before adjusting for ination) higher than it was

in 2021-22.

In fall 2020, 35% of all undergraduate students at the public

two-year sector were enrolled full time, compared with about

80% at public four-year and private nonprot four-year sectors.

Within public four-year and private nonprot four-year sectors,

doctoral institutions have higher prices than master’s and

bachelor’s institutions.

ALSO IMPORTANT:

The prices shown in Table CP-1 are for full-time students.

Prices for part-time students are typically less than those for

full-time students.

The prices shown in Table CP-1 are for one academic year. The

total price of a college education depends on how long a student

is enrolled before completing a degree—frequently more than

four years for a bachelor’s degree and more than two years for

an associate degree.

11

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

Student Budgets, 2022-23

In 2022-23, average budgets for full-time undergraduate students range from $19,230 for public two-year

in-district students and $27,940 for public four-year in-state students to $45,240 for public four-year

out-of-state students and $57,570 for private nonprot four-year students.

FIGURE CP-1 Average Estimated Full-Time Undergraduate Budgets (Enrollment-Weighted) by Sector, 2022-23

$0 $10,000 $20,000 $30,000 $40,000 $50,000

Other ExpensesTransportationBooks and SuppliesRoom and BoardTuition and Fees

Undergraduate Budget

$39,400

$1,070

$1,830

$1,240

$14,030 $57,570

Private Nonprofit

Four-Year

On-Campus

$28,240

$12,310

$1,250

$1,240

$2,200 $27,940

$12,310

$1,250

$1,240

$2,200 $45,240

Public Four-Year

Out-of-State

On-Campus

$10,940

Public Four-Year

In-State

On-Campus

$3,860 $9,610

$2,430 $19,230

$1,870

$1,460

Public Two-Year

In-District

Commuter

$340

$340

$900

$1,120

$1,240

$1,460

Four-Year

Public Two-Year

Books and Supplies

Course Materials Other Supplies

NOTE: Expense categories are based on institutional budgets for students as reported in the College Board’s Annual Survey of Colleges. Figures for tuition and fees

and room and board mirror those reported in Table CP-1. Data for books and supplies, transportation, and other expenses are projected and reect the average

amounts allotted in determining the total cost of attendance and do not necessarily reect actual student expenditures. Books and supplies may include course

materials such as hardcopy textbooks, online textbooks, textbook rentals, and other supplies such as a personal computer used for study.

SOURCE: College Board, Annual Survey of Colleges; NCES, IPEDS Fall 2020 Enrollment data; Student Watch and Student Monitor.

Student budgets are constructed by institutional nancial aid

oces. These budgets form the basis for determining the total

cost of attendance, which can aect the amount of nancial aid

for which students are eligible.

Room and board and other components of student budgets vary

less across sectors than tuition and fees. As a result, while the

average published in-district tuition and fee price at public

two-year institutions is 35% of the in-state price at public

four-year colleges, the total public two-year in-district student

budget is 69% of the public four-year in-state student budget

($19,230 vs. $27,940).

The average in-state published tuition and fee price at public

four-year institutions is 28% of the average price at private

nonprot four-year institutions; the average student budget is

about half the amount ($27,940 vs. $57,570).

ALSO IMPORTANT:

In the last decade, average student spending on college

textbooks and digital course materials declined by between 44%

and 48%. (Student Watch and Student Monitor: 2022 Reports)

12

research.collegeboard.org/trends.

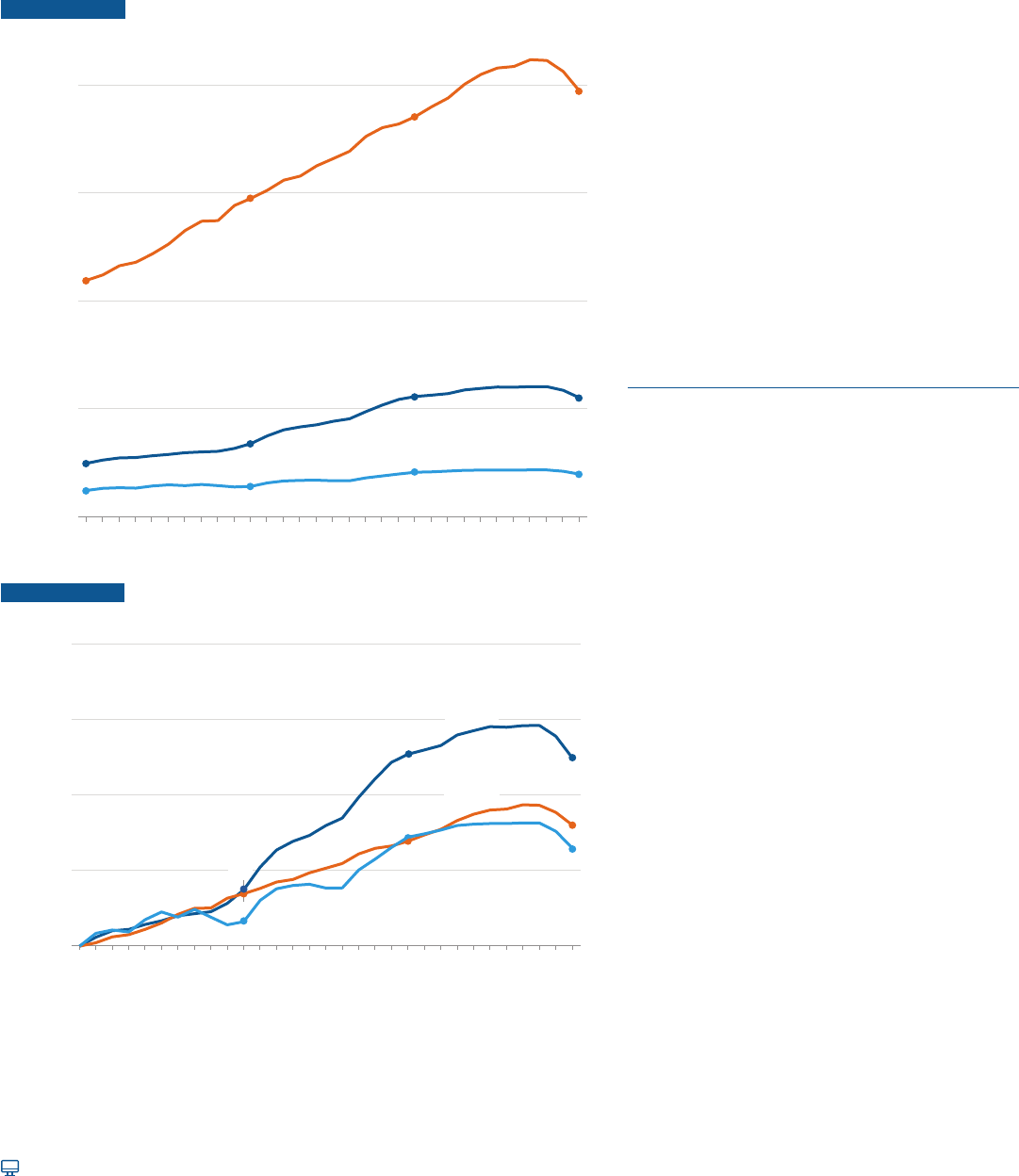

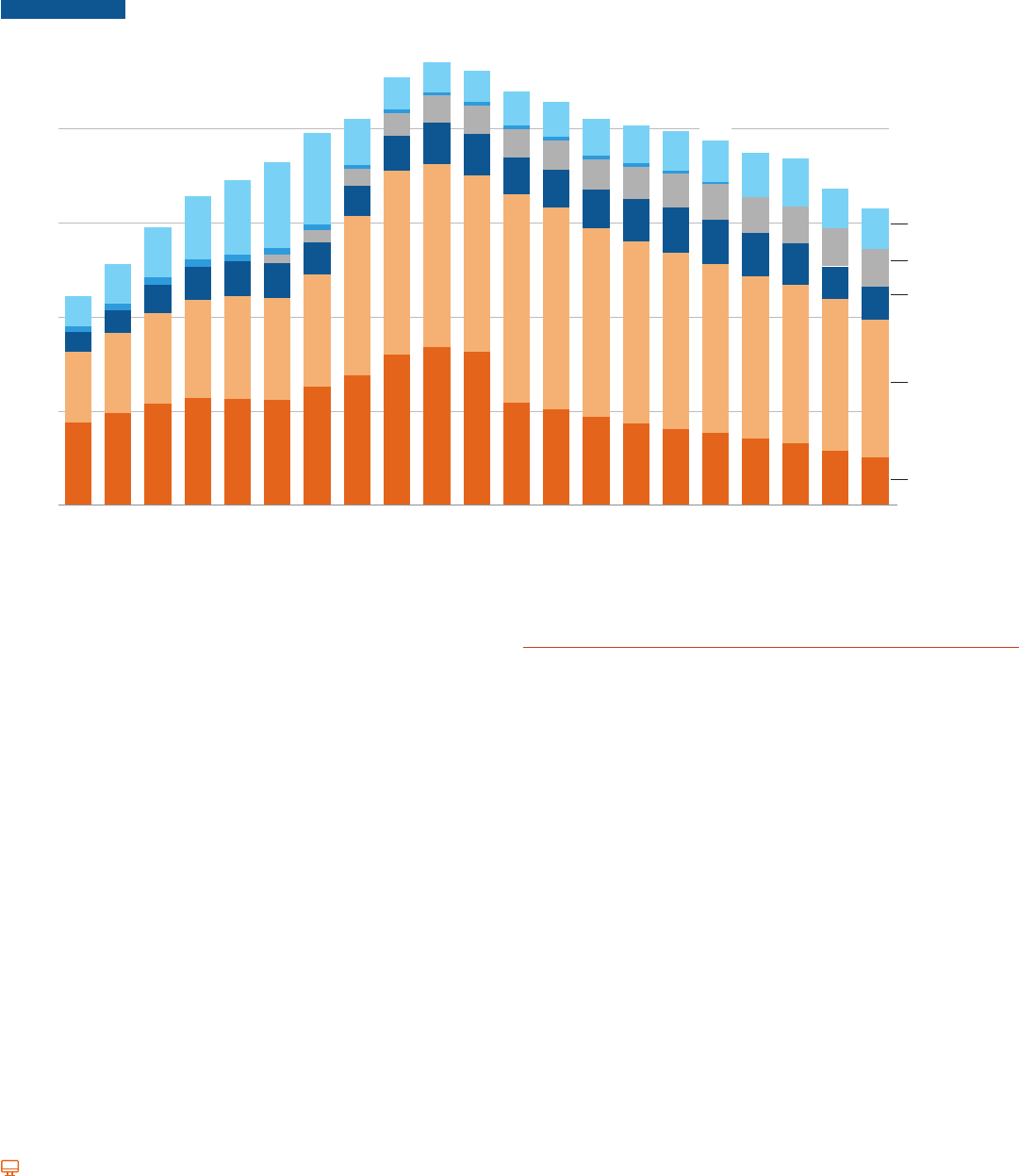

Published Tuition and Fees over Time

Between 1992-93 and 2022-23, the average tuition and fees increased from $2,340 to $3,860 at public

FIGURE CP-2

1992-93 to 2022-23

$21,860

$29,460

$37,050

$39,400

$30,000

$40,000

Published Tuition and Fees in 2022 Dollars

Private

Nonprot

Four-Year

$20,000

Public

Four-Year

$10,940

$11,060

$10,000

$6,690

Public

$4,870

$4,030

Two-Year

$3,860

$2,720

$2,340

$0

92-93 97-98 02-03 07-08 12-13 17-18 22-2

3

FIGURE CP-3

1992-93 to 2022-23 (1992-93 = 1.0)

3.0

Public

2.5

Four-Year

1.69

2.27

2.25

1.80

1.65

1.72

1.0

1.5

2.0

Inflation-Adjusted Published Tuition and Fees

Relative to 1992-93

Private

Nonprot

Four-Year

Public

Two-Year

1.35

1.16

1.37

92-93 97-98 02-03 07-08 12-13 17-18

22-23

the public four-year sector in 2022-23 is 2.25 times as high as it was in 1992-93, after adjusting

charges for public two-year institutions and in-state charges for public four-year institutions.

In 2022-23, the average published tuition and fee

price at public two-year colleges is 35% of the

was 48% in 1992-93.

In 2022-23, the average published tuition and fee

3.6 times as high as the average price at public

1992-93.

In 2022-23, the average published tuition and fee

price is 1.65 times as high as it was 30 years ago

at public two-year colleges, 2.25 times as high as

it was 30 years ago at public four-year institutions,

and 1.8 times as high as it was 30 years ago at

ALSO IMPORTANT:

The increases in the net prices that students actually

pay, after taking grant aid into consideration, have

been smaller over the long term than increases in

CP-10 for details on estimated average net prices

over time.

Over the 30-year period from 1991 to 2021, median

family income in the United States increased by

27% (from $69,915 to $88,590), after adjusting for

13

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

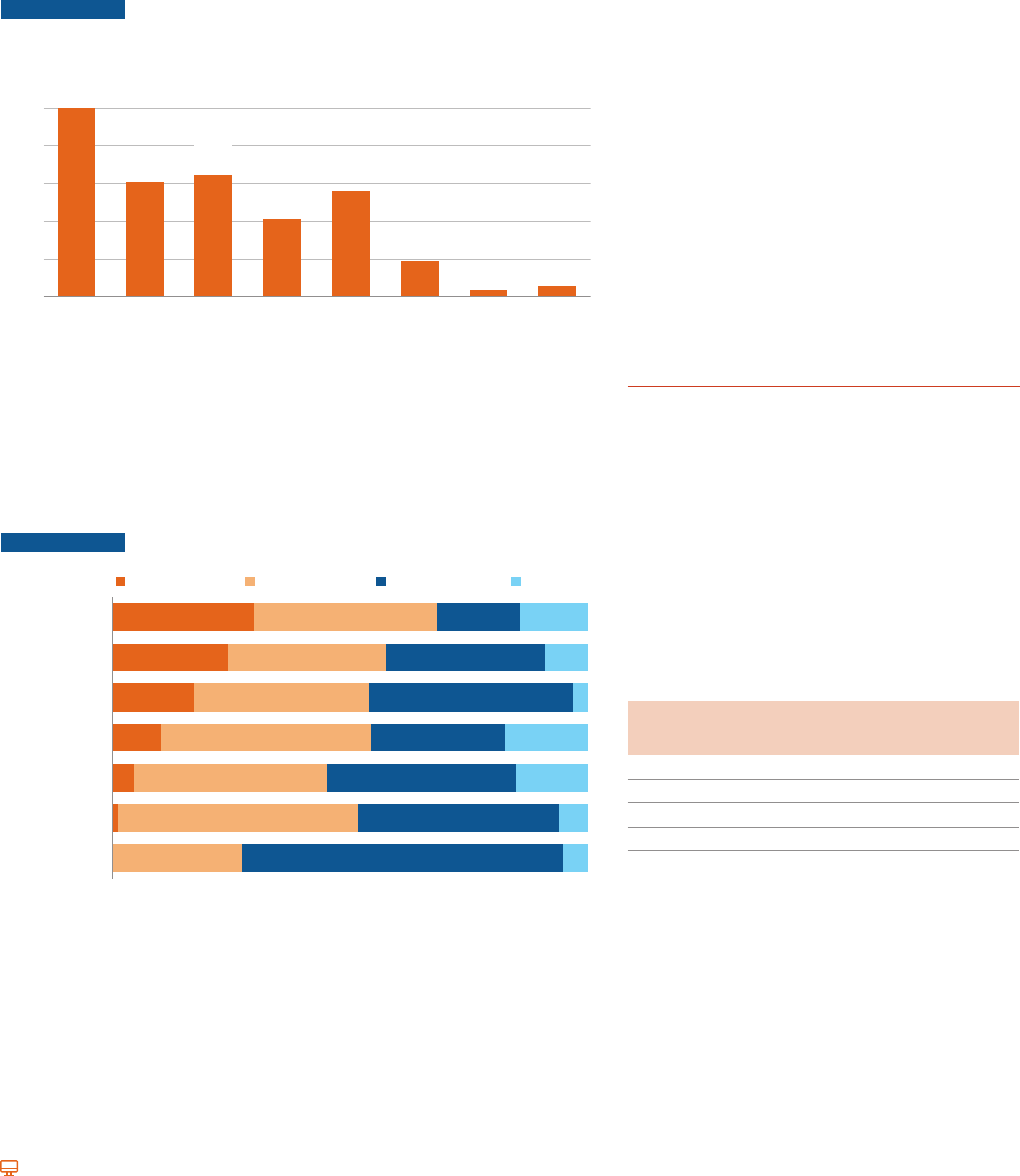

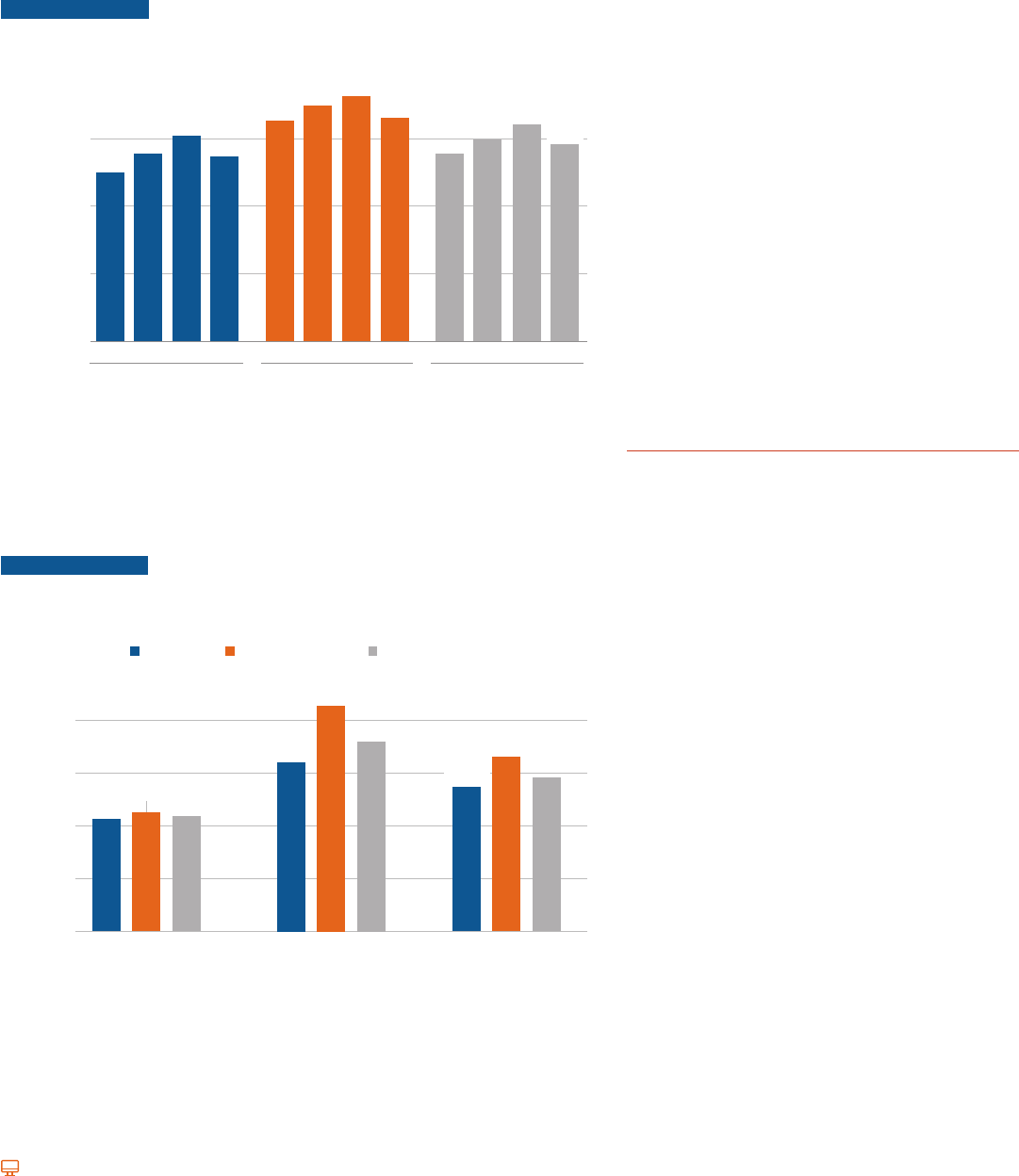

Published Charges over Time

After adjusting for ination, the average published tuition and fees in all three sectors remained unchanged

in 2020-21 and declined in 2021-22 and 2022-23. The ination rate was 1.2% in 2020, 4.7% in 2021, and

8.3% in the rst eight months of 2022.

