Contents

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Introduction 4

Findings 7

Current state 8

Future state 10

Roadmap to success 15

Business process redesign 16

Lower-cost sales and service channels 16

Legacy system fixes 17

Alternative sourcing strategies 17

Intelligent automation 18

The IA maturity scale 19

An end-to-end approach 21

Where to start on the IA journey 21

Key lessons 24

Conclusion 25

Contributors 26

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Introduction

4 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

In order to understand the current environment,

KPMG and ACORD recently completed a survey

focused on the challenges and opportunities

insurers face with respect to improving

operational efficiency. Responses were collected

from more than 60 life, P&C, composite and

reinsurance carriers from around the world, with

premiums ranging from less than US$1 billion to

more than US$10 billion.

Survey results indicate that, although 94 percent

of carriers say they are actively working on

improving operational efficiency, 55 percent

say they are behind target. In addition, most

respondents reported only limited integration

of their technology platforms across functions,

including underwriting, distribution and product

operations— functional areas key to achieving

operational efficiency.

Overall, survey responses make clear that the

majority of these organizations are falling behind

in their quest to improve operational efficiency,

and that a lack of process standardization and

strategic vision is the primary obstacle to future

transformation efforts.

The survey highlights the need for CEOs

and other senior leaders across the strategy,

technology and operations areas of insurance

organizations to carefully consider several

approaches to correct these deficiencies.

Initiatives and transformations critical to

this include:

1. Operating model and process redesign

2. Distribution

3. Legacy systems

4. Alternative sourcing

5. Intelligent automation (IA)

KPMG professionals have developed

methodologies and tools to help achieve these

efficiencies, and are working with insurers

around the world, focusing on cost reduction and

streamlining of operations. This paper will explore

the enterprise journey to achieving operational

efficiency leveraging KPMG’s approach.

I

nsurers are under more pressure than ever to effectively manage

their current operating expense environment. Persistent low

investment returns, ever-increasing competitive pressures and

enduring excess capacity have hampered the industry’s ability to

grow revenue faster than the rate of operating costs. Currently,

25 percent of every premium dollar is consumed by operating

expenses, a pattern that has held for the past 10 years or longer.

These expenses have largely kept pace with the rate of growth in

premium income among life and property & casualty (P&C) carriers,

with both growing in the low single digits over the same time period.

Operational excellence in insurance | 5

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

6 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

T

he survey included responses from 69companies worldwide, with a

majority of respondents holding titles of chief operating officer, chief

financial officer, chief technology officer or equivalents.

Respondents were split relatively proportionally

among life/health, P&C and reinsurance/

composite lines of business. Similarly, there was

roughly balanced geographic representation

among Europe/Middle East/Africa, the Americas,

and the Asia-Pacific region. About half of the

responses came from carriers writing less than

US$1 billion in premiums annually.

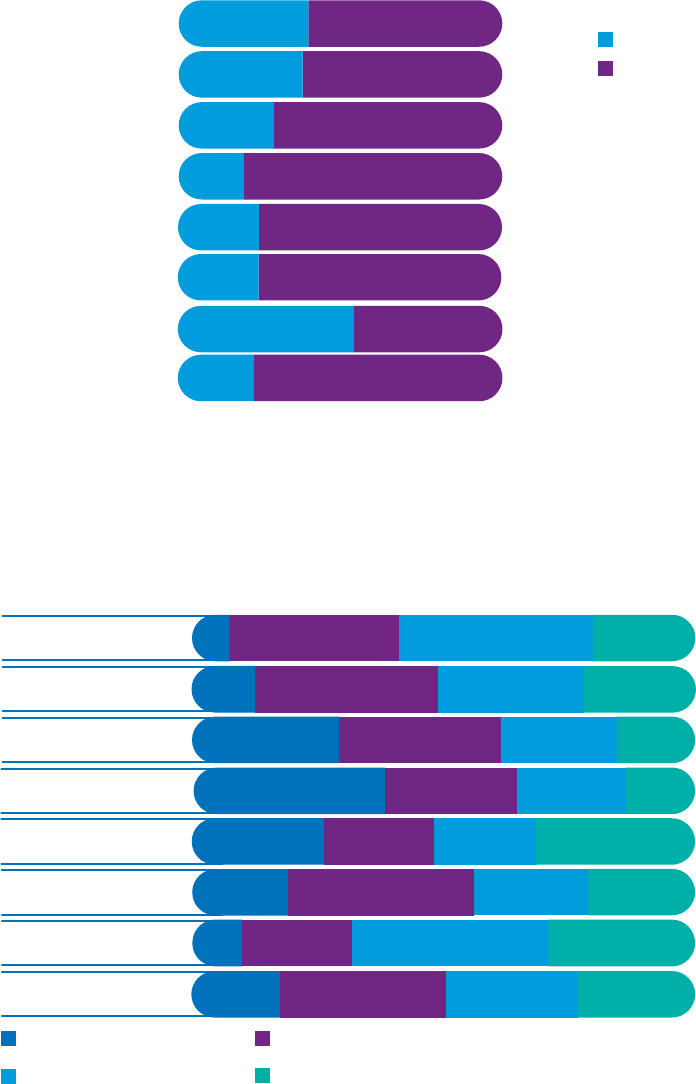

Primary line

of business

Headquarters

location

Carrier size

(Premium)

Life/Health

Property/Casualty

Reinsurance/Composite

North America

Latin America

EMEA

Asia Pacific

Small (<$1B)

Mid-size ($1–10B)

Large (>$10B)

30%

40%

30%

17%

15%

42%

26%

24%

52%

24%

Findings

Operational excellence in insurance | 7

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Current state

Insurers indicate they are behind

the curve with regard to gains in

operational efficiency, with a lack

of process standards and strategic

vision mentioned as key inhibitors.

Insurers that don’t focus strongly on

operational efficiency run the risk of

being non-competitive from either a

pricing or profitability perspective, and

could fail to deliver the experience

customers, agents and brokers expect.