FIGURE CP-4 Ten-Year Percentage Changes in Ination-Adjusted Published

Prices by Decade, 1992-93 to 2022-23

Tuition and Fees

and Room and Board

Public

Four-Year

Private Nonprofit

Four-Year

Tuition and Fees

Public

Two-Year

Public

Four-Year

Private Nonprofit

Four-Year

2012-13 to 2022-232002-03 to 2012-131992-93 to 2002-03

29%

29%

24%

44%

26%

35%

6%

37%

65%

-1%

48%

-4%

6%

2%

0%

20%

40%

60%

80%

10-Year Percentage Change

16%

NOTE: Each bar in Figure CP-4 shows the percentage change in published prices in ination-

adjusted dollars over a 10-year period. For example, from 2012-13 to 2022-23, average published

tuition and fees at private nonprot four-year colleges increased by 6% beyond increases in the

Consumer Price Index. Average tuition and fee prices reect in-district charges for public

two-year institutions and in-state charges for public four-year institutions.

SOURCE: College Board, Annual Survey of Colleges; NCES, IPEDS Fall Enrollment data.

Between 2012-13 and 2022-23, published in-state

tuition and fees at public four-year institutions

declined by -1% after adjusting for ination,

compared with increases of 37% between

1992-93 and 2002-03 and 65% between

2002-03 and 2012-13.

Between 2012-13 and 2022-23, published in-state

tuition and fees in the public four-year sector

declined by $120 in 2022 dollars, compared with

increases of $1,820 between 1992-93 and 2002-03

and $4,370 between 2002-03 and 2012-13.

Between 2012-13 and 2022-23, total tuition, fees,

room and board increased by 2% at public four-year

and by 6% at private nonprot four-year institutions,

after adjusting for ination.

ALSO IMPORTANT:

The price increases reported in Table CP-2 are

adjusted for ination and are smaller than the

unadjusted price changes in Table CP-1.

TABLE CP-2 Average Tuition and Fees and Room and Board (Enrollment-Weighted) in 2022 Dollars, 1992-93 to 2022-23, Selected Years

Ac

ademic

Year

Tuition and Fees in 2022 Dollars Tuition and Fees and Room and Board in 2022 Dollars

Private Nonprot

Four-Year

10-Year

$ Change

Public

Four-Year

10-Year

$ Change

Public

Two-Year

10-Year

$ Change

Private Nonprot

Four-Year

10-Year

$ Change

Public

Four-Year

10-Year

$ Change

1992-93 $21,860 $4,870 $2,340 $31,440 $12,190

2002-03 $29,460 $7,600 $6,690 $1,820 $2,720 $380 $40,570 $9,130 $15,770 $3,580

2012-13 $37,050 $7,590 $11,060 $4,370 $4,030 $1,310 $50,420 $9,850 $22,780 $7,010

2022-23 $39,400 $2,350 $10,940 -$120 $3,860 -$170 $53,430 $3,010 $23,250 $470

Academic

Year

Private Nonprot

Four-Year

One-Year

%Change

Public

Four-Year

One-Year

%Change

Public

Two-Year

One-Year

%Change

Private Nonprot

Four-Year

One-Year

%Change

Public

Four-Year

One-Year

%Change

2012-13 $37,050 $11,060 $4,030 $50,420 $22,780

2013-14 $37,960 2.5% $11,200 1.3% $4,080 1.2% $51,600 2.3% $23,150 1.6%

2014-15 $38,780 2.2% $11,340 1.3% $4,140 1.5% $52,620 2.0% $23,470 1.4%

2015-16 $40,040 3.2% $11,680 3.0% $4,210 1.7% $54,330 3.2% $24,230 3.2%

2016-17 $40,960 2.3% $11,820 1.2% $4,230 0.5% $55,450 2.1% $24,640 1.7%

2017-18 $41,560 1.5% $11,950 1.1% $4,240 0.2% $56,270 1.5% $24,890 1.0%

2018-19 $41,700 0.3% $11,930 -0.2% $4,240 0.0% $56,430 0.3% $25,010 0.5%

2019-20

$42,330 1.5% $11,980 0.4% $4,250 0.2% $57,240 1.4% $25,200 0.8%

2020-21 $42,260 -0.2% $11,990 0.1% $4,250 0.0% $57,350 0.2% $25,270 0.3%

2021-22 $41,230 -2.4% $11,640 -2.9% $4,120 -3.1% $55,980 -2.4% $24,580 -2.7%

2022-23 $39,400 -4.4% $10,940 -6.0% $3,860 -6.3% $53,430 -4.6% $23,250 -5.4%

NOTE: Average tuition and fee prices reect in-district charges for public two-year institutions and in-state charges for public four-year institutions.

SOURCE: College Board, Annual Survey of Colleges; NCES, IPEDS Fall Enrollment data.

14

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

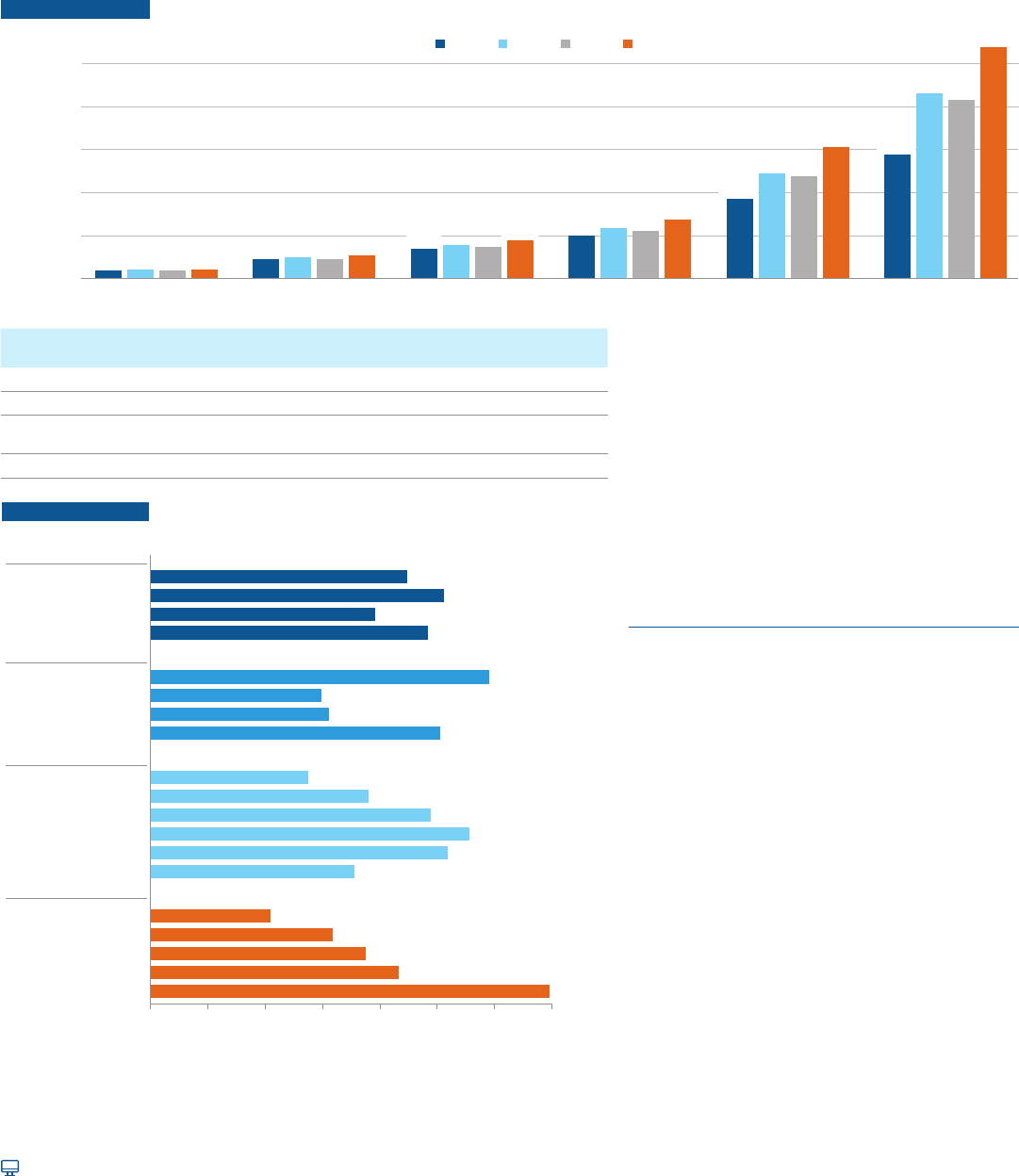

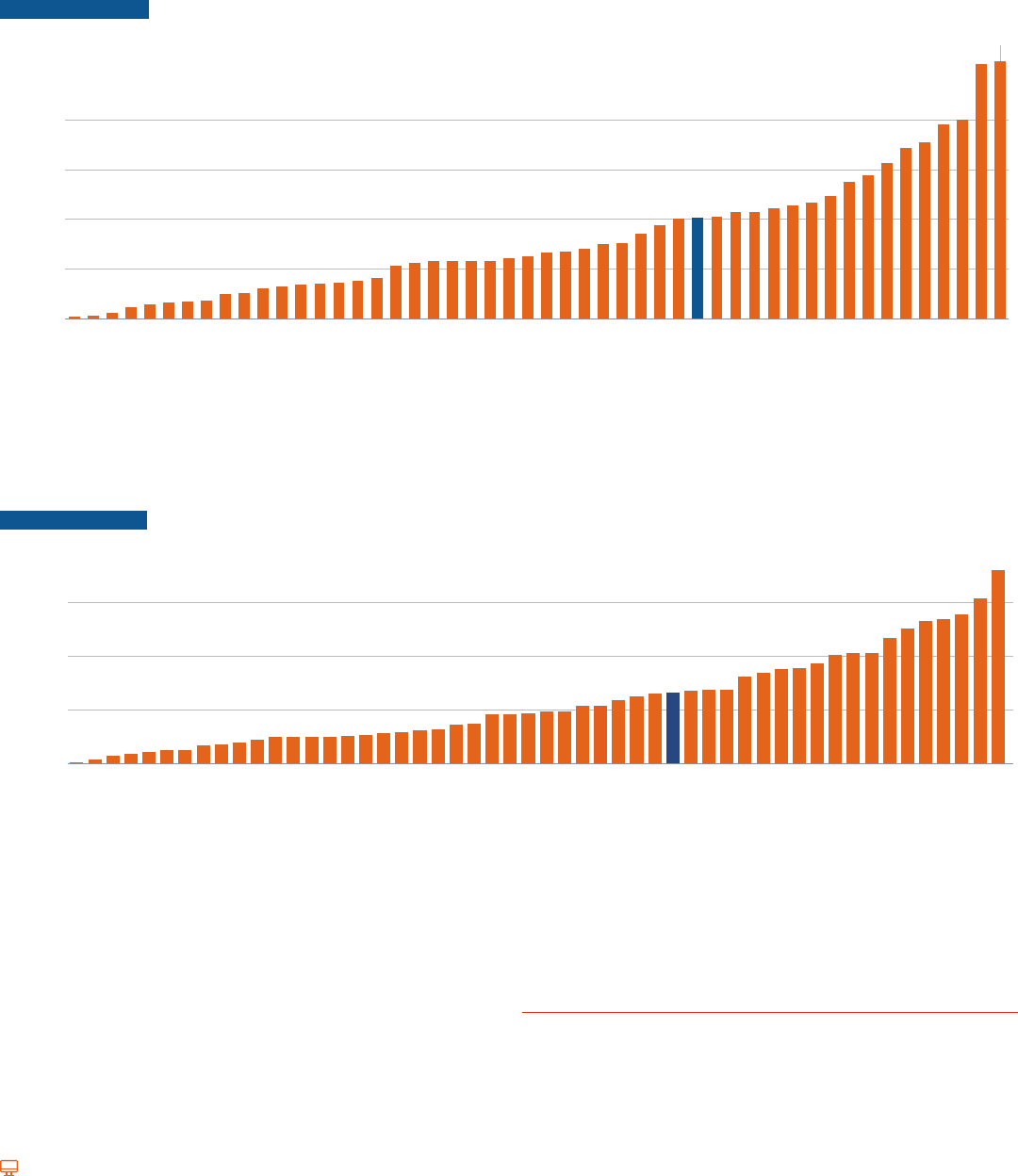

Tuition and Fees by State: Public Two-Year

In 2022-23, average published tuition and fees for full-time in-district students at public two-year colleges

range from $1,430 in California and $2,050 in New Mexico to $8,660 in Vermont.

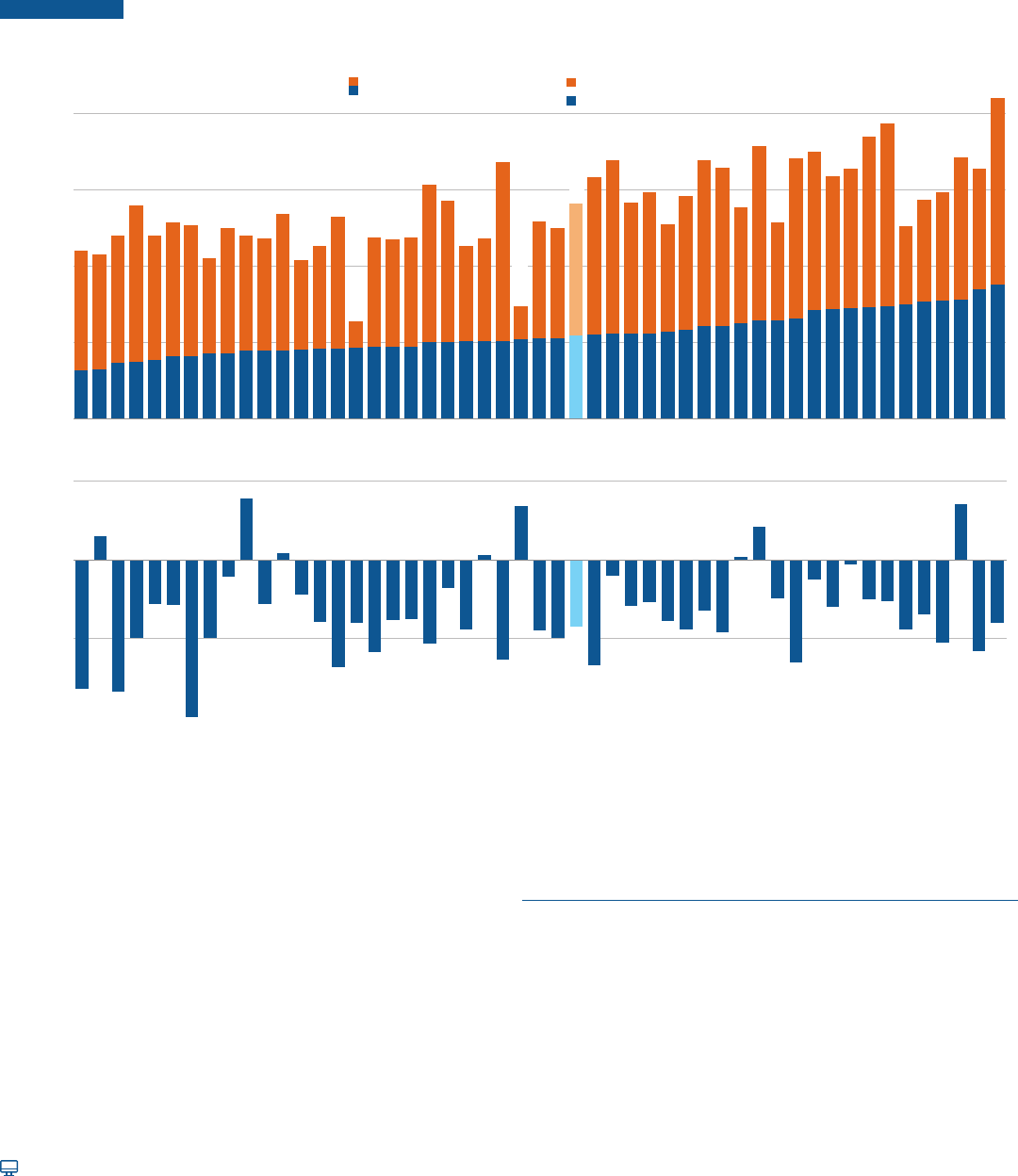

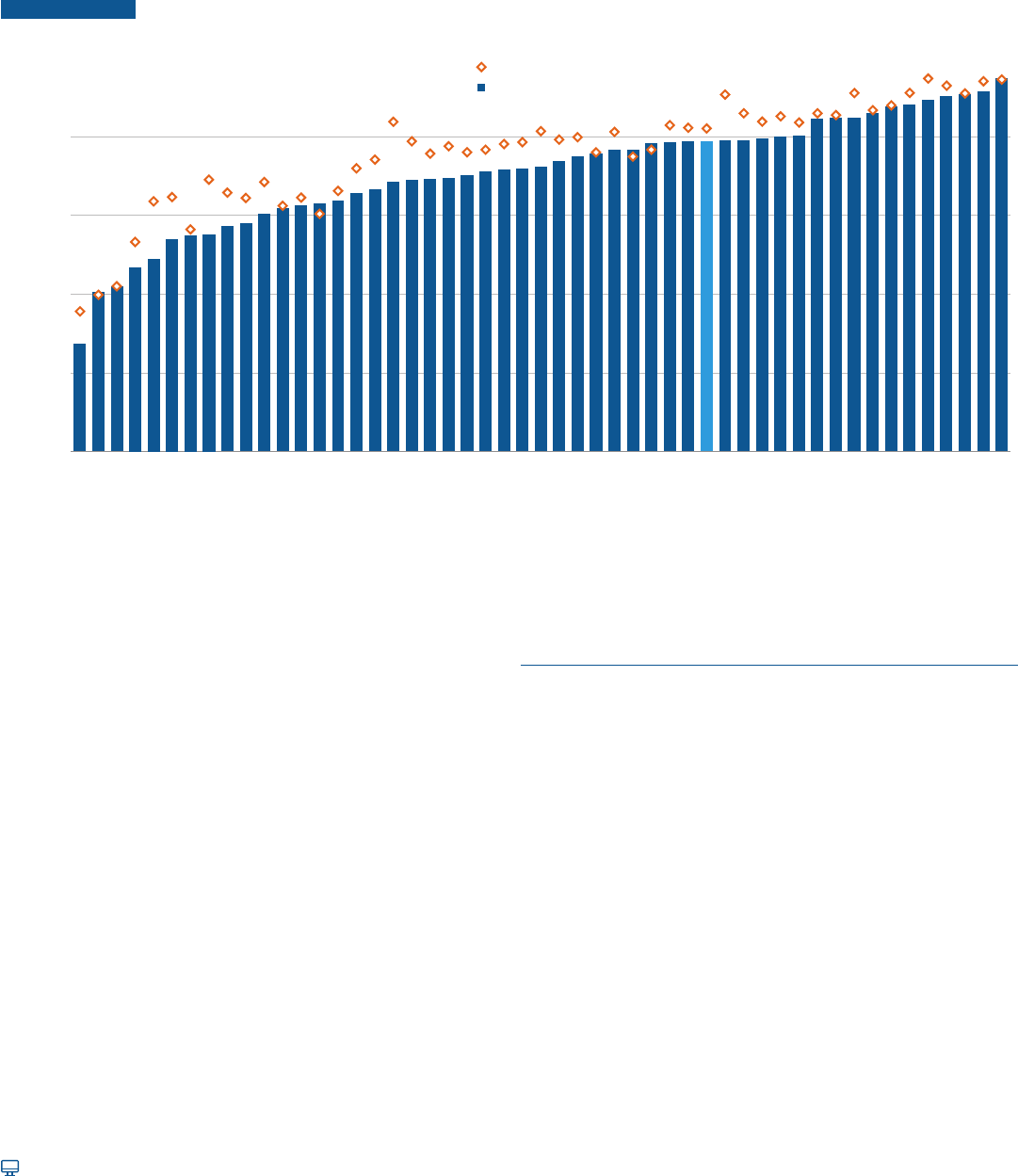

FIGURE CP-5 Average 2022-23 In-District Tuition and Fees at Public Two-Year Institutions and 2017-18 to 2022-23 Five-Year Percentage

Changes in Ination-Adjusted In-District Tuition and Fees, by State

$0

$2,000

$4,000

$6,000

$8,000

5-Year Percentage Change in

Average In-District Tuition and Fees

2022-23 Average In-District Tuition and Fees

$1,430

$2,050

$3,860

$8,660

$7,310

CA

NM

NC

AZ

TX

FL

KS

NE

MS

VA

OH

ND

NJ

KY

OR

MA

NH

SD

VT

ME

US

NV

MT

HI

GA

AR

ID

LA

UT

MI

MO

IL

WV

WY

TN

OK

WI

CT

MD

CO

WA

DE

AL

IN

RI

NY

PA

SC

IA

MN

$7,090

0%

10%

20%

California

New Mexico

North Carolina

Arizona

Texas

Florida

Kansas

Nebraska

Mississippi

Virginia

Ohio

North Dakota

New Jersey

Kentucky

Oregon

Massachusetts

New Hampshire

South Dakota

Vermont

Maine

United States

Nevada

Montana

Hawaii

Georgia

Arkansas

Idaho

Louisiana

Utah

Michigan

Missouri

Illinois

West Virginia

Wyoming

Tennessee

Oklahoma

Wisconsin

Connecticut

Maryland

Colorado

Washington

Delaware

Alabama

Indiana

Rhode Island

New York

Pennsylvania

South Carolina

Iowa

Minnesota

-16%

-9%

20%

-10%

SOURCE: College Board, Annual Survey of Colleges; NCES, IPEDS Fall Enrollment data.

Between 2017-18 and 2022-23, average in-district tuition and fees

at public two-year colleges increased in seven states and declined

in the remaining states, after adjusting for ination.

Between 2017-18 and 2022-23, average in-district tuition and fees

at public two-year colleges declined by more than 10% in 15 states,

after adjusting for ination.

ALSO IMPORTANT:

In California and Florida, tuition at public two-year colleges has

not changed since 2012-13 and 2015-16, respectively, before

adjusting for ination. (Table CP-5 online)

From 2021-22 to 2022-23, the average published two-year

in-district tuition and fees did not increase in eight states,

before adjusting for ination. (Table CP-5 online)

15

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

Tuition and Fees by State: Public Four-Year

In 2022-23, average published tuition and fees for full-time in-state students at public four-year institutions

range from $6,370 in Florida and $6,440 in Wyoming to $17,020 in New Hampshire and $17,650 in Vermont.

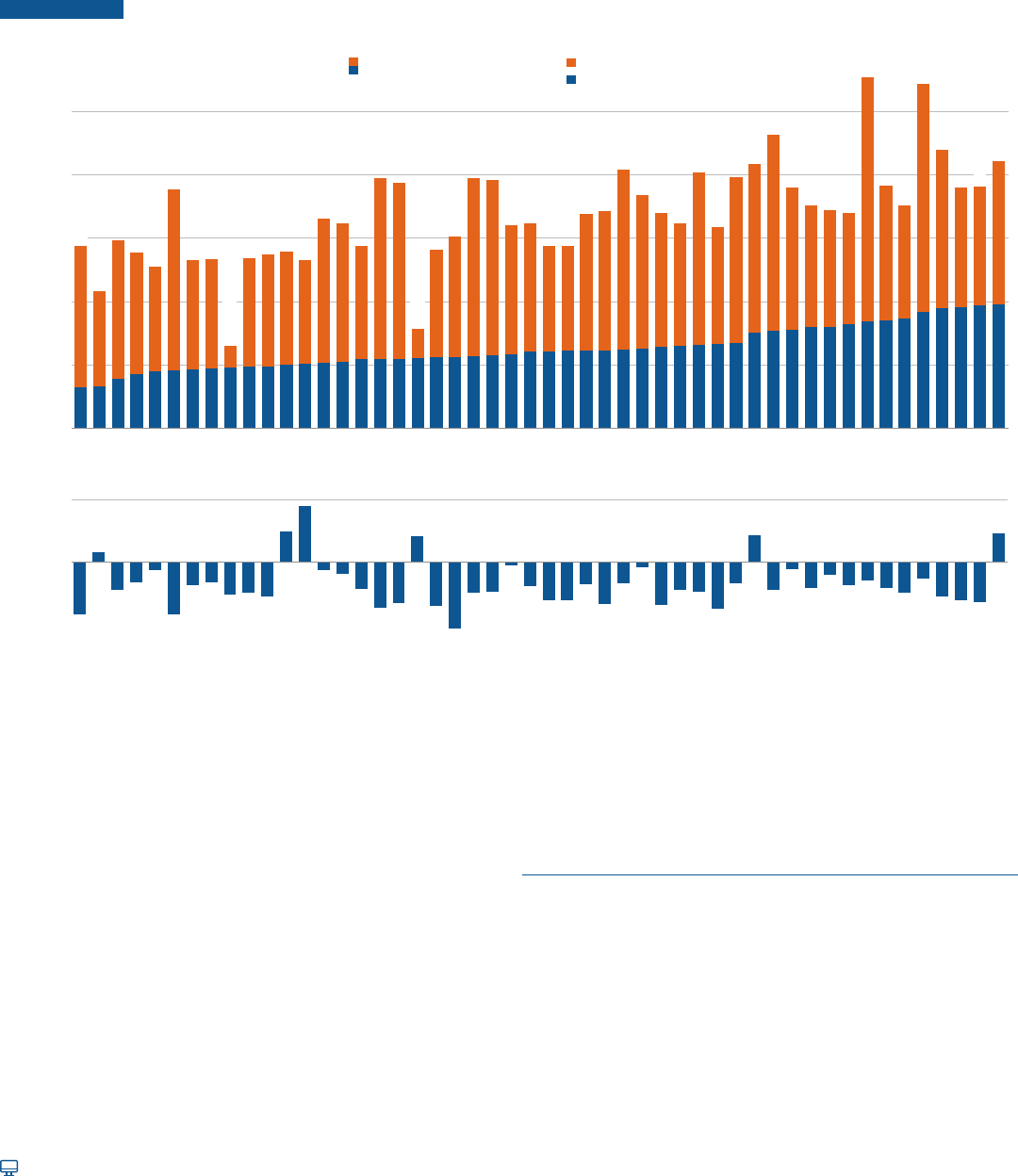

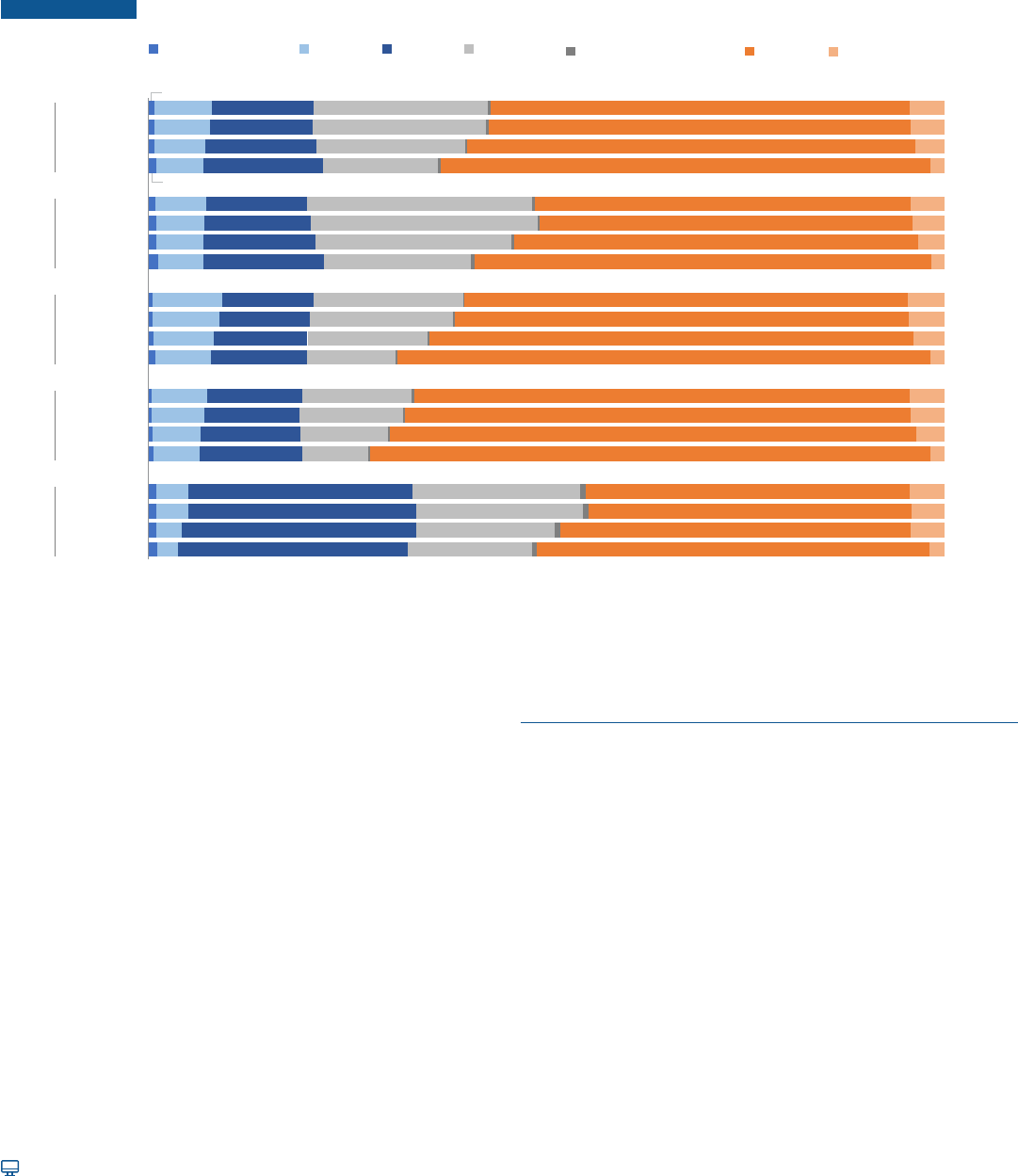

FIGURE CP-6 Average 2022-23 Tuition and Fees at Public Four-Year Institutions and 2017-18 to 2022-23 Five-Year Percentage Changes in

Ination-Adjusted In-State Tuition and Fees, by State

$22,010

$21,590

$12,830

$14,800

$41,9

80

$32,740

$10,000

$20,000

$30,000

$40,000

$0

5-Year Percentage Change in

Average In-State Tuition and Fees

2022-23 Average Tuition and Fees

In-State Tuition and Fees

Out-of-State Premium

Out-of-State Tuition and Fees

$28,240

$17,650

$17,020

$10,940

$6,370

$6,440

FL

WY

NC

MT

UT

ID

GA

NY

NV

NM

WV

AK

MS

NE

WI

SD

KS

OK

AR

IN

IA

LA

MO

CA

ND

MD

TN

US

HI

WA

TX

ME

KY

AL

CO

AZ

OH

OR

MN

SC

DE

MA

RI

VA

MI

IL

NJ

PA

CT

NH

VT

Florida

Wyoming

North Carolina

Montana

Utah

Idaho

Georgia

New York

Nevada

New Mexico

West Virginia

Alaska

Mississippi

Nebraska

Wisconsin

South Dakota

Kansas

Oklahoma

Arkansas

Indiana

Iowa

Louisiana

Missouri

California

North Dakota

Maryland

Tennessee

United States

Hawaii

Washington

Texas

Maine

Kentucky

Alabama

Colorado

Arizona

Ohio

Oregon

Minnesota

South Carolina

Delaware

Massachusetts

Rhode Island

Virginia

Michigan

Illinois

New Jersey

Pennsylvania

Connecticut

New Hampshire

Vermont

-16%

-17%

-20%

3%

0%

10%

-10%

7%

4%

-8%

SOURCE: College Board, Annual Survey of Colleges; NCES, IPEDS Fall Enrollment data.

Between 2017-18 and 2022-23, average in-state tuition and fees

at public four-year institutions increased in eight states, after

adjusting for ination.

Between 2017-18 and 2022-23, average in-state tuition and fees

at public four-year institutions fell in 42 states and fell by more

than 10% in 12 states, after adjusting for ination.

ALSO IMPORTANT:

A small number of public four-year institutions charge the same

tuition to out-of-state students as to in-state students.

From 2021-22 to 2022-23, the average published four-year

in-state tuition and fees did not increase in nine states, before

adjusting for ination. (Table CP-5 online)

16

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

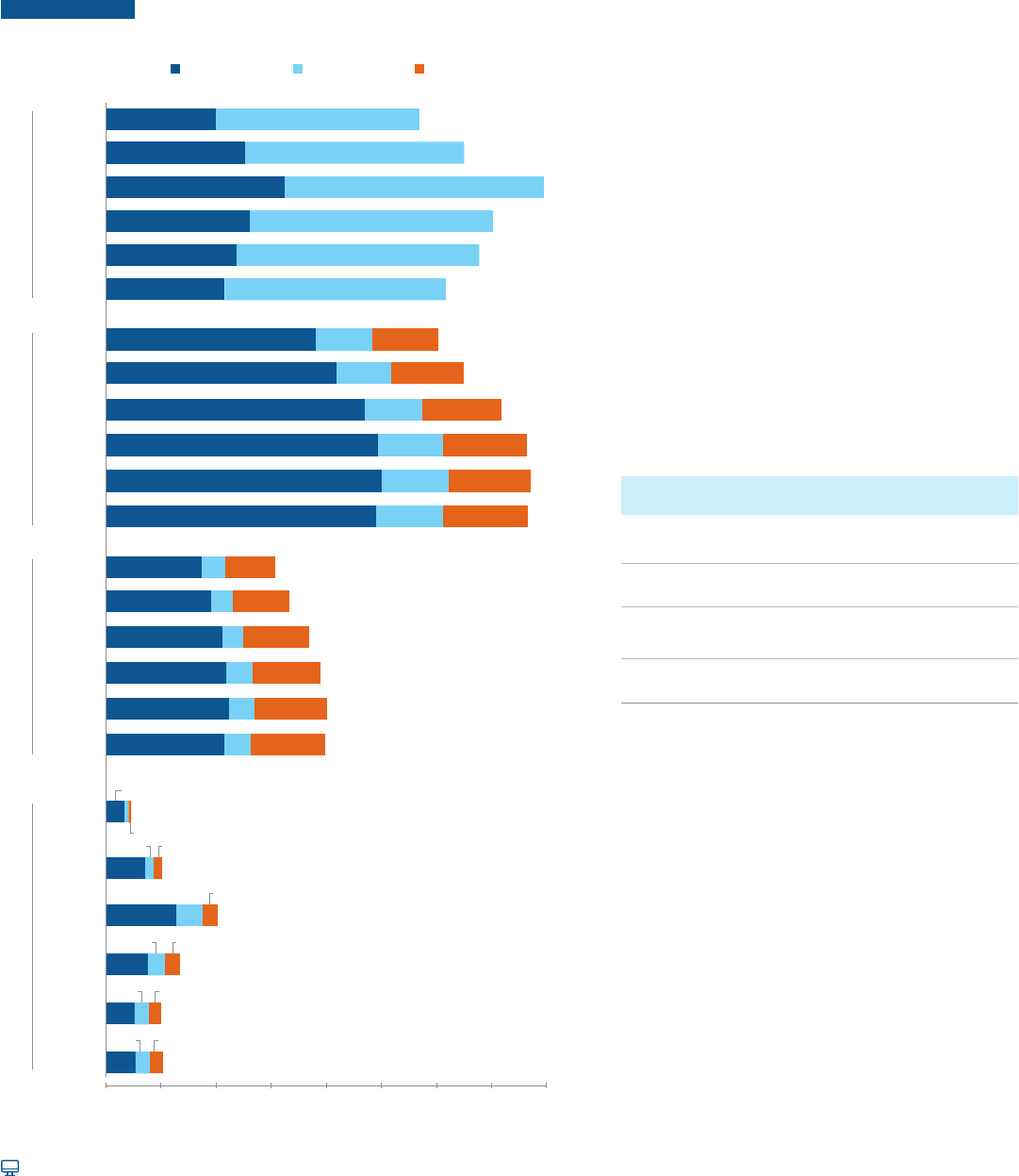

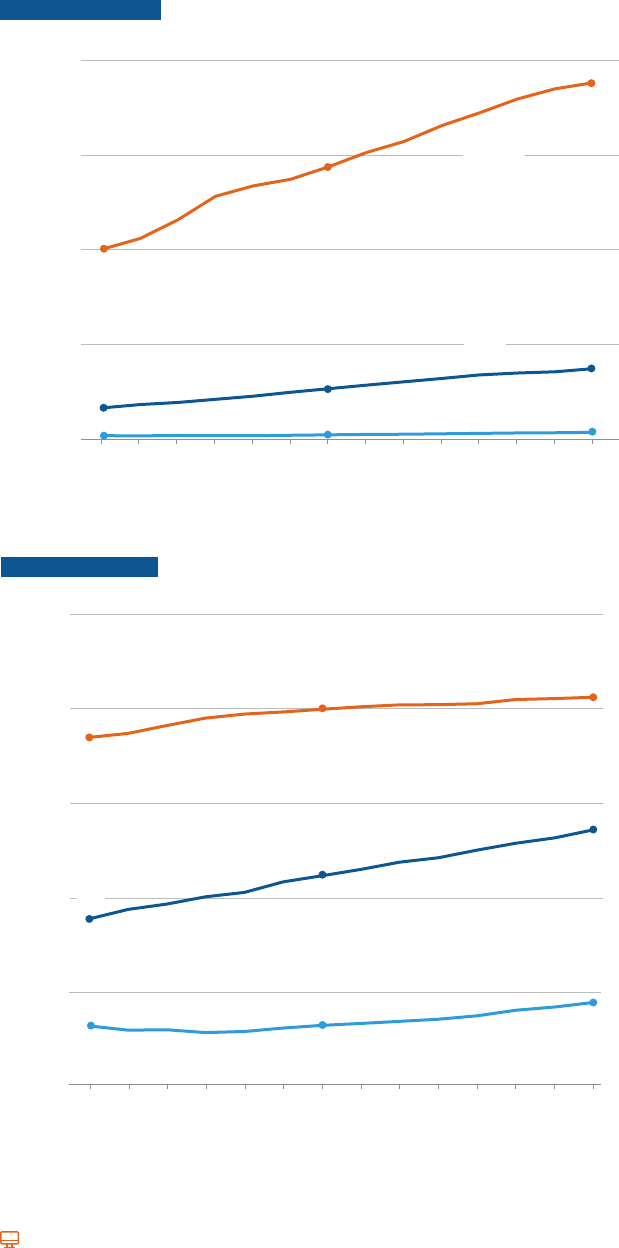

Tuition and Fees by State: Flagship Universities

In 2022-23, published tuition and fees for full-time in-state students at agship universities range from

$6,380 at the University of Florida and $6,440 at the University of Wyoming to $19,290 at Pennsylvania State

University and $19,430 at the University of Connecticut.