The survey found that most carriers are

currently focusing on process redesign,

implementation of lower cost sales and

servicing channels, and legacy systems

repair or replacement initiatives.

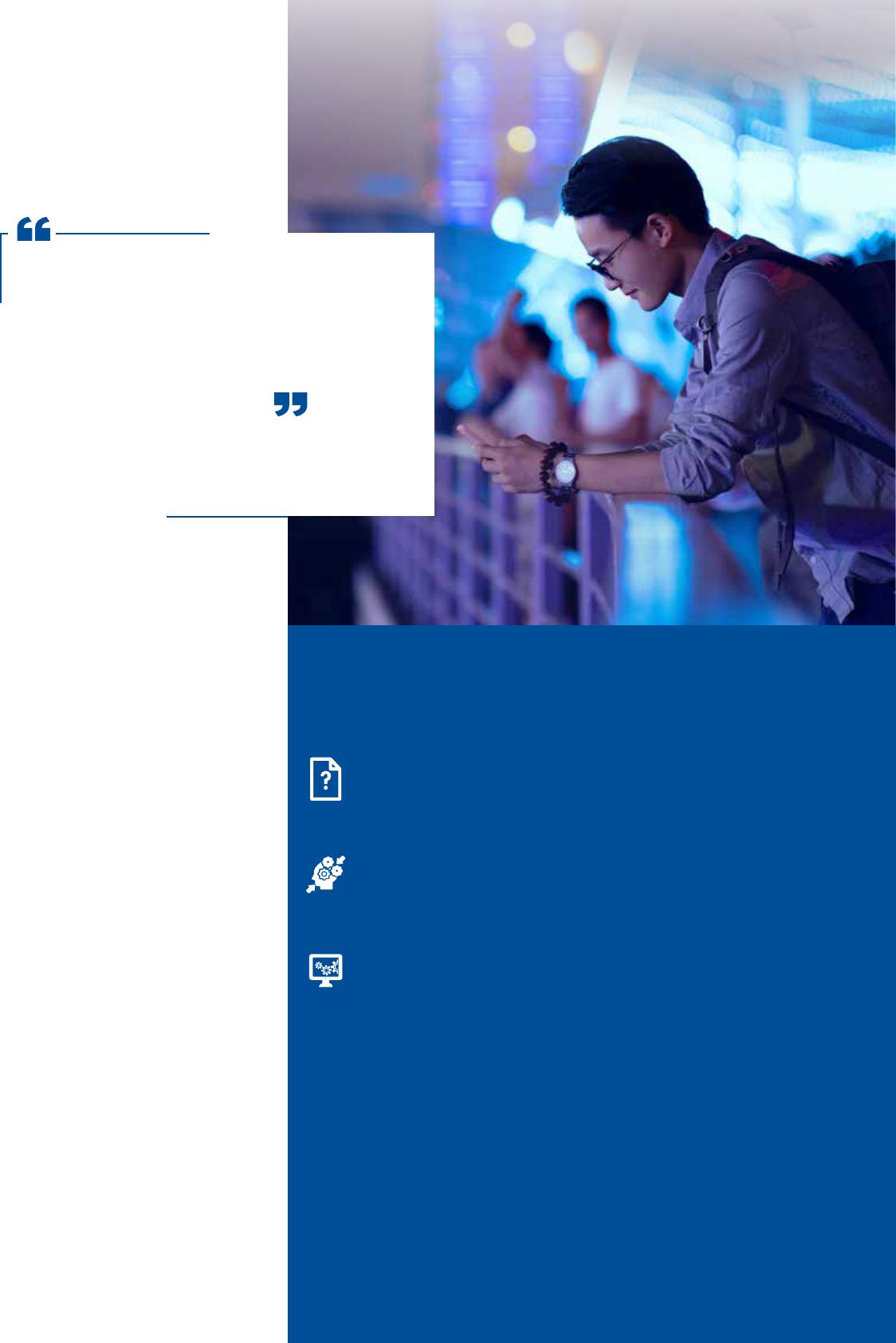

What are the key initiatives planned or underway

for the operational efficiency gains?

The risk to the

enterprise of delaying

action is increasing

and ultimately

a threat to the

company’s relevance

in the competitive

marketplace.

— Scott Shapiro

Principal

KPMG in the US

Basic process

efficiency and process

st

andardization, including

process redesign —

end-to-end value chain

improvement throughout

the customer lifecycle

Lower-cost channels,

self-service and

automation of

traditional channels

Legacy systems fix, new

co-strategies and efficient

data transformations

Transformative

operational

automation via

intelligent

automation —

RPA through

cognitive, IA

reduces labor cost

Alternative sourcing —

partnerships,

outsourcing

Any other

26%4%

24%21%

13

%

12%

8 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Integration between systems

supporting operational processes

across functions was severely limited

among most carriers. For any given

business function, more than two thirds

of insurers characterized their systems

as either lacking integration with

other systems, or having only limited

integration. Human resources (HR) and

finance reported the lowest levels, with

30 percent and 20 percent (respectively)

of respondents indicating a complete

lack of integration. Even those functions

most frequently described as ‘fully

integrated’ were categorized as such

by less than one fifth of carriers (claims

at 19 percent, and policy servicing at

16 percent). Overall, the majority of

respondents reported only limited

integration across all functions,

including underwriting, distribution,

product operations, information

technology (IT) and contact centers.

Clearly, insurers worldwide recognize the challenges in achieving their

operational efficiency goals.

“Lack of clarity on key objectives and an inability

to agree on strategic decisions combined with an

overall resistance to change across the business“

“Scarcity of qualified resources, especially those

with a combination of technological expertise and

insurance fundamentals“

“Sheer number and complexity of obsolete legacy

systems and processes combined with a lack

of experience in improving IT processes and

implementing newer technologies“

A lack of integration across an

insurer can result in incremental and

redundant processes, technology and

data — increasing costs and impacting

an insurer’s ability to serve customers

and engage with agents.