FIGURE CP-7 2022-23 Tuition and Fees at Flagship Universities and Five-Year Percentage Changes in Ination-Adjusted In-State Tuition and Fees

$28,660

$55,330

$54,390

$38,100

$42,100

$21,590

5-Year Percentage Change in

In-State Tuition and Fees

$0

$10,000

$20,000

$30,000

$40,000

$50,000

2022-23 Tuition and Fees

In-State Tuition and Fees

Out-of-State Premium

Out-of-State Tuition and Fees

MT

ID

NM

MS

UT

IA

WI

LA

WA

KY

DE

NJ

MI

MA

IL

VA

FL

WY

NC

WV

SD

NE

AR

AK

NM

NY

TX

ND

KS

GA

MD

IN

MO

AL

OK

ME

HI

OH

SC

CO

TN

AZ

OR

CA

MN

RI

VT

NH

PA

CT

$12,940

0%

20%

3%

10%

18%

8%

-15%

-21%

9% 9%

Univ. of MT

Univ. of ID

Univ. of MS

Univ. of UT

Univ. of IA

Univ. of WI-Madison

LA State Univ. & A&M College

Univ. of WA

Univ. of KY

Univ. of DE

Rutgers, State Univ. of NJ

Univ. of MI

Univ. of MA-Amherst

Univ. of IL-Urbana-Champaign

Univ. of VA

Univ. of FL

Univ. of WY

Univ. of NV: Reno

Univ. of NC-Chapel Hill

West VA Univ.

Univ. of SD

Univ. of NE-Lincoln

Univ. of AR

Univ. of AK Fairbanks

Univ. of NM

State Univ. of NY-Buff

alo

Univ. of TX-Austin

Univ. of ND

Univ. of KS

Univ. of GA

Univ. of MD-College Park

IN Univ. Bloomington

Univ. of MO-Columbia

Univ. of AL

Univ. of OK

Univ. of ME

Univ. of HI-Manoa

OH State Univ.-Columbus

Univ. of SC

Univ. of CO-Boulder

Univ. of TN-Knoxville

Univ. of AZ

Univ. of OR

Univ. of CA-Berkeley

Univ. of MN-Twin Cities

Univ. of RI

Univ. of VT

Univ. of NH

Penn State Univ. Park

Univ. of CT

-16% -17%

$6,380

$6,440

$19,290

$19,430

$9,660

$10,780

$16,740

$18,240

$15,570

SOURCE: College Board, Annual Survey of Colleges.

In 2022-23, published tuition and fees for full-time out-of-state

students at agship universities range from $12,940 at the

University of South Dakota and $15,570 at the University of North

Dakota to $54,390 at the University of Virginia and $55,330 at the

University of Michigan.

Public agship universities in 44 states had lower in-state tuition

and fees in 2022-23 than in 2017-18, after adjusting for ination.

ALSO IMPORTANT:

In 2022-23, 11 agship universities did not raise in-state tuition or

mandatory fees over those charged for the 2021-22 academic year,

before adjusting for ination. (Table CP-6 online)

17

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

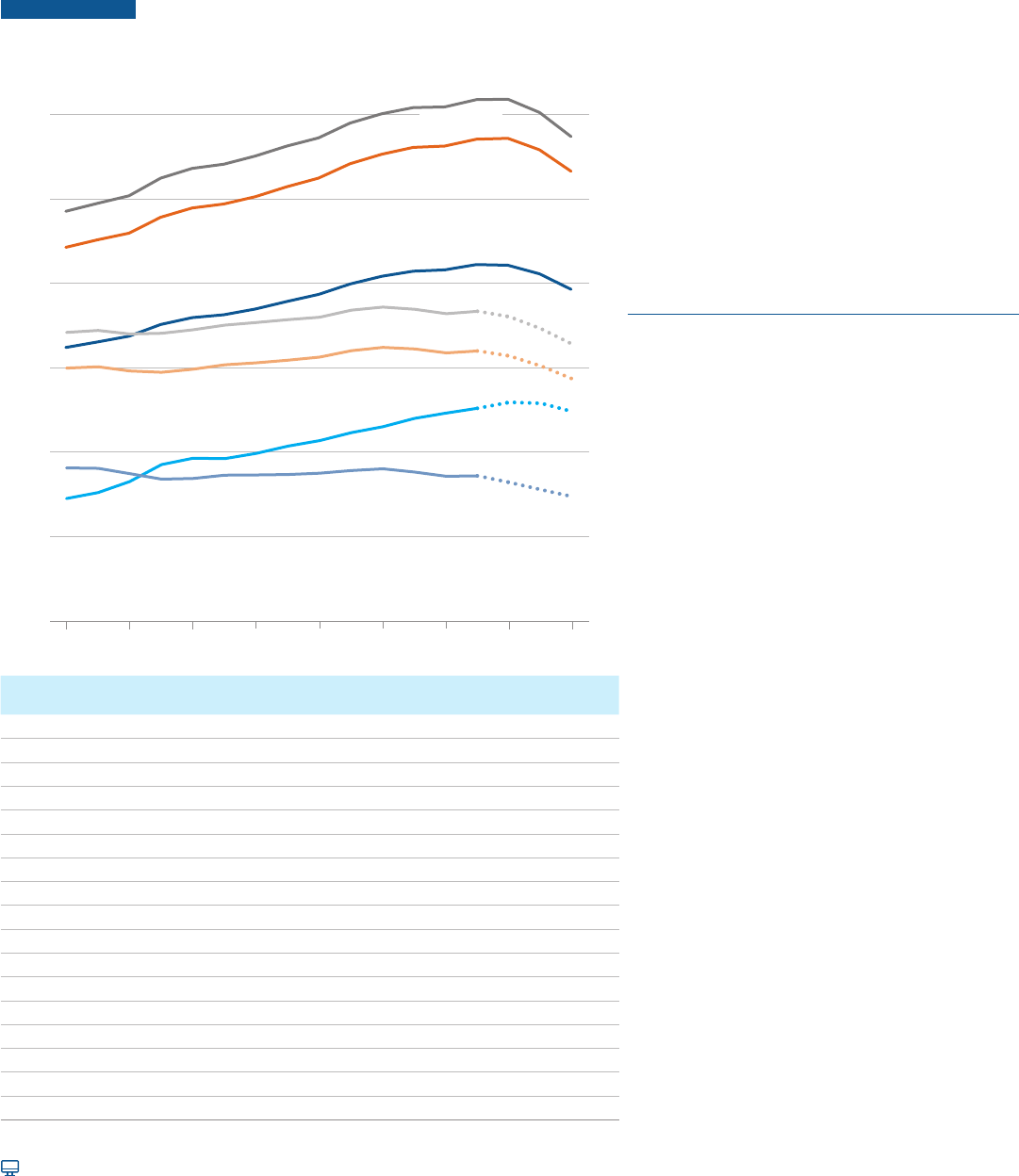

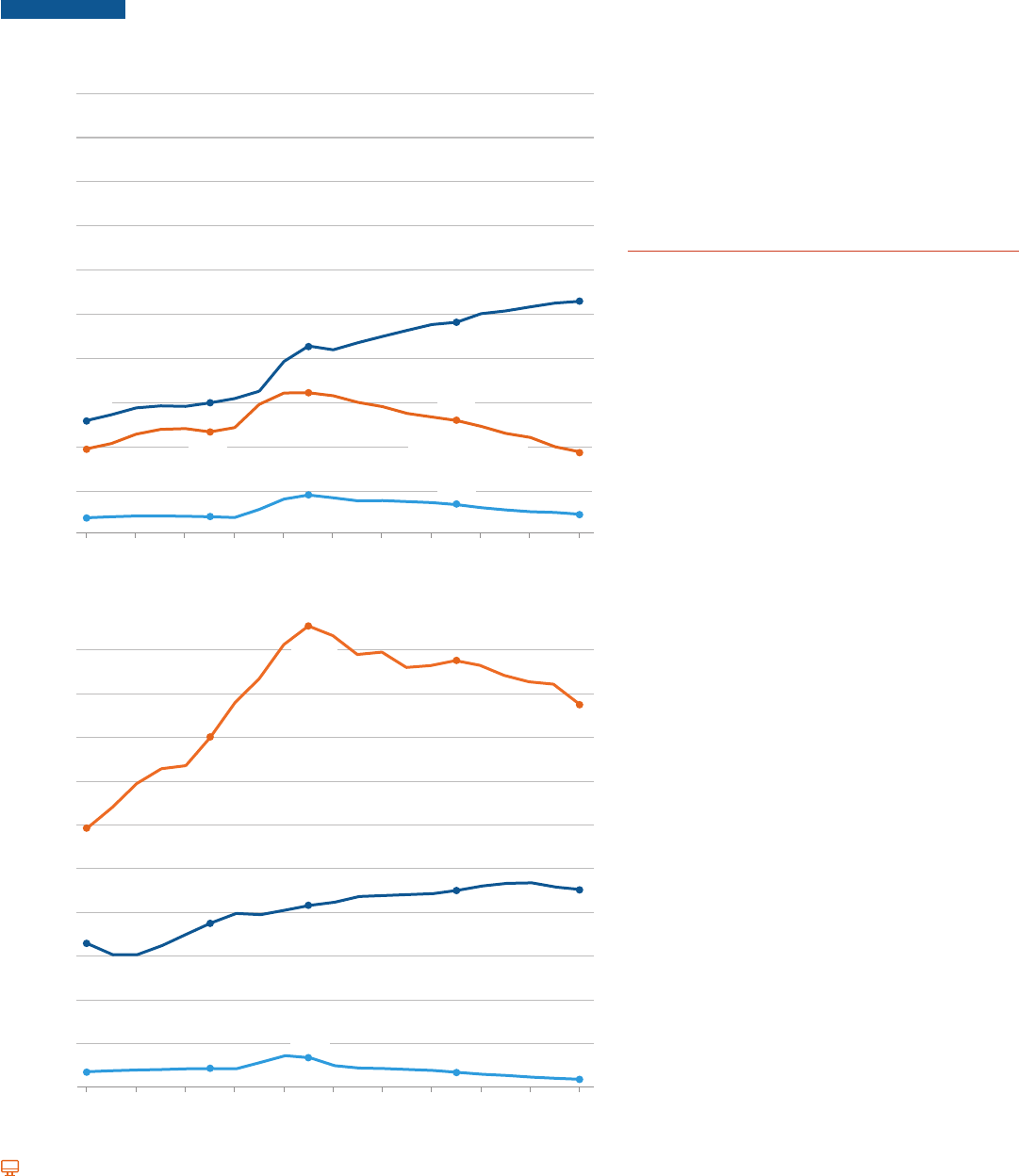

Average Net Price: Public Two-Year

Since 2009-10, rst-time full-time students at public two-year colleges have been receiving enough grant

aid on average to cover their tuition and fees.

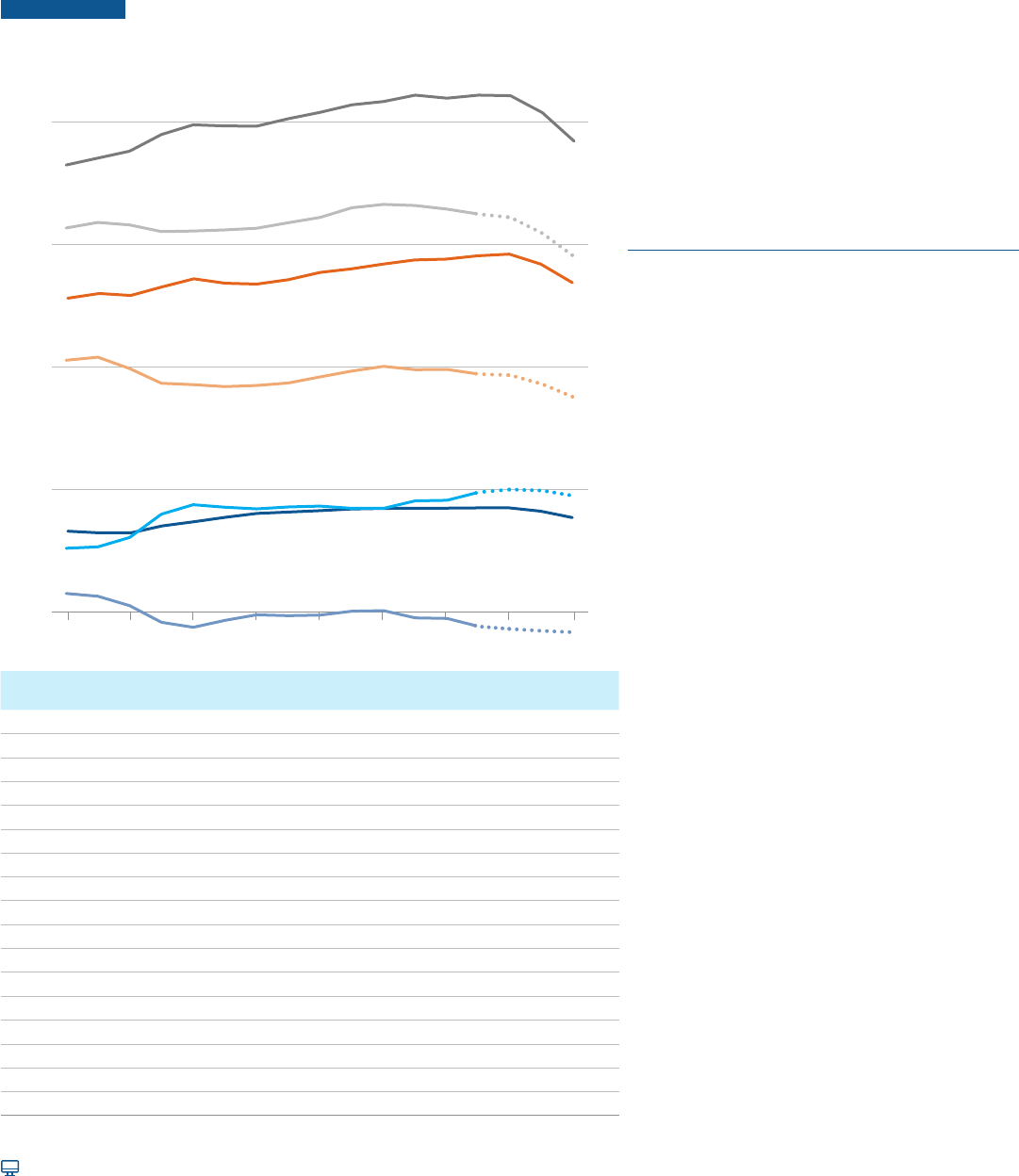

FIGURE CP-8 Average Published and Net Prices in 2022 Dollars, First-Time

Full-Time In-District Undergraduate Students at Public Two-Year

Institutions, 2006-07 to 2022-23

$0

$5,000

$10,000

$15,000

$20,000

Published Tuition

and Fees and Room

and Board (TFRB)

Net TFRB

Published Cost

of Attendance (COA)

Net COA

Grant Aid

Published

Tuition and Fees (TF)

Net TF

Public Two-Year

06-07 10-11 12-13 16-17 18-19 22-2308-09 14-15 20-21

Published

TF

Published

TFRB

Published

COA

Grant Aid

per Student Net TF Net TFRB Net COA

06-07 $3,300 $12,830 $18,250 $2,570 $730 $10,260 $15,680

07-08 $3,240 $13,020 $18,530 $2,630 $610 $10,390 $15,900

08-09 $3,240 $12,940 $18,820 $3,020 $220 $9,920 $15,800

09-10 $3,520 $13,290 $19,500 $3,970 -$450 $9,320 $15,530

10-11 $3,690 $13,620 $19,900 $4,350 -$660 $9,270 $15,550

11-12 $3,870 $13,440 $19,850 $4,250 -$380 $9,190 $15,600

12-13 $4,030 $13,410 $19,840 $4,180 -$150 $9,230 $15,660

13-14 $4,080 $13,590 $20,150 $4,260 -$180 $9,330 $15,890

14-15 $4,140 $13,880 $20,410 $4,300 -$160 $9,580 $16,110

15-16 $4,210 $14,030 $20,710 $4,210 $0 $9,820 $16,500

16-17 $4,230 $14,220 $20,850 $4,210 $20 $10,010 $16,640

17-18 $4,240 $14,390 $21,110 $4,510 -$270 $9,880 $16,600

18-19 $4,240 $14,430 $20,990 $4,540 -$300 $9,890 $16,450

19-20 $4,250 $14,570 $21,110 $4,870 -$620 $9,700 $16,240

20-21 $4,250 $14,630 $21,090 $4,980 -$730 $9,650 $16,110

21-22 $4,120 $14,220 $20,390 $4,930 -$810 $9,290

$15,460

22-23 $3,860 $13,470 $19,230 $4,720 -$860 $8,750 $14,510

In 2022-23, rst-time full-time students at public

two-year colleges need to cover an estimated

$8,750 in food and housing after grant aid, in

addition to another $5,760 in allowances for books

and supplies, transportation, and other personal

expenses.

The average net tuition and fee price declined in

this sector from 2006-07 through 2010-11, was

stable between 2012-13 and 2016-17 and has been

declining since.

ALSO IMPORTANT:

Because of changes in the data sources used in

calculating average grant aid per student, numbers

in Figures CP-8, CP-9, and CP-10 are not strictly

comparable with those in Trends in College Pricing

2019 and earlier editions.

The average net prices in Figure CP-8 are calculated

among all rst-time full-time undergraduate students

in the public two-year sector, including those who

did not receive grant aid. In 2019-20, 75% of rst-

time full-time undergraduate students in this sector

received federal, state, or institutional grant aid.

The large increase in average grant aid shown in

Figure CP-8 between 2008-09 and 2010-11 was

primarily a result of increases in Pell Grant funding.

Average Pell Grant aid per rst-time full-time student

in this sector almost doubled in this two-year period.

NOTE: Average net price is calculated as the dierence

between published price from College Board’s Annual

Survey of Colleges and grant aid from IPEDS Student

Financial Aid data. Because the latest year for which grant

aid data are available is 2019-20, grant aid and net prices for

2020-21 and after are projected and shown in dotted lines.

Higher Education Emergency Relief Fund is included in the

2019-20 grant aid data and projected for later years. Room

and board expenses are estimated based on housing and

food allowances for commuter students.

SOURCES: College Board, Annual Survey of Colleges; NCES,

IPEDS Student Financial Aid data.

18

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

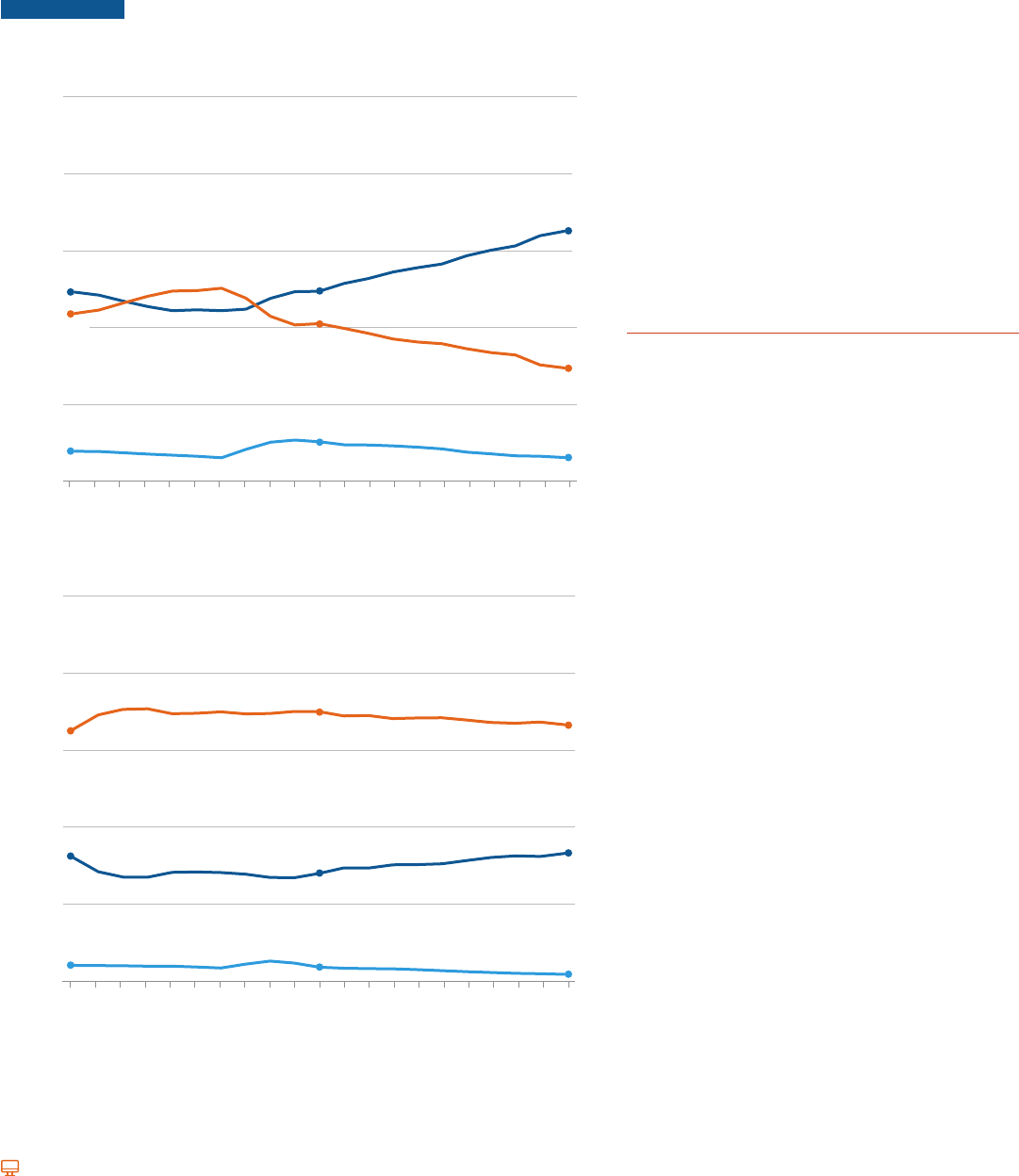

Average Net Price: Public Four-Year

Since 2016-17, the average net tuition and fee price paid by rst-time full-time in-state students

enrolled in public four-year institutions has been declining after adjusting for ination; it was an estimated

$2,250 in 2022-23.

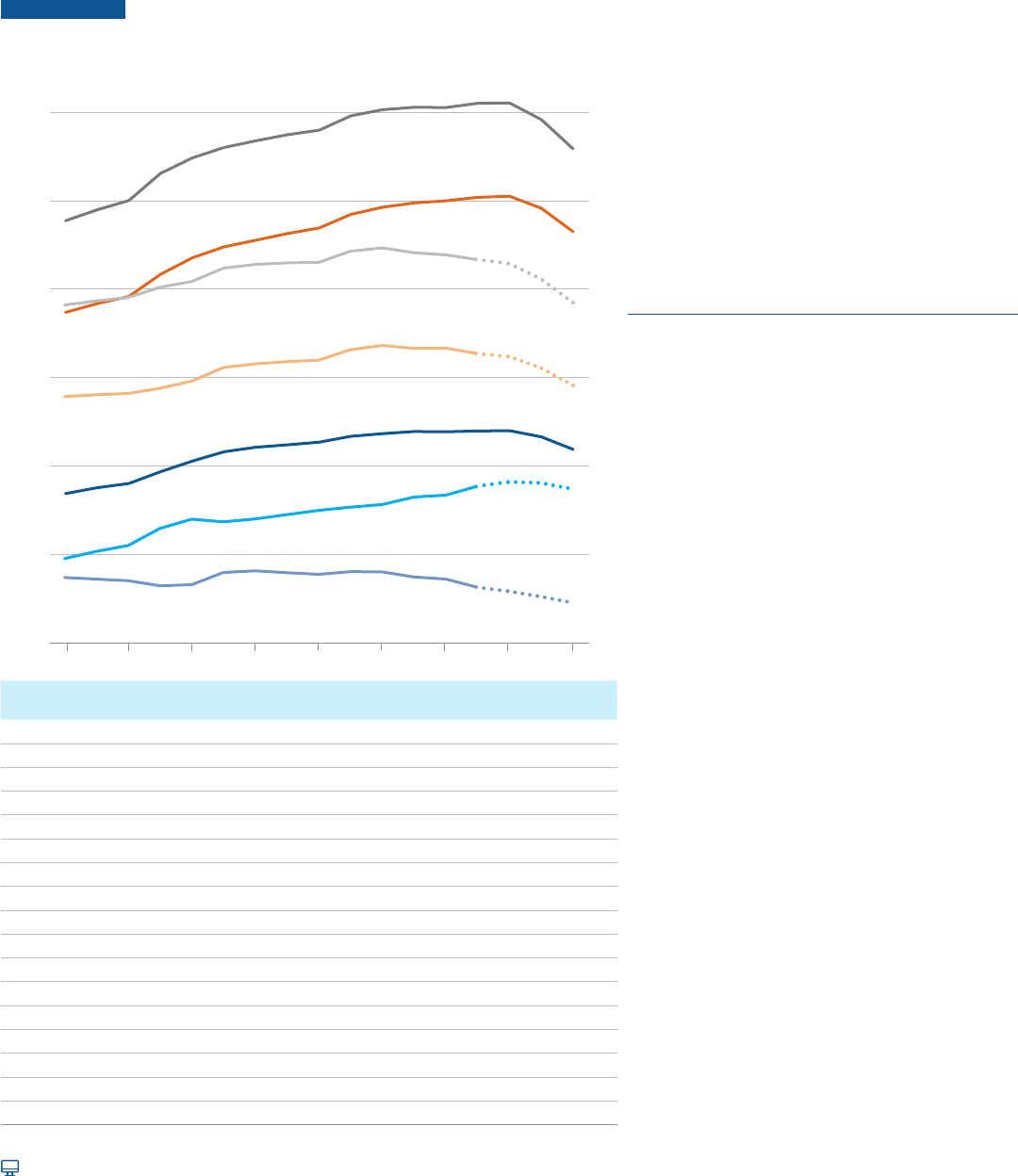

FIGURE CP-9 Average Published and Net Prices in 2022 Dollars, First-Time

Full-Time In-State Undergraduate Students at Public Four-Year

Institutions, 2006-07 to 2022-23

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

Published Tuition and Fees

and Room and Board (TFRB)

Published

Tuition and Fees (TF)

Published Cost

of Attendance (COA)

Net COA

Grant Aid

Net TFRB

Net TF

Public Four-Year

10-11 12-13 16-17 18-19 22-2308-09 14-15 20-2106-07

Published

TF

Published

TFRB

Published

COA

Grant Aid

per Student Net TF Net TFRB Net COA

06-07 $8,440 $18,690 $23,870 $4,760 $3,680 $13,930 $19,110

07-08 $8,760 $19,190 $24,500 $5,160 $3,600 $14,030 $19,340

08-09 $9,000 $19,590 $25,020 $5,490 $3,510 $14,100 $19,530

09-10 $9,670 $20,850 $26,560 $6,460 $3,210 $14,390 $20,100

10-11 $10,270 $21,780 $27,430 $6,990 $3,280 $14,790 $20,440

11-12 $10,800 $22,390 $28,020 $6,830 $3,970 $15,560 $21,190

12-13 $11,060 $22,780 $28,400 $7,000 $4,060 $15,780 $21,400

13-14 $11,200 $23,150 $28,740 $7,250 $3,950 $15,900 $21,490

14-15 $11,340 $23,470 $29,000 $7,480 $3,860 $15,990 $21,520

15-16 $11,680 $24,230 $29,820 $7,660 $4,020 $16,570 $22,160

16-17 $11,820 $24,640 $30,160 $7,820 $4,000 $16,820 $22,340

17-18 $11,950 $24,890 $30,300 $8,240 $3,710 $16,650 $22,060

18-19 $11,930 $25,010 $30,290 $8,340 $3,590 $16,670 $21,950

19-20 $11,980 $25,200 $30,520 $8,850 $3,130 $16,350 $21,670

20-21 $11,990 $25,270 $30,540 $9,090 $2,900 $16,180 $21,450

21-22 $11,640 $24,580 $29,610 $9,040 $2,600 $15,540 $20,570

22-23 $10,940 $23,250 $27,940 $8,690 $2,250 $14,560 $19,250

In 2022-23, rst-time full-time in-state students

at public four-year colleges need to cover an

estimated average of $14,560 in tuition and fees

and room and board after grant aid, in addition

to $4,690 in allowances for books and supplies,

transportation, and other personal expenses.

Between 2006-07 and 2022-23, average grant aid

per rst-time full-time in-state student at public

four-year colleges increased by $3,930 after

adjusting for ination, from $4,760 (in 2022 dollars)

to an estimated $8,690; average published tuition

and fees in this sector increased by $2,500, from

$8,440 (in 2022 dollars) to $10,940.

ALSO IMPORTANT:

In 2019-20, the latest year for which detailed

nancial aid data are available from IPEDS, 49% of

the total $8,850 (in 2022 dollars) in grant aid per

rst-time full-time in-state student in the public

four-year sector comes from institutional grant aid

provided by colleges and universities in the form of

discounts from their published prices.

The average net prices in Figure CP-9 are calculated

among all rst-time full-time undergraduate

students in the public four-year sector, including

those who did not receive grant aid. In 2019-20,

78% of rst-time full-time undergraduate students

in this sector received federal, state, or institutional

grant aid.

NOTE: Average net price is calculated as the dierence

between published price from College Board’s Annual Survey

of Colleges and grant aid from IPEDS Student Financial Aid

data. Because the latest year for which grant aid data are

available is 2019-20, grant aid and net prices for 2020-21 and

after are projected and shown in dotted lines. Higher Education

Emergency Relief Fund is included in the 2019-20 grant aid data

and projected for later years.

SOURCE: College Board, Annual Survey of Colleges; NCES,

IPEDS Student Financial Aid data.

19

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

Average Net Price: Private Nonprot Four-Year

Since 2017-18, the average net tuition and fee price paid by rst-time full-time students enrolled in

private nonprot four-year institutions has been declining after adjusting for ination; it was an estimated

$14,630 in 2022-23.

FIGURE CP-10 Average Published and Net Prices in 2022 Dollars, First-Time

Full-Time Undergraduate Students at Private Nonprot Four-Year

Institutions, 2006-07 to 2022-23

$0

$20,000

$10,000

$30,000

$40,000

$60,000

$50,000

Published Tuition and Fees

and Room and Board (TFRB)

Net TFRB

Published Cost

of Attendance (COA)

Net COA

Grant Aid

Published

Tuition and Fees (TF)

Net TF

Private Nonprofit Four-Year

10-11 12-13 16-17 18-19 22-2308-09 14-15 20-2106-07

Published

TF

Published

TFRB

Published

COA

Grant Aid

per Student Net TF Net TFRB Net COA

06-07 $32,480 $44,400 $48,670 $14,420 $18,060 $29,980 $34,250

07-08 $33,150 $45,280 $49,620 $15,130 $18,020 $30,150 $34,490

08-09 $33,830 $46,070 $50,510 $16,440 $17,390 $29,630 $34,070

09-10 $35,210 $47,970 $52,610 $18,480 $16,730 $29,490 $34,130

10-11 $36,030 $49,080 $53,770 $19,220 $16,810 $29,860 $34,550

11-12 $36,370 $49,540 $54,280 $19,170 $17,200 $30,370 $35,110

12-13 $37,050 $50,420 $55,240 $19,810 $17,240 $30,610 $35,430

13-14 $37,960 $51,600 $56,430 $20,670 $17,290 $30,930 $35,760

14-15 $38,780 $52,620 $57,400 $21,330 $17,450 $31,290 $36,070

15-16 $40,040 $54,330 $59,170 $22,280 $17,760 $32,050 $36,890

16-17 $40,960 $55,450 $60,280 $23,000 $17,960 $32,450 $37,280

17-18 $41,560 $56,270 $61,000 $23,990 $17,570 $32,280 $37,010

18-19 $41,700 $56,430 $61,100 $24,620 $17,080 $31,810 $36,480

19-20 $42,330 $57,240 $61,960 $25,200 $17,130 $32,040 $36,760

20-21 $42,260 $57,350 $62,010 $25,910 $16,350 $31,440 $36,100

21-22 $41,230 $55,980 $60,430 $25,770 $15,460 $30,210 $34,660

22-23 $39,400 $53,430 $57,570 $24,770 $14,630 $28,660 $32,800

In 2022-23, rst-time full-time students at private

nonprot four-year colleges need to cover an

estimated average of $28,660 in tuition and fees

and room and board after grant aid, in addition

to $4,140 in allowances for books and supplies,

transportation, and other personal expenses.

Between 2006-07 and 2022-23, average grant aid

per rst-time full-time student at private nonprot

four-year colleges increased from $14,420 (in

2022 dollars) to an estimated $24,770; average

published tuition and fees in this sector increased

from $32,480 (in 2022 dollars) to $39,400 during

this time period.

ALSO IMPORTANT:

In 2019-20, the latest year for which detailed

nancial aid data are available from IPEDS, 86%

of the total $25,200 (in 2022 dollars) in grant

aid per rst-time full-time student in the private

nonprot four-year sector comes from colleges

and universities in the form of discounts from their

published prices.

The average net prices in Figure CP-10 are

calculated among all rst-time full-time

undergraduate students in the private nonprot

four-year sector, including those who did not

receive grant aid. In 2019-20, 88% of rst-time

full-time undergraduate students in this sector

received federal, state, or institutional grant aid.

NOTE: Average net price is calculated as the dierence

between published price from College Board’s Annual Survey

of Colleges and grant aid from IPEDS Student Financial Aid

data. Because the latest year for which grant aid data are

available is 2019-20, grant aid and net prices for 2020-21

and after are projected and shown in dotted lines. Higher

Education Emergency Relief Fund is included in the 2019-20

grant aid data and projected for later years.

SOURCE: College Board, Annual Survey of Colleges; NCES,

IPEDS Student Financial Aid data.

20

research.collegeboard.org/trends.

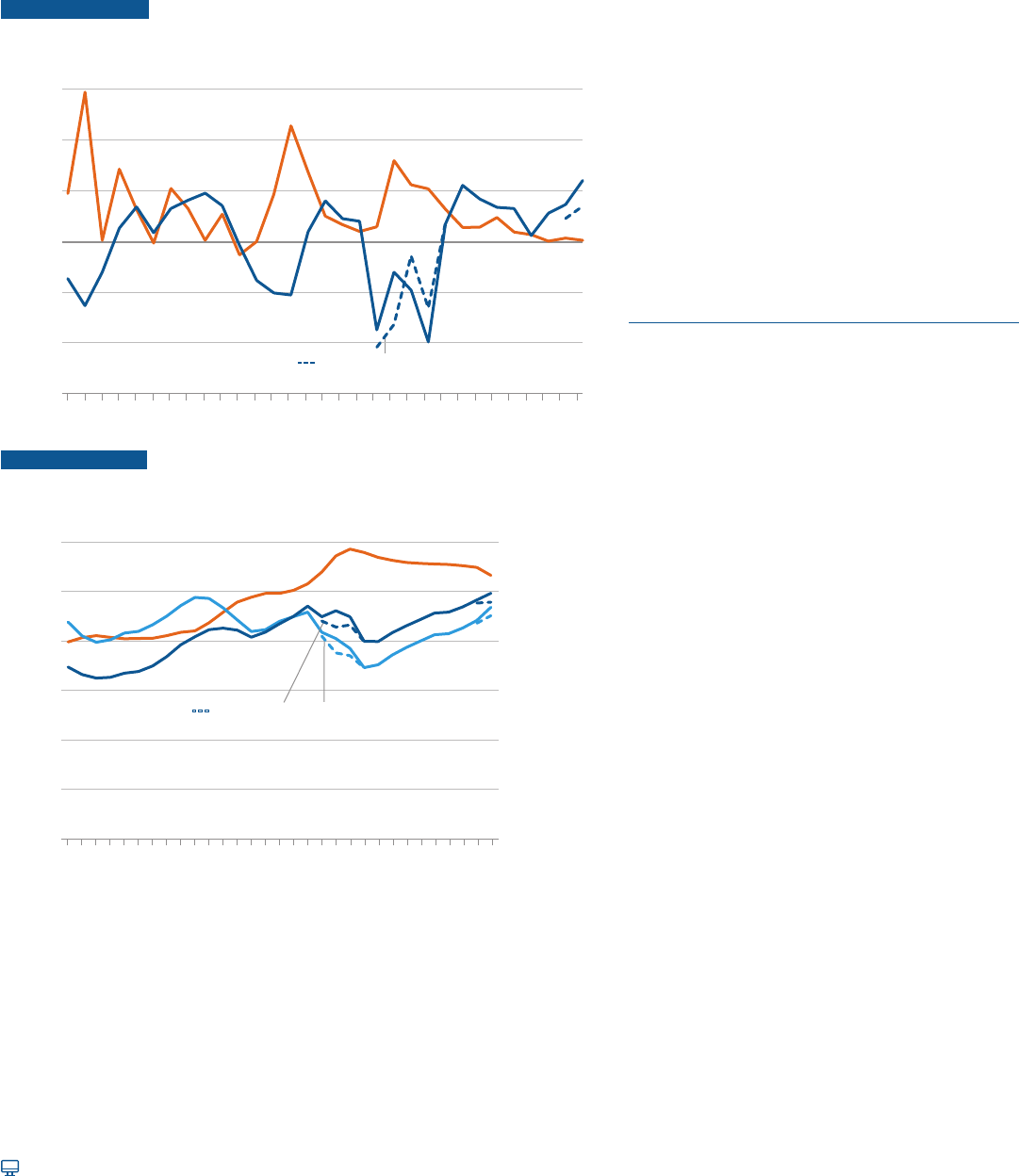

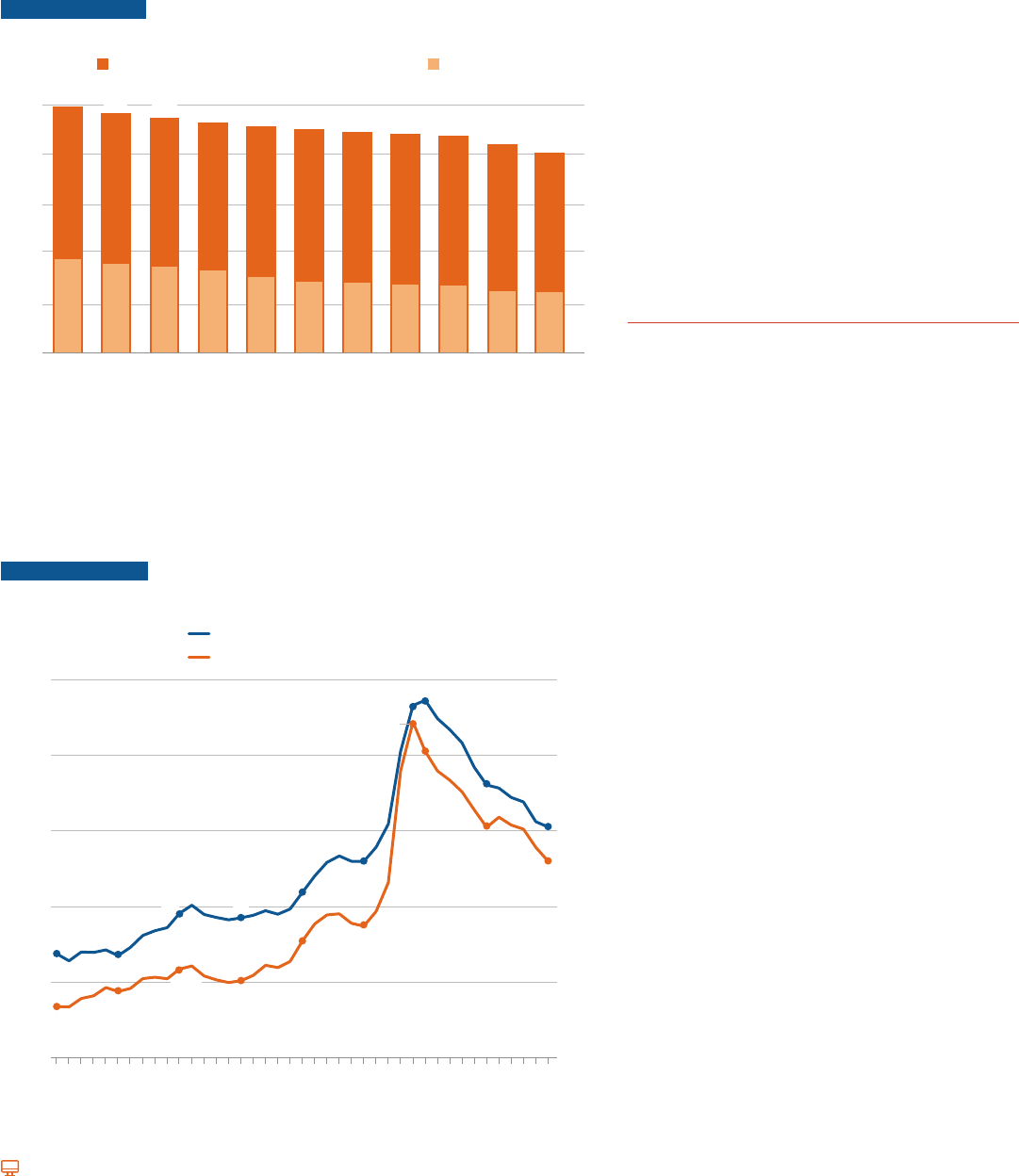

Institutional Revenues:

State and Local Funding

State and local funding for higher education tends to be cyclical. Historically, declines in state and local

funding per student were followed by large percentage increases in tuition and fees in the public sector.