— Mike Adler

Principal

KPMG in the US

Respondents identified several obstacles to achieving desired efficiency gains.

Key inhibitors spanned organizational culture, talent and legacy issues. Some

typical responses around obstacles were:

Operational excellence in insurance | 9

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Future state

Where are carriers planning to focus

in the quest for operational efficiency

gains? Claims (55 percent), policy

service (51 percent) and underwriting

(45 percent) were cited by respondents

as the highest-priority areas for

improvement initiatives over the next

12 to 24 months. On the other hand,

the majority of respondents ranked HR

(74percent) and finance (57 percent) as

the lowest-priority areas of focus.

The prioritization of value chain

components was one area in the study

where significant differences emerged

depending on the location of the insurer.

— While claims was cited by the largest

number of respondents overall, it was

particularly common in the Asia Pacific

region, with 75 percent of insurers

assigning claims the highest level of

priority. Policy servicing received the

second most responses (60 percent),

with underwriting (45 percent),

distribution (40 percent) and contact

centers (40 percent) rounding out the

top five.

— In North America, 60 percent of

carriers cited distribution as the

highest level of priority, followed by

underwriting, policy servicing and

claims (all cited by 50 percent of

respondents).

— Across EMEA, policy servicing

received the highest level of

responses (56 percent), followed

by claims (48 percent) and contact

centers (41 percent).

— While the finance function received

the lowest level of high-priority

response, Latin American and

Caribbean-based insurers were the

exception, with 58 percent of carriers

in this region listing finance as a high-

priority function for efficiency gains.

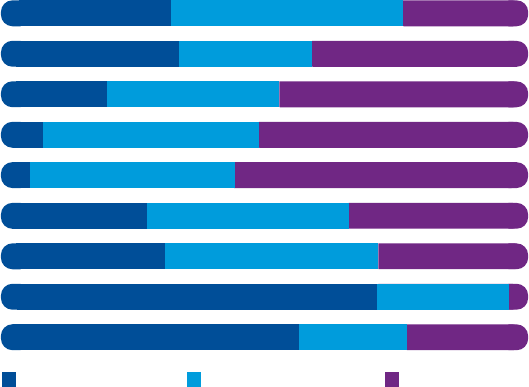

What are the key value chain areas identified

for the operational efficiency gains in the next

12 to 24 months? Ranked from 1 (high) to 9 (low).

(Percent respondents)

Lowest (7,8,9) Neutral (4,5,6) Highest (1,2,3)

Product

Distribution

Underwriting

Policy servicing

Claims

Contact center

IT

HR

Finance

35%

30%

30%

32%

74 %

57%

33%

33%

36%

22%

9%

6%

39%

43%

40%

39%

38%

25%

20% 23%

36%

45%

51%

55%

25%

22%

1%

10 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Value chain prioritization by region

North America:

— Distribution

— Underwriting

— Policy servicing

— Claims

Latin America:

— Finance

— Underwriting

— IT

EMEA:

— Policy servicing

— Claims

— Contact center

ASPAC:

— Claims

— Policy servicing

— Underwriting

Operational excellence in insurance | 11

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

In pursuit of these efficiencies, insurers

are looking to technology solutions to

deliver value. While processing time was

listed as a critical concern (cited by an

average of 20 percent of respondents

as a primary measure of value across

most functions), the leading factor was

impact on customer experience. Not

surprisingly, this was cited as a leading

focus area for customer-facing functions

including product, operations, distribution

and contact centers. However, it was

also among the top-ranked priorities

across less obvious areas, such as IT,

underwriting and HR. In KPMG member

firms’ experience, technology solutions

in support of insurance operations

that provide an improved customer

experience at a lower cost, and are highly

automated with the appropriate quality

and controls, are optimal and deliver the

most value.

Survey responses indicate a clear shift

in the approach carriers expect to take

in order to achieve these operational

efficiency improvements. From the

current state to the near future, there is

an expected reallocation of resources

away from process standardization and

legacy fixes to implementation of IA and

alternative sourcing programs.

While most carriers (58 percent of

respondents) have been focused on

process standardization and legacy

systems repair, this number is expected

to fall to 48 percent in the next

12 to 24 months. We believe that is

primarily a result of insurers looking for

quick wins and cost savings through

tactical automation as opposed

to process standardization and

transformation, which may have higher

long-term benefits but typically cost

more and take longer.

IA and alternative sourcing, however,

are expected to rise from 20 percent

to 33 percent of efficiency-focused

projects in the next 12 to 24 months.

Product operations, policy servicing

and claims accounted for the highest

focus on process standardization and

legacy systems repair; claims, IT and

underwriting are expected to see the

biggest uptake in IA and alternative

sourcing methods.

Regionally, insurers in North America

are most likely to pursue operational

efficiencies through IA across all

functions, with 27 percent indicating

they will implement IA over the next

12 to 24 months, the highest level

among all regions. Insurers in all other

regions are more likely to focus on

process standardization, with this

approach listed by the highest level of

respondents (about 30 percent).

A moderate to significant increase

in automation is expected across

all functions over the next 2 years.

Respondents particularly identified

claims (77 percent), underwriting

(66 percent) and IT (68 percent) as areas

where automation will play an increasing

role in the next 12 to 24 months.

In particular, robotic process

automation (RPA) is expected to

emerge as a significant application

to reduce operational costs.

Respondents reported that RPA

implementations are expected to

expand dramatically in the near future

across almost all business functions.

22%

20%

19%

33%

48%

58%

Process

standardization &

legacy system fix

Intelligent

automation

and alternative

sourcing

Other/None

Next

12–24 months

Previous

12–24 months

How did your

organization pursue

operational efficiencies

in the past 12 to 24

months, and how does

it plan to pursue them

in the next 12 to 24

months?

(Percent respondents)

12 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

How will automation play a role in your

organization in the next 12 to 24 months?