FIGURE CP-11A

15%

10%

5%

0%

–5%

–10%

Tuition and Fees

Funding per FTE Student

- - - Excluding Federal Stimulus Funds

Percentage Change

–15%

90-91 93-94 96-97 99-00 02-03 05-06 08-09 11-12 14-15 17-18 20-

21

FIGURE CP-11B

1990-91 to 2020-21

Total Funding (in Billions of 2020 Dollars)

$120 ($)12

$100

($)10

$80

($)8

$60

($)6

Public FTE Enrollment (Millions)

Total Funding (Billions) Funding per FTE (Thousands)

- - - Excluding Federal Stimulus Funds

Public FTE Enrollment (in Millions)

and Funding per FTE Student

(in Thousands of 2020 Dollars)

$40

($)4

$20

($)2

$0

90-91 93-94 96-97 99-00 02-03 05-06 08-09 11-12 14-15 17-18

($)0

20-21

excluding medical students. Annual percentage changes in public tuition and fees are the averages

of annual percentage changes in tuition and fees in the public four-year and public two-year

other state and local funds for higher education, but not funding for capital expenditures.

Digest of Education Statistics, 2021,

The national average state and local funding per

dollars) for the ninth consecutive year, following

four years of decline during and after the Great

Recession of 2008.

State and local funding per student reached $9,330

in 2020-21, the highest level since 2000-01 when it

was $9,680 (in 2020 dollars).

In the last 30 years, total state and local funding

funding per student increased by 7%.

ALSO IMPORTANT:

In response to the Covid-19 pandemic, the federal

government provided stimulus funding that

supplemented state and local funding for higher

Similarly, the federal government provided stimulus

funding for higher education during the Great

Recession of 2008. This funding was available from

2008-09 through 2011-12.

21

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

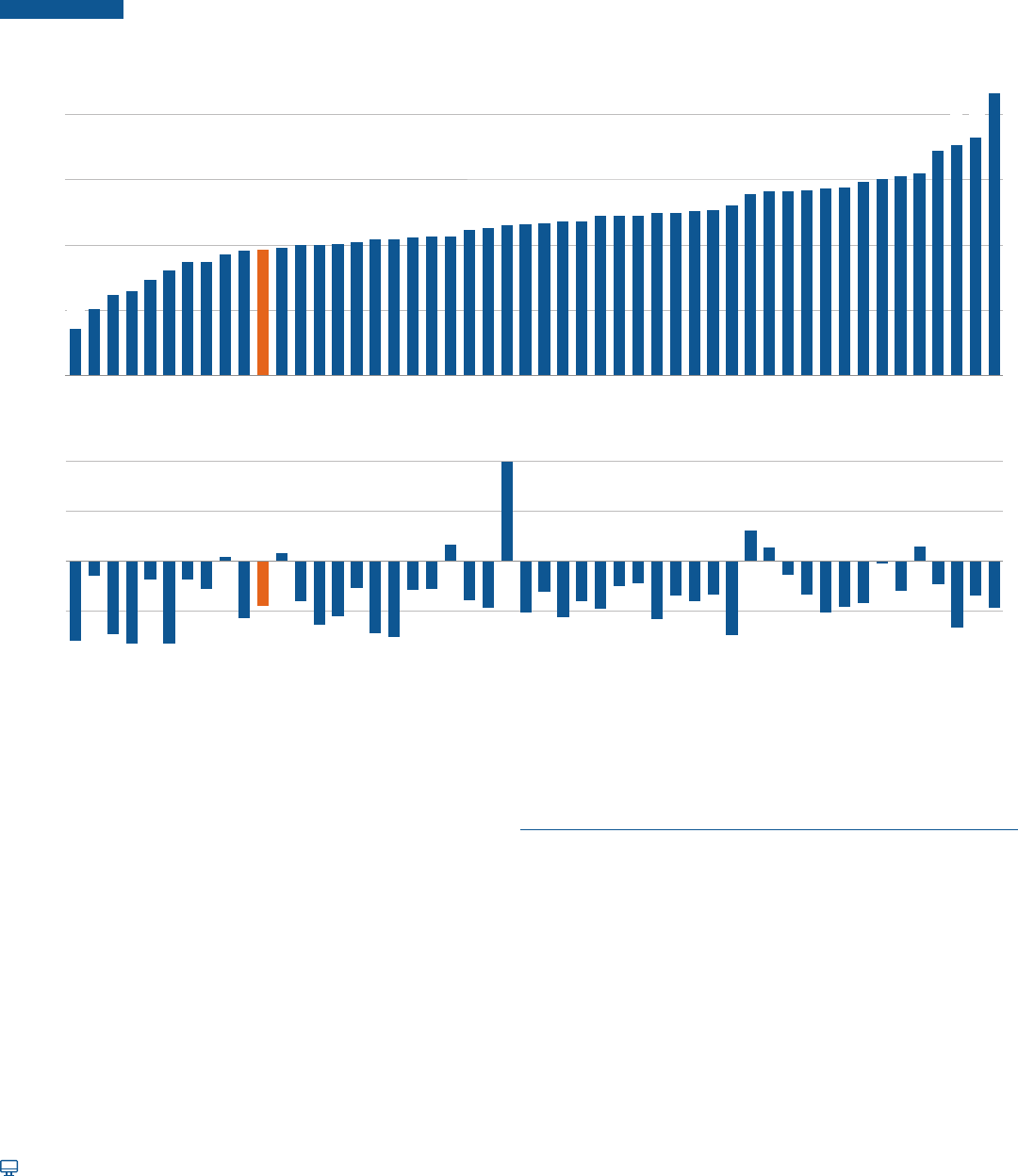

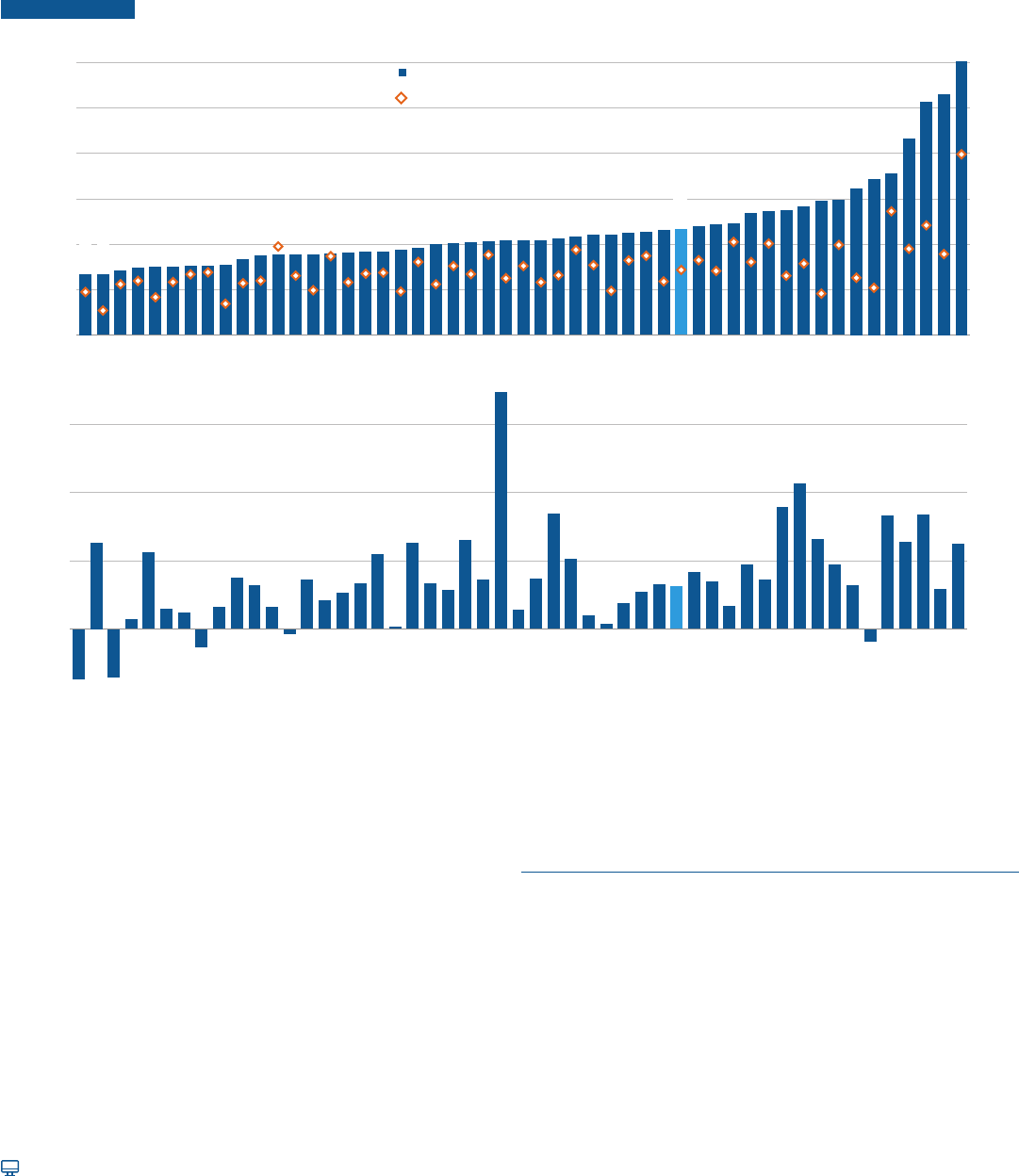

Institutional Revenues:

State and Local Funding

In 2020-21, state and local funding for public higher education averaged $9,330 per full-time equivalent

(FTE) student in the United States; it ranged from $5,350 in Oklahoma and $5,380 in New Hampshire to

more than $20,000 in Hawaii, Alaska, and Wyoming.

FIGURE CP-12 2020-21 State and Local Funding for Higher Education per Student and per $1,000 in Personal Income and 10-Year Percentage

Changes in Ination-Adjusted Funding per Student, by State

$9,330

$5.04

$8,000

$12,000

$16,000

$20,000

$4,000

$24,000

$0

OK

NH

LA

IA

CO

IN

WV

AZ

PA

OH

SD

MS

KY

RI

AL

VA

MI

SC

NV

AR

MO

DE

MT

KS

VT

TX

FL

OR

UT

WI

NJ

GA

ND

ME

US

ID

TN

NC

10%

–10%

–3%

1%

51%

52%

139%

68%

3%

25%

0%

40%

80%

120%

Oklahoma

–29%

51%

–28%

New Hampshire

Louisiana

Iowa

Colorado

Indiana

West Virginia

Arizona

Pennsylvania

Ohio

South Dakota

Mississippi

Kentucky

Rhode Island

Alabama

Virginia

Michigan

South Carolina

Nevada

Arkansas

Missouri

Delaware

Montana

Kansas

Vermont

Texas

Florida

Oregon

Utah

Wisconsin

New Jersey

Georgia

North Dakota

Maine

United States

Idaho

Tennessee

10-Year Percentage Change in

Inflation-Adjusted Funding per FTE Student

MD

NE

WA

MN

MA

CA

$21,210

$20,540

$24,100

$0

$4

$8

$12

$16

$20

$24

NY

CT

NM

IL

HI

AK

WY

2020-21 Funding per $1,000 in Personal Income

72%

85%

53%

–8%

67%

51%

67%

24%

50%

North Carolina

Maryland

Nebraska

Washington

Minnesota

Massachusetts

California

New York

Connecticut

New Mexico

Illinois

Hawaii

Alaska

Wyoming

Funding per Public FTE Student

Funding per $1,000 in Personal Income

$5,350

$5,380

2020-21 Funding per FTE Student

SOURCE: SHEEO, SHEF reports; Bureau of Economic Analysis, Annual State Personal Income 2020; calculations by the authors.

Between 2010-11 and 2020-21, ination-adjusted per-student

state and local funding for higher education increased by 25% in

the United States and increased by 50% or more in 12 states.

Between 2010-11 and 2020-21, ination-adjusted per-student

state and local funding for higher education declined in ve states.

ALSO IMPORTANT:

Federal stimulus funding is reected in Figure CP-12. In Vermont,

federal stimulus funding accounted for 42% of total state and

local funding in 2020-21. Excluding the federal stimulus, the

10-year percentage change in ination-adjusted per-student

funding in Vermont is 40%. (Authors’ calculations using SHEEO

SHEF data)