(Percent respondents)

No change/Decrease

Moderate/Significant

increase

Product

Distribution

Underwriting

Claims

Contact center

IT

HR

60%

68%

73%

80%

75%

75%

46%

77%

40%

32%

27%

20%

25%

25%

54%

23%

Finance

Where do you see your organization heading

in the next 12 to 24 months with basic use of

RPA capabilities?

(Percent respondents)

Claims not only currently sees

the highest focus area of RPA

implementations — with 42 percent of

respondents indicating some usage —

but was also the most cited area for RPA

capability increases (64 percent).

Emerging tech, on the other hand, is

expected to play a more limited role

in operational efficiency improvement

activities. Insurtech is currently a lower

priority for carriers, with only around

half of respondents currently deploying

these technologies, primarily in the areas

of underwriting and claims. Big data and

machine learning were among the more

popular emerging technology focus

areas, with implementations expected

to double over the next 2 years in those

functional areas where the technology

is currently less utilized. The field of

IA sits at the intersection of process

automation and machine learning,

making it fertile ground for operational

efficiency gains in the near future.

39

Product

Distribution

Underwriting

Claims

Contact center

IT

HR

Finance

No significant changes

Limited increase

Significant increase

Not applicable

33%

20%

36%

22%

32%

29%

16%

26%

38%

14%

22%

26%

32%

36%19%

22%

22%

10%

29%

33%

18%

23%

13%

8%

39%

29%

23%

22%

20%

23%

39%

26%

Operational excellence in insurance | 13

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

14 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

W

hile the vast majority of insurance carriers understand the need to

improve operational efficiencies, 54 percent have indicated that

they are falling behind in reaching their objectives.

Roadmap to success

Complicating matters, insurers face myriad

options from traditional cost take-out

initiatives to emerging technology-based

solutions including automation, cloud computing

and sourcing options, just to name a few.

Internally, insurance operating environments

have grown exponentially complex. Product

and geographic expansion, M&A, regulatory

mandates and other factors have created layers

of operational systems, many of which are

homegrown or heavily customized and lack

integration with other systems.

Leveraging big data, AI and other capabilities,

insurers have the opportunity to not only

improve efficiency, but increase competitive

advantage by delivering richer customer, agent

and employee experiences. This involves the

following four key foundational elements:

1. Customer engagement (personalization,

customization, co-creation and collaboration)

2. Changing nature and value of assets

(data-as-an-asset, intellectual property,

shared assets, networks and alliances)

3. Everything as a service (services vs.

products, subscribing to what you need,

process-as-a-service)

Insurers that have not

achieved the benefits they

are seeking are beginning to

take a longer-term and more

strategic view and developing

roadmaps and leveraging

all potential enablers to help

them steer to their goals.

— Mike Adler

Principal

KPMG in the US

4. Workforce of the future (automation and

augmentation, talent gaps, contingent

workforce, collaboration)

In seeking to improve operational efficiency,

insurers have a number of options, including

business process redesign, distribution

channels, legacy systems, alternative

sourcing and IA.

Operational excellence in insurance | 15

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Business process redesign

The complexity of the business models

currently underlying the operations of

the average global insurance carrier

provides many avenues for expense

leakage. It is therefore not surprising

that the largest percent of insurers in our

survey (26 percent) indicated business

process redesign as a primary initiative

for operational efficiency gains. A lack of

standard processes, combined with an

existing complex set of over-customized

applications common across most

carriers, currently consumes enormous

amounts of time, energy and cost.

At the same time, insurers are under

intense pressure to deliver timely

and innovative business services to

maximize workforce potential, capture

market growth opportunities, and drive

competitive advantage.

Addressing these challenges

requires the constant monitoring of

operations, organizational structures

and processes by management. One

of the most common approaches

to increase efficiency and reduce

operating costs is the review and

re-engineering of the business

process operating model in line with

defined strategic goals. Key goals and

objectives of the process redesign

effort include:

— Reducing or eliminating duplicate

and parallel functions at the

enterprise, business unit or

individual job levels

— Minimizing labor-intensive tasks

and processes and rationalizing

manual workloads

— Improving the utilization of the

current IT infrastructure and

functionalities

— Developing a transparent and

coherent enterprise operation

model focused on processes

— Implementing improvement

programs supported by detailed

feasibility analysis, realistic

and quantifiable measures and

incentives, and a well-defined

implementation plan.

Lower-cost sales and service channels

Customer, agent and other market

drivers continue to push insurers

to develop and maintain an omni-

channel presence across sales

and service functions. This trend

represents both an opportunity and

a challenge for insurers from an

operational expense perspective.

Among survey respondents, 24

percent indicated lower-cost channel

options and automation of traditional

channels as a key focus of operational

efficiency improvements. Beyond

the more traditional focus of channel

transformation (e.g. agent to direct),

insurers are seeking to leverage non-

traditional sales and servicing options.

Examples include the shift from live

call center representatives to email

and chatbots. Implementation of self-

service and automation will also play

a key role in reducing channel costs

by reducing turnaround times and

minimizing errors.

16 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Legacy system fixes

The ongoing impact of legacy systems

continues to be a pervasive issue

across the industry, exacerbated by the

increasing pace of innovation and the

decline in resources with the skills to

maintain older systems. Past experience

has shown that large-scale, multiyear

technology replacements take too

long, fail too often, and are constantly

reprioritized due to their size, scale,

and complexity. A better approach

involves freezing legacy code bases

and wrapping legacy technology with

middleware and web service capabilities

which can leverage core data while

shortening time to market. Insurers

would then be able to apply analytics to

present data in the form of information

reporting and dashboards which can

enhance sales and decision-making

capabilities and enrich experiences for

customers. Undertaking this approach

may enable insurers to reduce the cycle

time of legacy system fixes from years

to months — or even weeks — while

at the same time aligning revenue and

market-share enhancement goals to

budget spends.

Alternative sourcing

strategies

Alternative sourcing strategies were

cited by 12 percent of respondents

as a key initiative for cost saving,

and were expected to see an

increase in adoption over the next

12 to 24 months. These programs,

which include shared services and

outsourcing, seek to provide insurers

with enhanced competitiveness

through reduced operational costs,

greater access to qualified talent,

harmonized processes, improved risk

management and increased focus on

core competencies. A well-designed

alternative sourcing delivery model

can enable insurers to compete more

effectively by transforming internal

operations through:

— centralization of non-core functions

to achieve economies of scale

— harmonization of processes to create

standardized procedures

— more effective management of talent

to align skill sets

— reduction of ongoing internal

operating costs

— leveraging of investments in

technology.

While cost remains a key

consideration, service quality and

governance, process improvement,

and increased integration are also

top-of-mind factors in designing an

alternative sourcing framework that

enables insurance organizations to

leverage the most appropriate internal,

external and blended solutions.

IA in retirement forms fulfillment

KPMG in the US helped an insurance client automate key

elements of its retirement forms fulfillment process for customers

requesting a roll-over or cash disbursement. The original process

required a customer service representative (CSR) to validate

customer information by phone or fax, record notes in the system,

print customer forms and a cover sheet, and route the form to

the mail center before it was sent to the customer. This manual

process not only required significant employee hours, but also

resulted in slow processing times for customers.

Robotic process automation (RPA) now mimics CSRs’ actions,

completing, validating and routing forms automatically for both

onshore and offshore call centers, freeing up CSRs to handle

more difficult customer inquiries. With this end-to-end solution,

KPMG helped automate more than 75 percent of the annual

workflow volume.

Case study

Operational excellence in insurance | 17

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

I

ntelligent automation, which was identified as a key cost take-out

initiative by 13 percent of survey respondents, should be visualized as a

backbone capability spanning the value chain.

Intelligent automation

Carriers must create new capabilities by applying

IA to policy intake, claims and other areas, and

then leveraging those improvements across the

enterprise. Ultimately, the organization must take

what it learns in these initial, siloed forays and build

it across its varied processes, lines of business and

geographies.

18 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

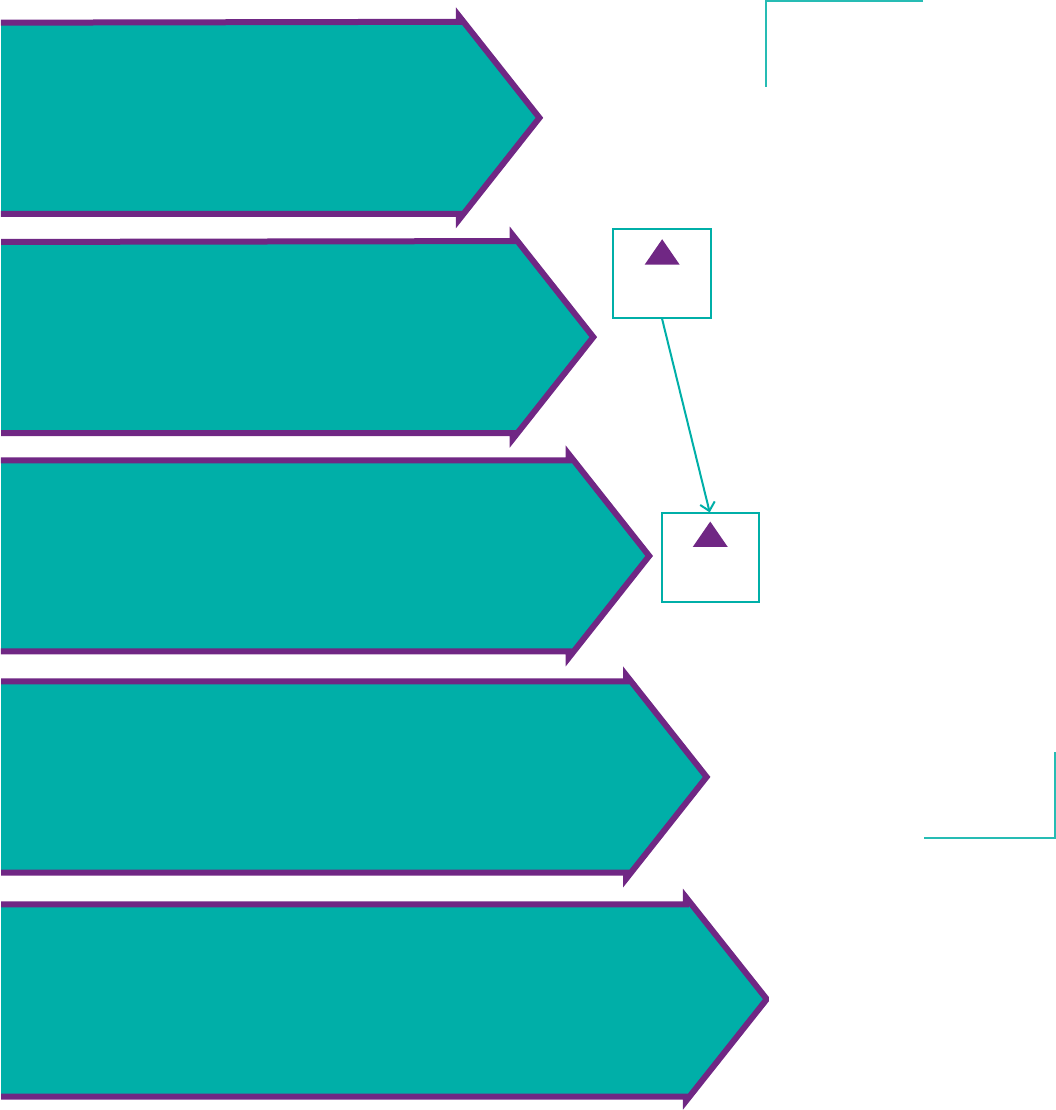

The IA maturity scale

Level 1

Level 2

Level 3

Level 4

Level 5

Static

Incremental

Organized

Institutionalized

Transformative

Most

insurers

12-month

target

— IA activities not organized

— Little central control and

governance over business

processes and data

— Manual processes

— Disorganized data

— IA setup in planning stages (e.g. Center of

Excellence (CoE))