22

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

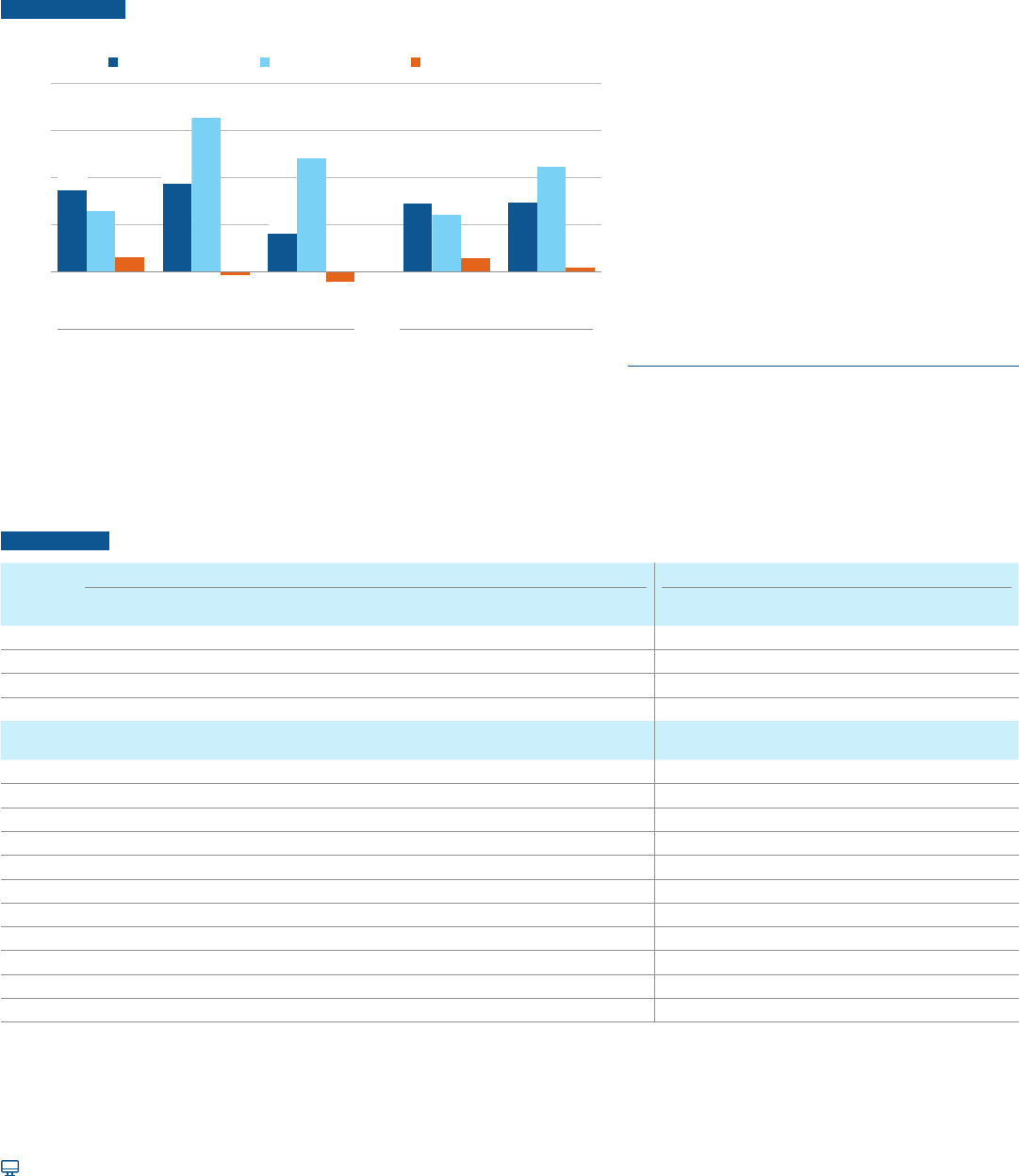

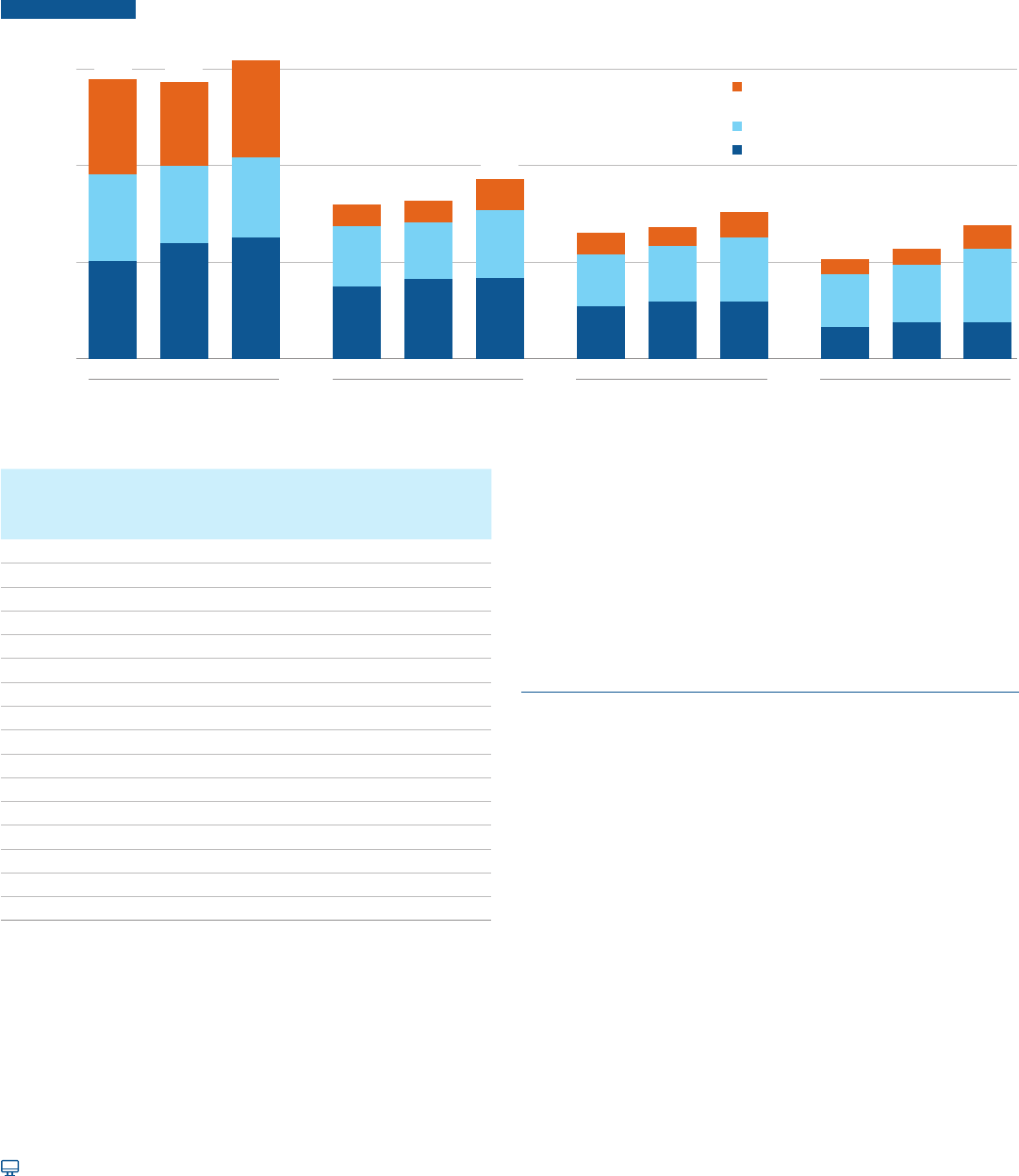

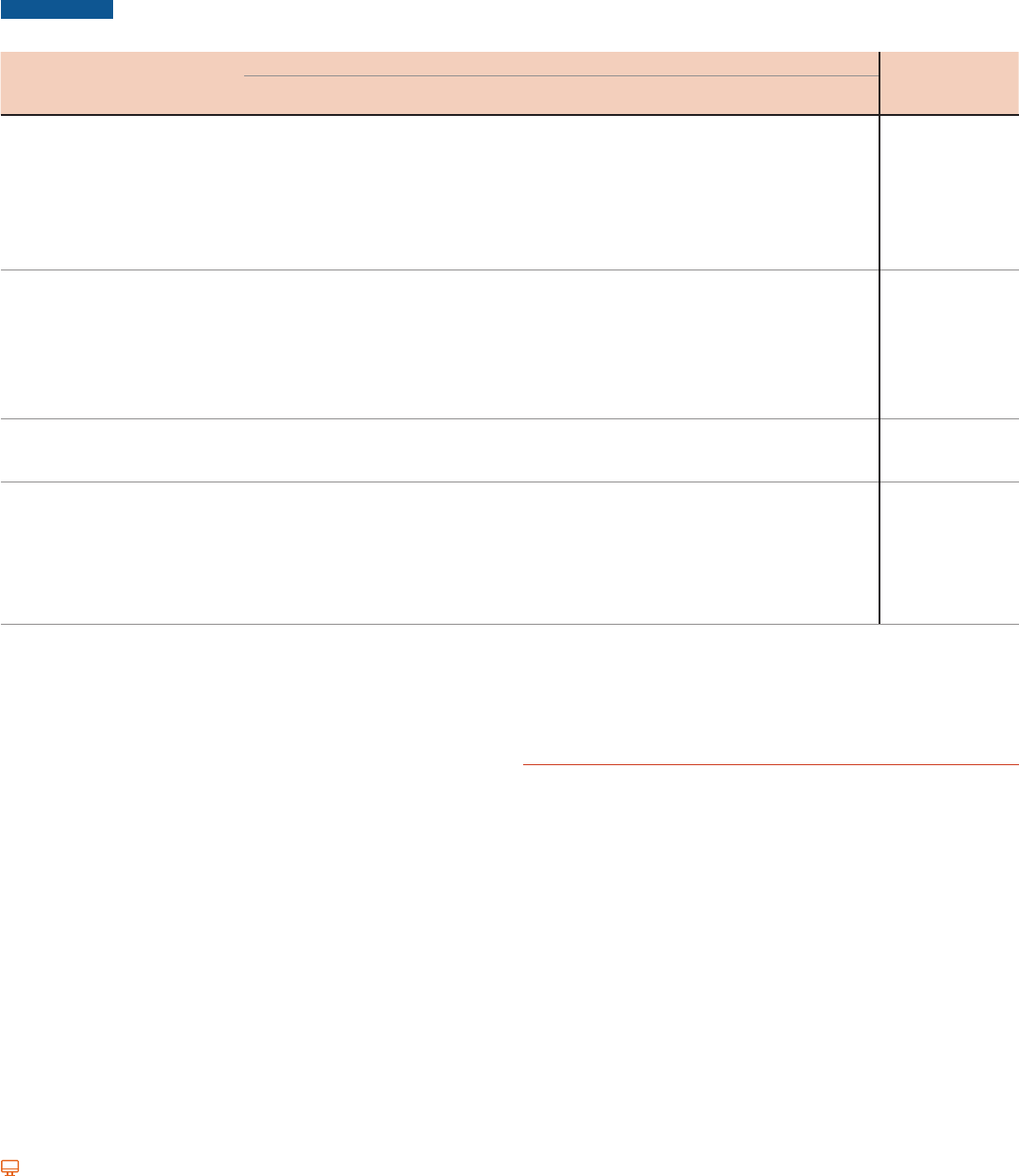

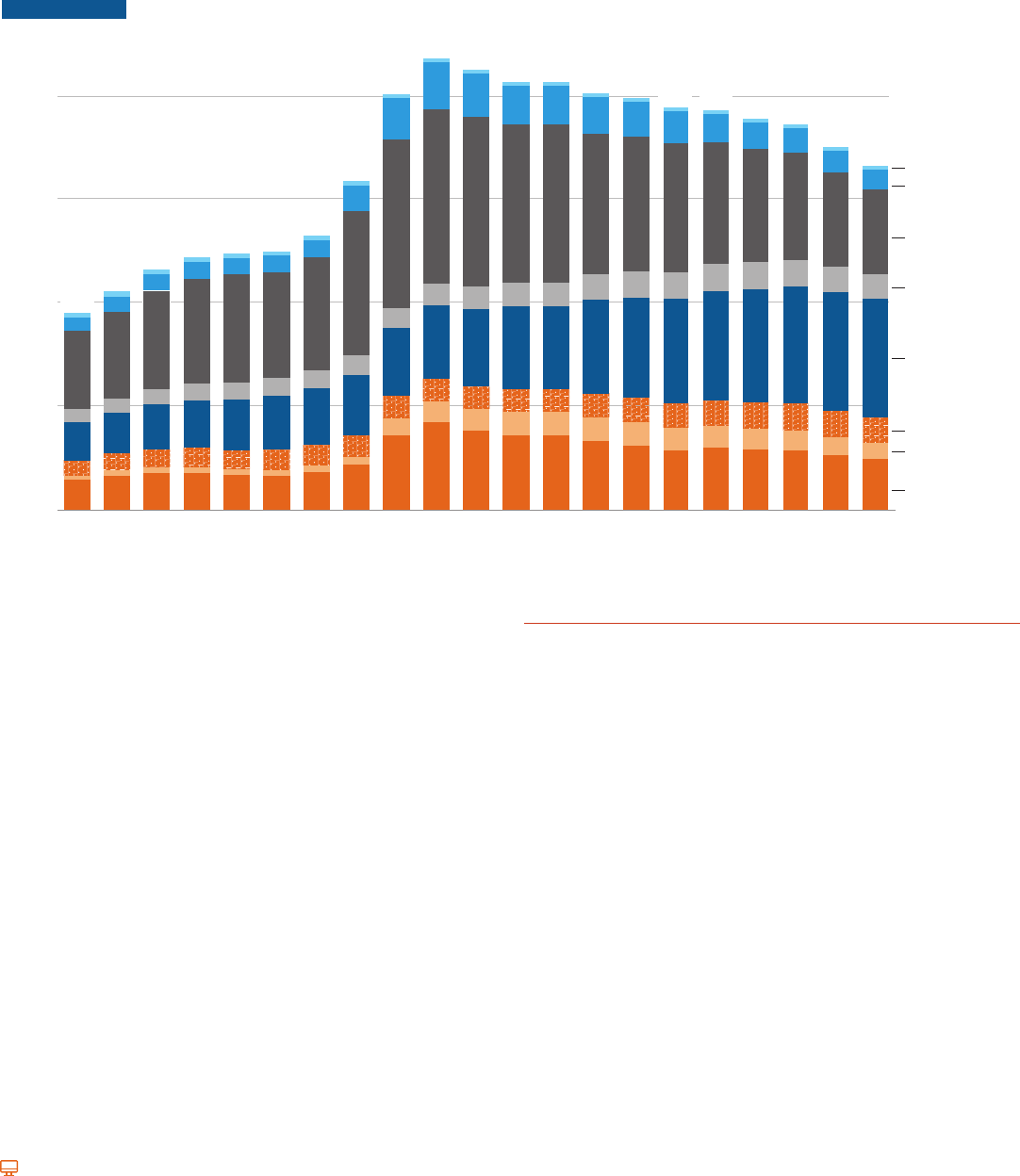

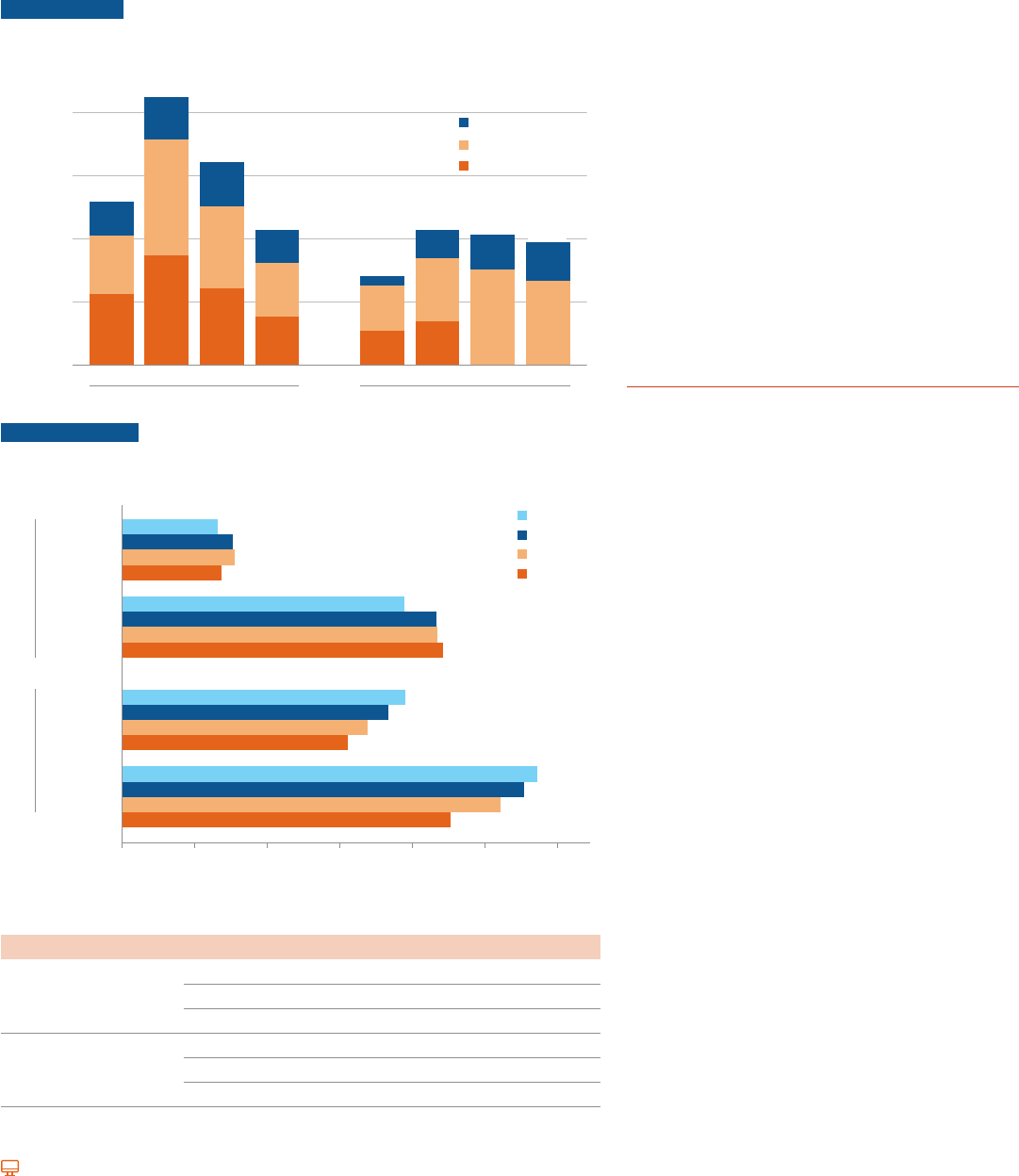

Institutional Revenues: Public Institutions

In 2019-20, net tuition revenue accounted for 41% of total revenues at public doctoral universities.

Net tuition as a share of total revenues in this sector remained stable between 2014-15 and 2019-20,

after increasing from 35% to 42% during the previous ve years.

FIGURE CP-13 Institutional Revenues per Full-Time Equivalent (FTE) Student in 2019 Dollars at Public Institutions, 2009-10, 2014-15,

and 2019-20

2009-10 2014-15

2019-20 2009-10 2014-15 2019-20 2009-10 2014-15 2019-20

2009-10 2014-15 2019-20

Revenue in 2019 Dollars

Public Doctoral Public Master’s Public Bachelor’s Public Associate

Federal Appropriations and Federal, State,

and Local Grants and Contracts

State and Local Appropriations

Net Tuition Revenue

$0

$10,000

$20,000

$30,000

$9,820

$8,610

$28,640

$10,010

$30,890

$28,970

$16,000

$16,330

$18,580

$13,020

$13,620

$15,150

$10,300

$11,350

$13,780

$5,470

$5,970

$7,540

$3,220

$3,740

$3,770

$5,400

$5,430

$5,920

$5,730

$5,860

$6,680

$7,480

$8,220

$8,320

$6,280

$5,930

$7,100

$9,070

$8,070

$8,320

$12,560

$10,080

$11,960

$2,240

$2,180

$3,160

$2,190

$1,970

$2,610

$1,610

$1,640

$2,470

Percentage of Institutional Revenues from Various Sources

Net Tuition

Revenue

State and Local

Appropriations

Federal Appropriations

and Federal, State,

and Local Grants and

Contracts

Public Doctoral

2009-10 35% 31% 34%

2014-15 42% 28% 30%

2019-20 41% 27% 32%

P

ublic Master’s

2009-10 47% 39% 14%

2014-15 50% 36% 13%

2019-20 45% 38% 17%

Public Bachelor’s

2009-10 41% 42% 17%

2014-15 43% 42% 14%

2019-20 39% 44% 17%

Public Associate

2009-10 31% 53% 16%

2014-15 33% 53% 14%

2019-20 27% 55% 18%

NOTE: Net tuition revenue is the amount of revenue an institution takes in from

tuition and fees, net of all institutional grant aid provided to students. Some of

this revenue comes in the form of Pell Grants and other nancial aid from federal

and state governments and other sources. Institutional averages are weighted by

12-month FTE enrollments including both undergraduate and graduate students.

Institution groupings are based on the 2018 Carnegie Classication. Percentages

may not sum to 100 because of rounding.

SOURCE: NCES, IPEDS Finance and 12-Month Enrollment data, 2010, 2015 and

2020; calculations by the authors.

At other types of public institutions, net tuition as a share of total

revenues declined between 2014-15 and 2019-20, after increasing

during the previous ve years.

In 2019-20, per-student revenues from the combination of

government sources and net tuition were more than twice as

large at public doctoral universities as at public bachelor’s and

two-year colleges. These per-student revenues were $30,890 at

doctoral universities, $18,580 at master’s universities, $15,150

at bachelor’s colleges, and $13,780 at associate colleges in the

public sector.

ALSO IMPORTANT:

In addition to the revenue sources included in Figure CP-13,

institutions also receive revenues from gifts and investment

returns, which account for a small share of total revenues at

public institutions.

Revenues from auxiliary enterprises such as residence halls,

dining facilities, hospitals, and independent operations, not

included in Figure CP-13, are usually dedicated to running those

operations.