— Cost reduction with process focus

— Emergence of proofs-of-concepts of IA

within functions

— Scope of technology is limited

— Data and analytics is embedded in functions

— Digitized tasks fall outside of enterprise

resource management processes

— IA setup in pilot, e.g. in the form of a CoE

— Deployment of automation across functions

using a narrow scope of solutions and

processes

— Data and analytics as a key focus area

— Coordinated processes, technology and governance,

and multichannel delivery for scale and adaptability

— Wide range of IA options

— Widespread functional deployment of IA

— Ongoing rationalization of technology as ecosystem

becomes mature

— Data and analytics is governed as part of CoE

— Well-established IA CoE for enterprise

— Multifunctional, multichannel business service delivery synced end to end

— Full range of IA options

— Transactional, expert and analytic services

— Business outcome-oriented governance

— Enterprise deployment

— Responsive adaptation of machine deployment

Most insurers

are developing a

12-month roadmap

that takes into

consideration the

following factors:

— Integration with

business strategy

— Focus on business

outcomes

— Scalable operating

model

— Control over data

quality

— Technology stack

integration

— End-to-end process

focus

— Talent management

— Adoption

of cognitive

technology

Operational excellence in insurance | 19

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Pursuit of operational efficiencies today vs. the

next 12 to 24 months (Percent respondents)

23%

25%

10%

9%

29%

19%

21%

33%

Previous

12–24 months

Process

standardization

Legacy

system fix

Intelligent

automation

Alternative

sourcing

Other/None

Next

12–24 months

12%

19%

KPMG’s approach

to building a center

of excellence is to

leverage the benefits

of appropriate

governance, while

enabling an innovative

and agile approach to

deployment.

— Scott Shapiro

Principal

KPMG in the US

20 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

An end-to-end approach

Insurers need to consider an end-to-end

IA approach to maximize the benefits on

investments. IA should be envisioned

as a continuum of growth, starting with

some basic RPA capabilities and then

advancing to machine learning and

natural language processing (NLP) over

the next 12, 24 and 36 months following

a technology roadmap.

Insurers will continue to face a variety of

needs relating to business processes,

and the necessity of changing how they

carry out those processes in order to

keep up with the industry. This means

that insurers will need a clear strategy

to leverage technology to assist with

their business processes. We think it

is important for insurers now to move

beyond the pilot stage, leverage lessons

learned through initial implementations

of technology such as RPA and AI, and

apply them to end-to-end processes in

order to realize efficiencies.

In addition, we advocate the cultivation

of strong change-management

capabilities to enable this growth

and maximize adoption of new or

changed capabilities. These must

include good communications skills,

in order to effectively articulate why

these transformations are good for the

organization and its people.

Where to start on the IA journey

It is important to recognize that

the starting point for developing IA

capabilities isn’t nearly as important

as simply making the decision to start.

Lessons learned in deploying one

aspect of IA can then be leveraged to

improve other business processes,

whether they are closely related or not.

For example, an organization may

choose to start with creating a digital

virtual agent. They may devote

resources to the automation of call

centers, using IA tools to enable

intelligent conversations, create

valuable insights, and anticipate and

predict certain events or customer

demands. Another common focus area

is the core processes of underwriting

and processing of claims, as well as

time-consuming and manually powered

back-office work, in areas such as HR,

finance and compliance.

Case

study

IA in HR ticket

gatekeeping

When this global insurance client

came to KPMG, its HR department

was using a manual process to

route more than 50,000 internal

and external HR tickets through its

CRM system each year. Human

“gatekeepers” were required to

read and categorize emails based

on priority, functional category,

region and other criteria, requiring

both significant employee time

and creating potential errors due to

human judgment.

KPMG in the US implemented an

end-to-end automation solution.

Under the new process, an RPA

bot accesses the HR tickets in

the CRM queue, extracts relevant

information and passes the

information to a machine learning/

NLP module. This module ingests

and processes the unstructured

text, predicts the required priorities

and categories, and returns the

result to the RPA bot, which then

selects the relevant values based

on the prediction.

This automated process now

handles 85 percent of annual

HR ticket volume, routing tickets

more quickly and accurately

while freeing up the HR team for

higher-value activities.

Several years ago, the insurance

industry would have been at level

one of the IA maturity scale — the static

stage — characterized by disorganized

and decentralized activities, processes

and data. Now, we believe insurers are

beginning to advance up the scale. In

fact, the number of survey respondents

implementing IA is expected to double,

from 10 percent today to 21 percent

over the next 12 to 24 months.

Most of the insurers we are working with

are at level two, the incremental stage.

At this level, we are seeing insurers build

some IA capabilities, and in-house data

science organizations are being formed

and are working on projects. However,

we think it is time for insurers to work

on scaling these disparate programs and

projects to achieve a level of maturity

that is not broadly evident in the industry.

This requires the right governance

to bring capabilities together in an

orchestrated fashion.

We are seeing many insurers creating

a CoE around IA as a way to scale. But

we also urge caution in such efforts,

because if there is an overzealous

effort to centralize and strongly govern

these activities, there is a risk of losing

the spirit of innovation both in lines of

business and in operations.

Operational excellence in insurance | 21

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

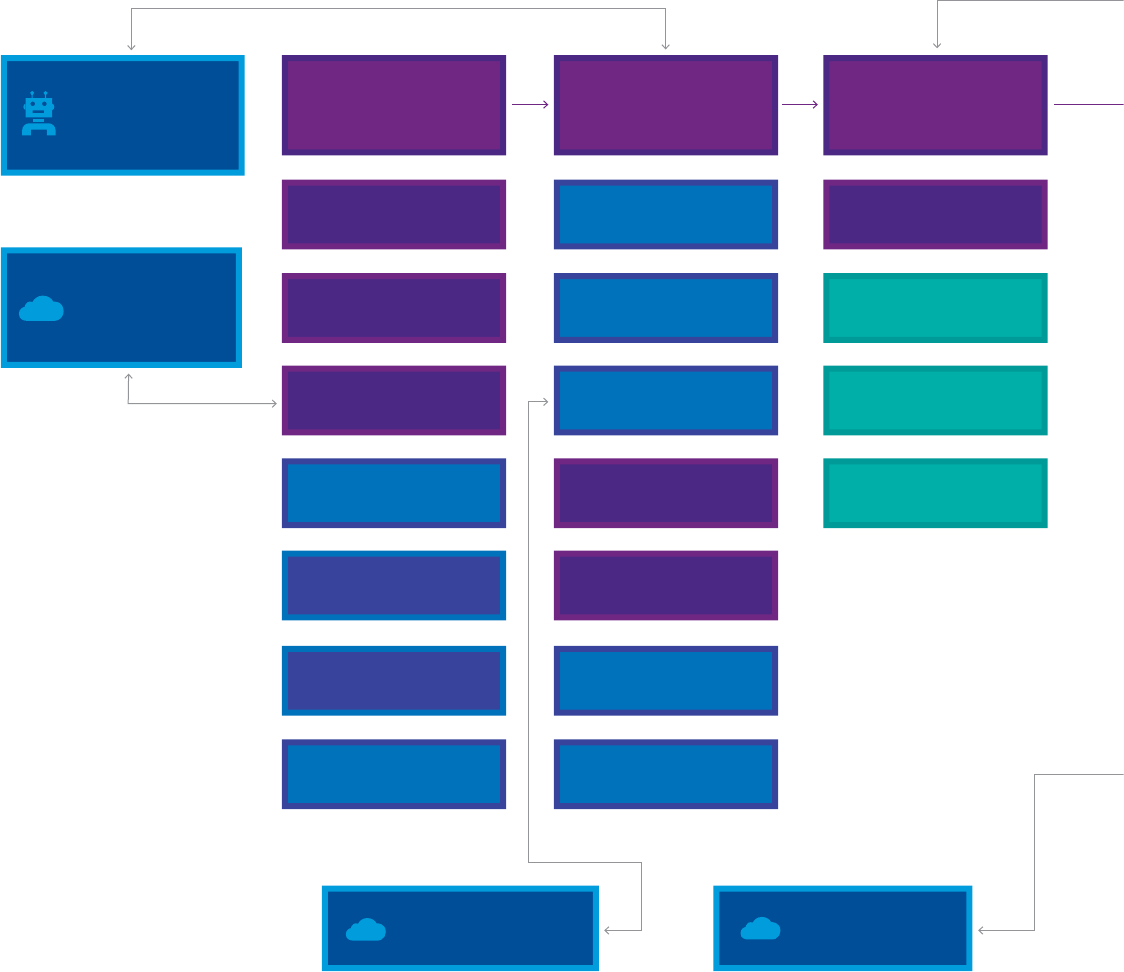

Where to start IA in

the insurance

v

alue chain?

New business and/or

renewal processing

Enrollment

Retention

Marketing and

channel strategy

Channel

development

Channel profitability

Product monitoring

& management

Portfolio

management

Product

launch

Policy construction

Product innovation

Product research

& analysis

Product strategy

Contact planning

and execution

Risk assessment

New business FNOL & triage

Investigation

Evaluation

Adjudication

Settlement

Fraud handling and

investigation

Litigation

Recoveries, salvage

& subrogation

Renewal

Endorsement

Cancellation

Bind

Issue/complaint

Customer service

Call center

Class 1: Basic

automation

Class 2: Enhanced

automation

Class 3: Cognitive

automation

Limited

opportunity

Account structure

and coverages

Rating and pricing

Portfolio risk

evaluation

Sales and

distribution

Underwriting

Claims

Intelligent

underwriting

Cognitive claim

intake

Claims analyzer

Legend

Product

development

Digital virtual

agent

Smart product

development

Cognitive

enrollment

Cognitive

call center

Cognitive

claims

Fraud/Legal/

Claim recovery

vendors

Predicted legal

reserve

22 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Where to start IA in the insurance

value chain?

New business and/or

renewal processing

Enrollment

Retention

Marketing and

channel strategy

Channel

development

Channel profitability

Product monitoring

& management

Portfolio

management

Product

launch

Policy construction

Product innovation

Product research

& analysis

Product strategy

Contact planning

and execution

Risk assessment

New business FNOL & triage

Investigation

Evaluation

Adjudication

Settlement

Fraud handling and

investigation

Litigation

Recoveries, salvage

& subrogation

Renewal

Endorsement

Cancellation

Bind

Issue/complaint

Customer service

Call center

Class 1: Basic

automation

Class 2: Enhanced

automation

Class 3: Cognitive

automation

Limited

opportunity

Account structure

and coverages

Rating and pricing

Portfolio risk

evaluation

Sales and

distribution

Underwriting

Claims

Intelligent

underwriting

Cognitive claim

intake

Claims analyzer

Legend

Product

development

Digital virtual

agent

Smart product

development

Cognitive

enrollment

Cognitive

call center

Cognitive

claims

Fraud/Legal/

Claim recovery

vendors

Predicted legal

reserve

Operational excellence in insurance | 23

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Widespread deployments of IA solutions across the insurance

industry have resulted in some key lessons learned.

Key lessons

1. Don’t underestimate the power of good data —

Sufficient volumes of quality data must exist to train

models properly. Accessibility and availability of data

can help scientists to build accurate solutions, or

equally inhibit their ability to build trustworthy models.

2. Produce more with the same number of people —

Leverage IA to reduce the administrative task load of

employees through automation, freeing them up to

perform high-value tactical and strategic work. Just

as importantly, use IA to drive insights and detect

issues and opportunities in data that is too large

for traditional approaches to effectively accomplish

meaningful results.