23

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

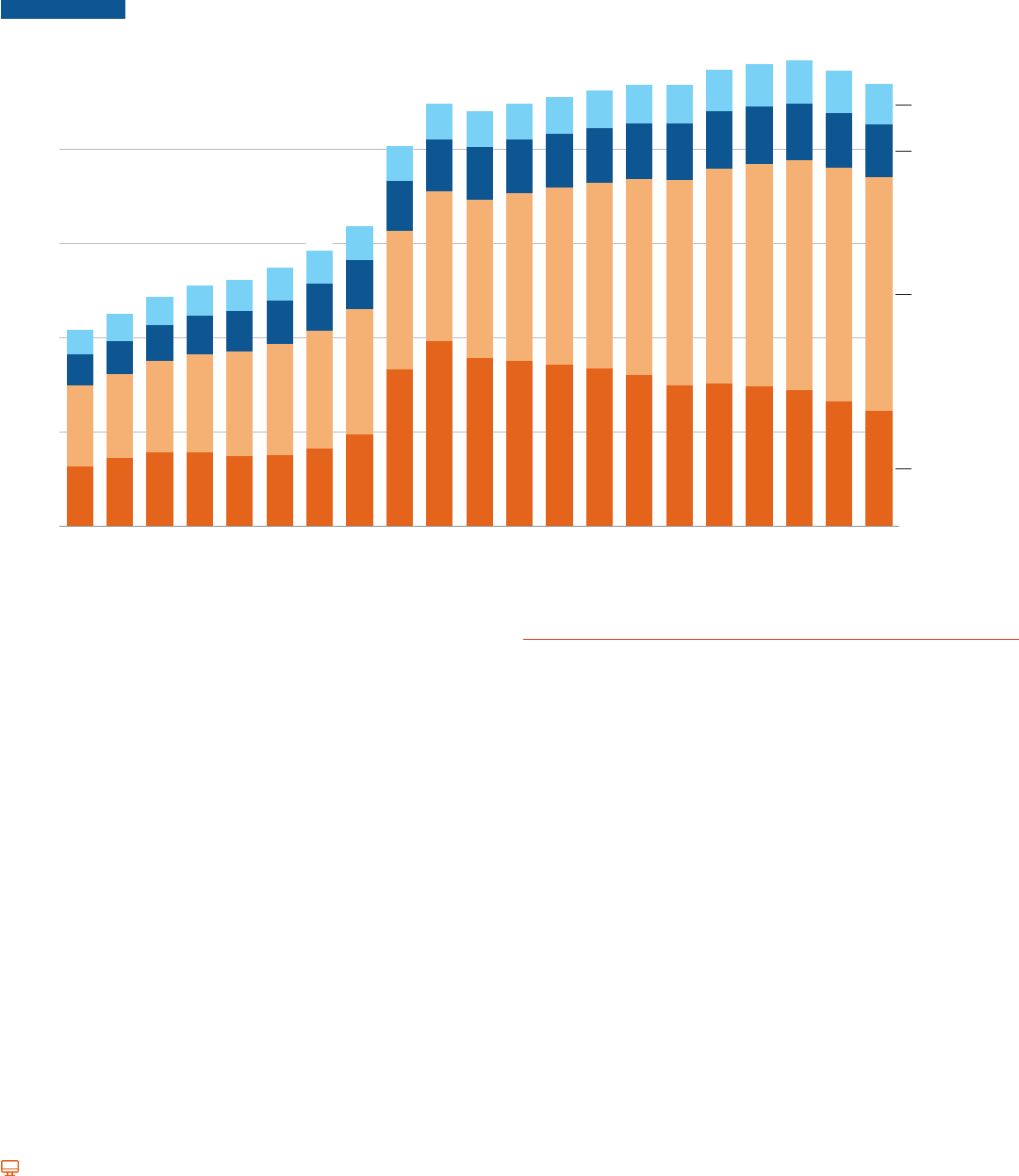

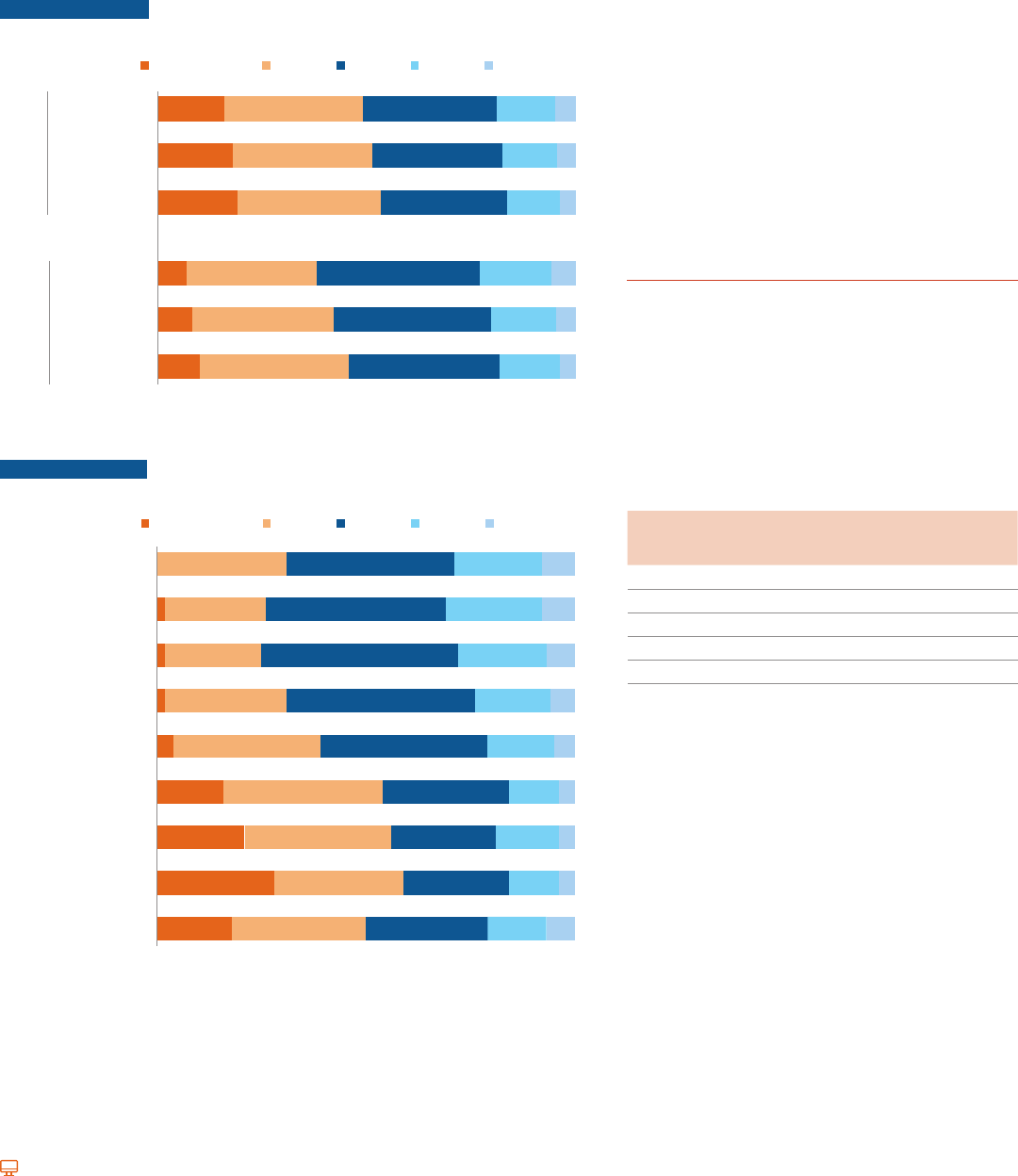

Institutional Revenues and Expenditures

Between 2014-15 and 2019-20, the average subsidy per full-time equivalent (FTE) student increased

(after adjusting for ination) at all types of public and private nonprot institutions.

FIGURE CP-14 Net Tuition Revenues, Subsidies, and Education and Related Expenditures per Full-Time Equivalent (FTE) Student in 2019

Dollars, 2009-10, 2014-15, and 2019-20

$8,220

$6,920

$15,140

$8,320

$6,950

$15,270

$5,400

$6,540

$11,940

$5,920

$7,280

$13,200

$5,860

$7,880

$13,740

$3,220

$5,970

$9,190

$3,740

$6,770

$10,510

$3,770

$7,880

$11,650

$22,470

$16,910

$39,380

$24,280

$18,350

$42,630

$25,800

$19,800

$45,600

$15,560

$1,790

$17,350

$15,930

$2,640

$15,270

$3,230

$17,730

$9,860

$27,590

$17,560

$11,320

$17,070

$13,510

$30,580

2014-15 2019-20 2009-10 2014-15 2019-20 2009-10 2014-15 2019-20 2009-10 2014-15 2019-20 2009-10 2014-15 2019-20 2009-10 2014-15 2019-20

Doctoral

Master

’

s

Bachelor

’

s

Public

Private Nonprofit

Education and Related Expenditures per FTE Student

(in 2019 Dollars)

$10,080

$8,690

$11,960

$8,260

$20,220

$12,560

$8,380

$20,940

$7,480

$6,650

$14,130

$0

$10,000

$20,000

$30,000

$40,000

2009-10 2014-15 2019-20 2009-10

Master

’

s

Bachelor

’

s

Associate

Doctoral

Net Tuition Revenue

Subsidy

$18,770

$18,570

$18,500

$28,880

Education and Related Expenditures

$3,220

$3,740

$3,770

Institutional Subsidy as a Percentage of Education and Related Expenditures

Public Private Nonprot

Doctoral Master’s Bachelor’s Associate Doctoral Master’s Bachelor’s

2009-10 46% 47% 55% 65% 43% 10% 36%

2014-15 41% 46% 55% 64% 43% 14% 39%

2019-20 40% 46% 57% 68% 43% 17% 44%

Net Tuition as a Percentage of Education and Related Expenditures

Public Private Nonprot

Doctoral Master’s Bachelor’s Associate Doctoral Master’s Bachelor’s

2009-10 54% 53% 45% 35% 57% 90% 64%

2014-15 59% 54% 45% 36% 57% 86% 61%

2019-20 60% 54% 43% 32% 57% 83% 56%

NOTE: Institutional subsidy to students represents the portion of the cost of educating students

not covered by net tuition revenue. Net tuition revenue is the amount of revenue an institution takes

in from tuition and fees, net of all institutional grant aid provided to students. Some of this revenue

comes in the form of Pell Grants and other nancial aid from federal and state governments and

other sources. Institutional averages are weighted by 12-month FTE enrollments including both

undergraduate and graduate students. Institution groupings are based on the 2018 Carnegie

Classication. The percentages in the top table are not institutional discount rates, which represent

institutional grant aid as a share of published tuition and fees.

SOURCE: NCES, IPEDS Finance and 12-Month Enrollment data, 2010, 2015, and 2020; calculations

by the authors.

Education and related (E&R) expenditures include

spending on instruction, student services, and

the education share of spending on central

academic and administrative support, as well as

operations and maintenance. These expenditures

can be considered institutions’ costs of providing

education to students. A portion of these

expenditures is covered by net tuition revenues

from students and the remaining portion is a subsidy

to students. In addition to E&R expenditures,

institutional budgets include expenditures for other

purposes such as research, public service, and

auxiliary enterprises.

In 2019-20, the share of E&R expenditures at

public institutions that was subsidy to students

ranged from 40% at doctoral institutions to 68%

at associate colleges.

In 2019-20, the share of E&R expenditures at private

nonprot institutions that was subsidy to students

was 17% at master’s institutions, 43% at doctoral

institutions, and 44% at bachelor’s colleges.

24

For detailed data behind the graphs and additional information, please visit: research.collegeboard.org/trends.

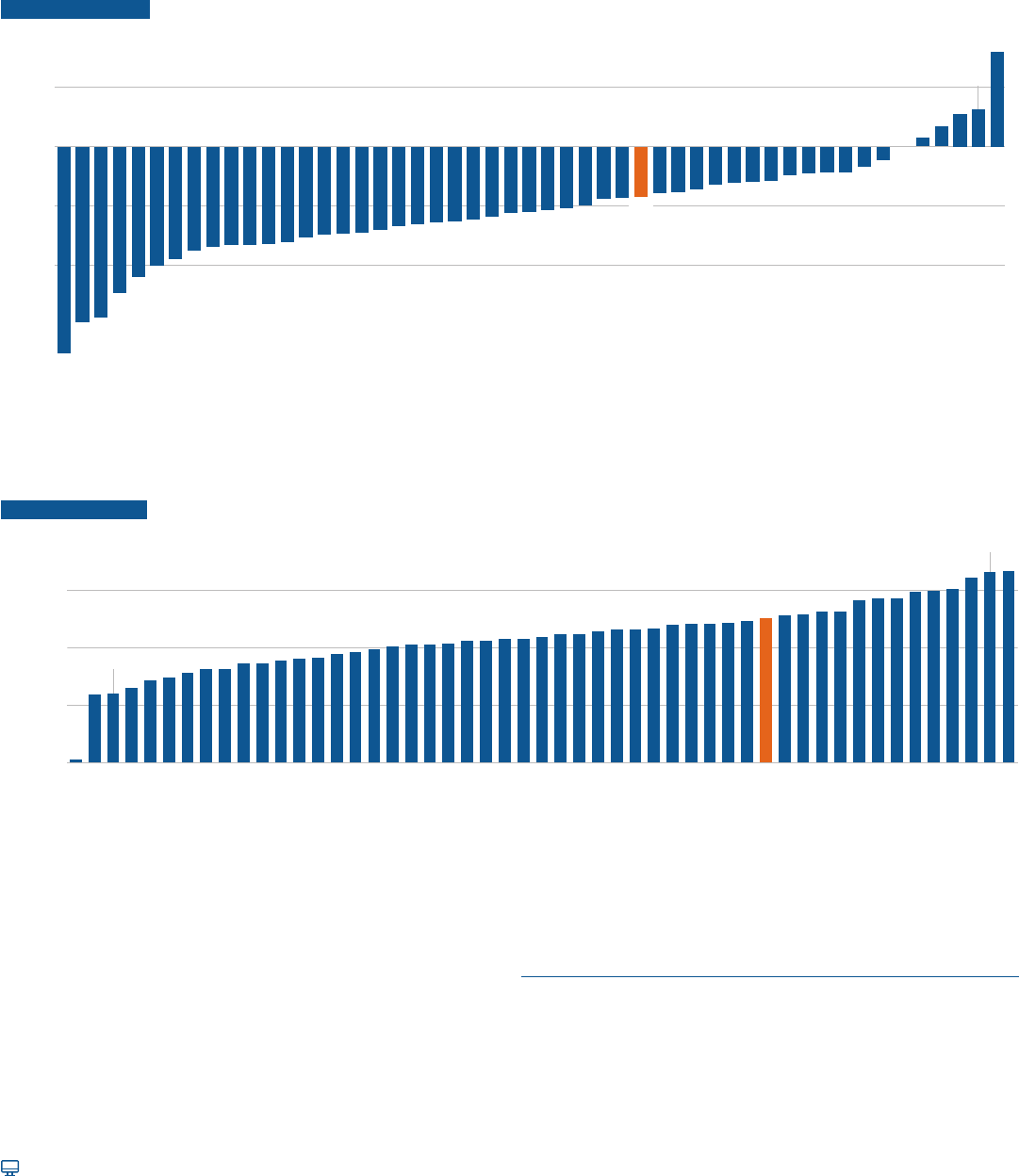

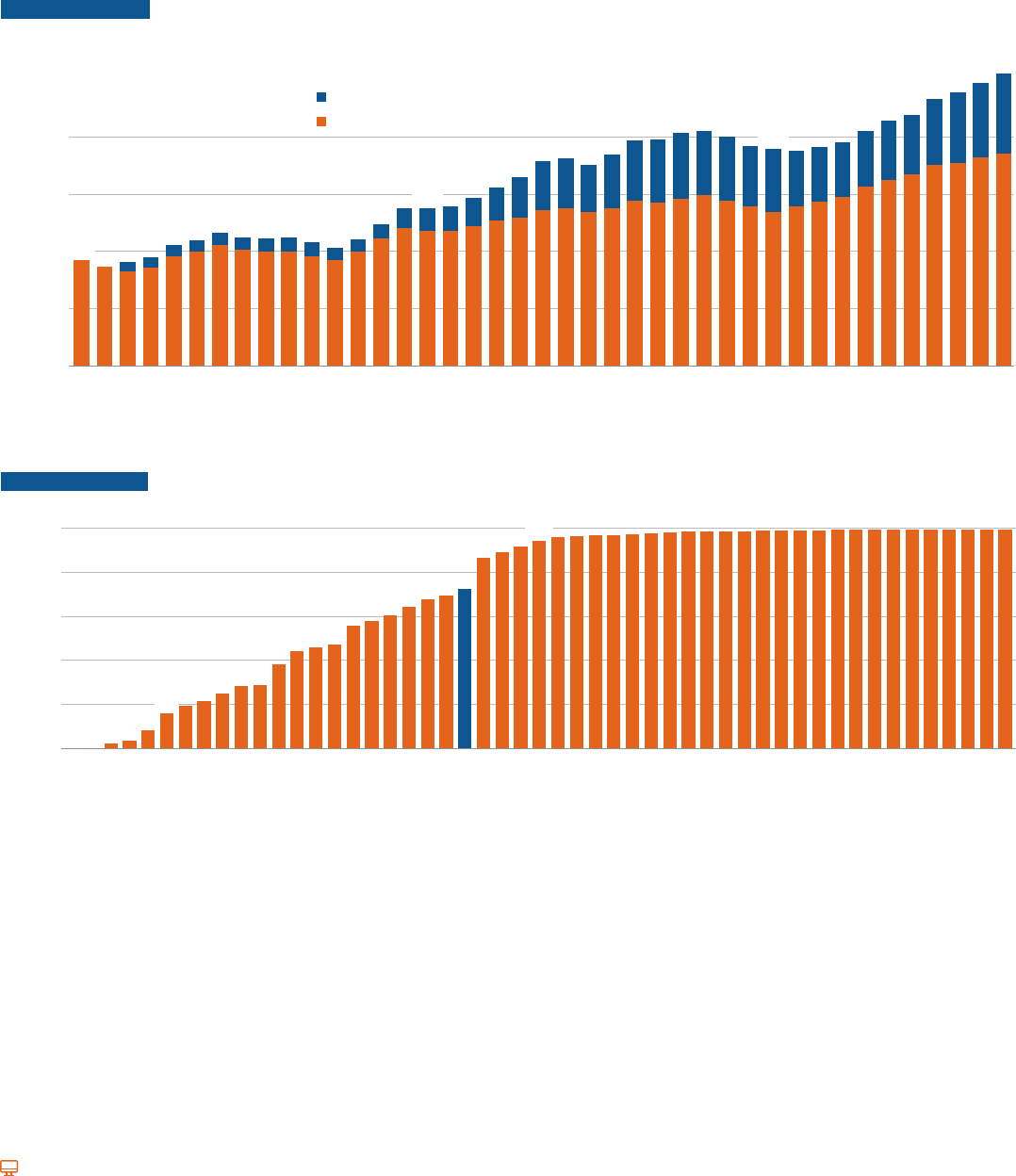

Family Income

Between 1991 and 2021, the average income increased by 64% for the top quintile of families and by 17%

for the lowest quintile of families, after adjusting for ination.

FIGURE CP-15A Mean Family Income in 2021 Dollars by Quintile, 1991, 2001, 2011, and 2021

Mean Family Income

$0

$100,000

$200,000

$500,000

$400,000

$300,000

Lowest 20% Second 20% Third 20% Fourth 20% Highest 20% Top 5%

1991 2001 2011 2021

$18,940

$44,950

$22,120

$54,980

$69,740

$88,960

$101,160

$137,650

$185,840

$305,500

$287,560

$538,470

Lowest

20%

Second

20%

Third

20%

Fourth

20%

Highest

20%

Top

5%

$ Change from 1991 to 2021 $3,180 $10,030 $19,220 $36,490 $119,660 $250,910

% Change from 1991 to 2021 17% 22% 28% 36% 64% 87%

2021 Income Bracket

$40,000

or Less

$40,001 to

$70,506

$70,507 to

$109,354

$109,355 to

$174,001

$174,002

or More

$319,770

or More

2021 Mean Income $22,120 $54,980 $88,960 $137,650 $305,500 $538,470

FIGURE CP-15B Median Family Income by Selected Characteristics, 2021

$86,570

$75,210

$63,450

$41,740

$71,190

$103,640

$111,220

$97,680

$76,060

$55,010

$100,980

$62,300

$59,540

$118,390

$96,680

$78,480

$102,320

$89,520

$0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000

Bachelor’s Degree or Higher

Associate Degree

Some College

High School

Less Than High School

65 and over

55 to 64

45 to 54

35 to 44

25 to 34

15 to 24

White Alone, Non-Hispanic

Hispanic

Black Alone, Non-Hispanic

Asian Alone, Non-Hispanic

West

South

Northeast

Midwest

Education

Age

Race/Ethnicity

Region

2021 Median Family Income (Median of All Families = $88,590)

$140,000

$139,300

SOURCE: U.S. Census Bureau, Current Population Survey, 2021 Annual Social and Economic

Supplement, Table F-1, Table F-3, Table F-5, and FINC-01; calculations by the authors.

In 2021, average incomes ranged from $22,120

for the lowest quintile to $305,500 for the highest

quintile and $538,470 for the top 5% of families.

In 2021, the median income of families headed

by individuals ages 45 to 54—the age bracket of

parents of most traditional-age college students—

was 26% higher than the overall median ($111,220

compared with $88,590).

In 2021, the $139,300 median family income of

families with at least one four-year college graduate

was more than double the median for families

headed by a high school graduate ($63,450).