3. IA solutions are not plug‑and‑play — While many

application program interfaces (APIs) and prebuilt

platforms are great accelerators, most solutions also

require custom programming and training to attain

target accuracy and results. Long-term efficient models

need to be well trained and improved over time.

4. Carefully select opportunities for deploying IA —

Make sure the cost to implement is being balanced

with expected ROI from day one. Prioritize back-office

computer-to-computer interaction use cases; IT, finance

and accounting are particularly good places to start.

Insurers can then take what they

have learned in developing these

basic capabilities, and leverage that

knowledge in subsequent focus areas.

Insurers must ask themselves: How can

I migrate this expertise across functional

areas and lines of business? It is vital to

take stock of the business’s entire value

chain, and construct an orchestrated

roadmap accordingly.

Finally, it is important to recognize that

IA is not a one-size-fits-all technology.

One of the keys is to understand the

concept of employing a platform that

can be customized for your business’s

purposes and strategy.

24 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

T

he innovation and change currently being felt across the insurance

industry are pervasive and significant, and will continue to expand at

an accelerating pace.

Conclusion

In order to address these challenges —

while at the same time maximizing

value — operational efficiency programs

should focus primarily on the creation of

a leaner, more flexible, organization, with

cost reduction as a consequence, not

necessarily just the target. A structured

approach to cost management therefore

means thinking beyond short-term cost

savings to assess and question underlying

business models. By focusing on some of

the key dimensions of the business, leaders

can identify the core cost drivers and take

steps to effectively manage costs in a

sustainable manner.

Operational excellence in insurance | 25

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

Contributors

Michael Adler is a Principal and leader in KPMG in the US’

Insurance Advisory practice. Michael works closely with

leading insurance companies to drive transformation,

adopting digital, data, analytics, technology and best

operational practices. Michael has a proven track record of

delivering business value on large, complex transformation

programs utilizing the latest and most innovative technologies

in conjunction with an insurer’s existing capabilities. At

KPMG in the US he has recently led significant operational

transformation programs leveraging intelligent automation

capabilities such as RPA and AI.

Michael Adler

Principal, Advisory and Leader,

US Intelligent Automation

Lead, Insurance

KPMG in the US

Scott Shapiro

Principal

Actuarial and Insurance Risk

KPMG in the US

Marc Finkelstein

Manager

Management Consulting

KPMG in the US

Scott Shapiro is a Principal with KPMG in the US and has over

25 years of experience in the insurance industry both as an

insurance executive and a consultant. Scott is the insurance

leader for KPMG in the US’ Risk Consulting practice and

specializes in operational improvement, data & analytics,

and transformation.

Marc Finkelstein is a Manager with KPMG in the US

Insurance Advisory practice. Leveraging intelligent

automation, Marc has successfully delivered cost take-out

and end-to-end process improvement engagements to

insurance clients.

David Sterner is the Vice President of R&D at ACORD,

where he is responsible for leading global market research

activities in support of ACORD’s strategy, as well as the

goals and objectives of the organization’s member firms.

Dave has over 20 years of experience delivering strategic

research to the insurance industry. His focus includes

financial and operational benchmarking, issues-based

surveys, and developing insightful viewpoints on business

and technology topics.

David Sterner

Vice President,

Research & Development

ACORD

26 | Operational excellence in insurance

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

About KPMG

Today’s insurance executives face complex market issues such as

regulatoryuncertainty, evolving governance and risk management frameworks,

sustainingoperational performance, and maintaining liquidity.

KPMG’s insurance professionals can help transform today’s uncertainty

intoopportunity. We view the current challenges facing insurersas possible

breakthroughs that can transform their operations and create asustainable

advantage. We have accepted that change happens and business willnever

stop changing.

KPMG member firms work with leading insurers to help them redirect

these changes — with thegoal of creating answers to their most pressing

business questions.

About ACORD

ACORD, the global standards-setting body for the insurance industry, facilitates

fast, accurate data exchange and efficient workflows through the development

of electronic standards, standardized forms and tools to support their use. For

nearly 50 years, ACORD has been an industry leader in identifying ways to help its

members make improvements across the insurance value chain.

ACORD engages more than 8,000 participating organizations spanning over

100 countries, including insurance and reinsurance companies, agents and brokers,

software providers, financial services organizations, and industry associations.

With the tools and resources provided by ACORD, our members are equipped to

address current business and technology imperatives while influencing and shaping

the future.

Learn more at acord.org.

Operational excellence in insurance | 27

© 2019 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor

to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be

accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

© 2019 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG

International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm

vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. All rights reserved.

The KPMG name and logo are registered trademarks or trademarks of KPMG International.

Designed by Evalueserve | Publication name: Operational excellence in insurance | Publication number:

136188-G | Publication date: March 2019

kpmg.com/socialmedia

Contacts

Country

Michael Adler

Principal, Advisory and Leader

US Intelligent Automation Lead,

Insurance

KPMG in the US

E: mic[email protected]

Chad Miller

Director, Insurance

KPMG in Japan

E: c[email protected].com

Hendrik Jahn

Partner, Financial Services

Transformation Insurance

KPMG in Germany

Karen Parkes

Partner, Management Consulting

Operations Advisory

KPMG Australia

Julien Pavillon

Director, Financial Services

Strategy and Business Transformation

Insurance

KPMG in France

Roman Ryzer

Executive Director

Management Consulting

KPMG in Canada

Simona Scattaglia Cartago

Partner,

Technology & Accounting

Change Implementation

KPMG in Italy

E: sscattaglia@kpmg.it

Scott Shapiro

Principal

Actuarial and Insurance Risk

KPMG in the US

Lee‑Han Tjioe

Partner, Insurance

KPMG China

Mark Wylie

Director

Management Consulting, Operations

Insurance

KPMG in the UK

E: mark.wylie@kpmg.co.uk

Laura Hay

Global Head of Insurance

KPMG International

Gary Plotkin

Global Advisory Operations Lead

KPMG International